Will Trump’s New Tariffs Push Global Inflation Higher — And Delay Rate Cuts in Canada?

As former U.S. President Donald Trump announces aggressive new tariffs on Asian goods, Canadian borrowers are left wondering: could this global tension creep into our wallets and delay the Bank of Canada’s next rate cut?

With proposed 25% tariffs on Japanese vehicles, electronics, and goods from countries like South Korea and Taiwan, economists warn of a potential global supply chain shakeup. And when global prices rise, it’s rarely long before Canadians feel the heat — especially at a time when many are asking, “Will mortgage rates finally drop?”

What Exactly Is Trump Proposing?

Trump’s trade team is pushing for:

- 25% tariffs on imports from Japan and South Korea

- Additional duties on electronics, cars, machinery, and semiconductors

- Expanded protectionist measures targeting Asian supply chains

This move, if enacted, could seriously disrupt global trade flows — raising costs on everything from laptops to drywall.

“A 25% tariff on Japanese goods could raise costs of electronics, cars, and even housing materials imported into Canada.”

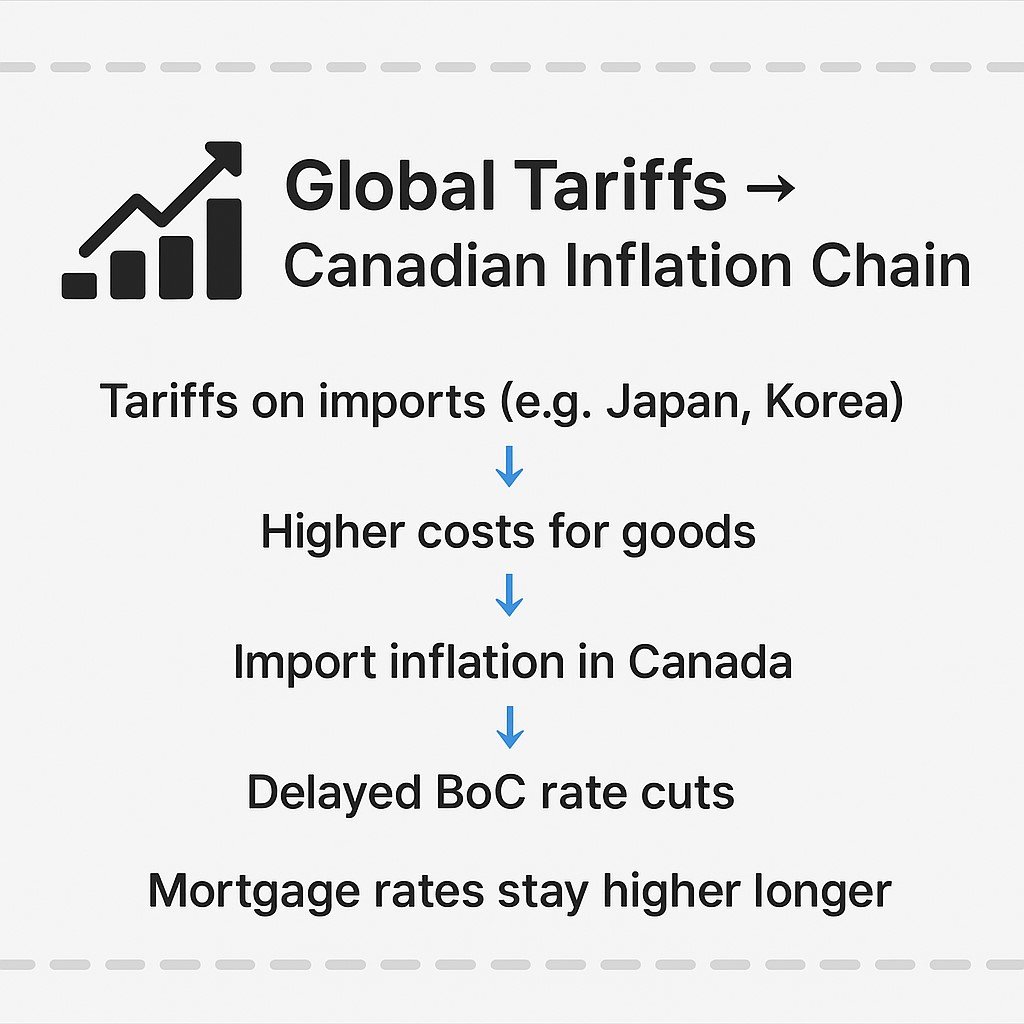

Could This Delay a Bank of Canada Rate Cut?

Just weeks ago, most economists expected the Bank of Canada to cut interest rates again in July or September. Inflation had cooled to 2.7%, bond yields were falling, and mortgage lenders began trimming fixed rates.

But if tariffs raise import prices globally, inflation could tick back up — and that’s something the Bank of Canada watches very closely. They’ve said many times they want to “see sustainable progress on inflation” before cutting again.

So if inflation resurfaces? The BoC might hold rates higher, longer.

📦 Tariff Impact Areas

🖥️ Electronics • 🚘 Cars & Auto Parts • 🛠️ Housing Materials • 🚿 Fixtures • 🧱 Construction Inputs

A 25% U.S. tariff on Japan/South Korea can raise the cost of these items in Canada.

What It Means for Mortgage Borrowers

Many Canadians were hoping 5-year fixed rates would dip below 4.5% by fall. But with bond yields climbing again due to inflation concerns, that drop may be delayed or even reversed.

Here’s how this could play out for borrowers:

- Fixed mortgage rates (tied to bond yields) may remain in the 4.84–5.29% range

- Variable rates may stay elevated if BoC delays cuts

- Renovation and housing material costs could spike again — just like they did in 2021–2022

If you’re waiting to buy, renew, or refinance, this news should push you to watch rates closely and act early.

“To see how this could impact your home loan directly, read how Trump’s tariffs might push Canadian mortgage rates higher.”

📞 Get Pre-Approved With Nesto or Compare With Local Brokers in Your Area

Explore exclusive online rates like Nesto’s 4.69% or speak to a licensed broker near you. Find out which offer saves you more.

Talk to a Mortgage ExpertFinal Thoughts

While these tariffs haven’t taken effect yet, just the fear of global inflation is already nudging yields upward. For the Canadian housing market — still struggling with affordability — this adds a layer of uncertainty.

If you’re in the market, don’t just track rates — track global headlines. A trade war might seem far away, but it could land right in your renovation plans or renewal offer.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts