Why Canadian Mortgage Rates Spiked This Week (Hint: It’s Not All About Canada)

Mortgage rates in Canada jumped unexpectedly this week — but the real driver lies south of the border. From U.S. bond yield movements to Federal Reserve signals, this article unpacks how global forces are influencing Canadian borrowing costs and what it means for homeowners in 2025.

Mortgage shoppers across Canada got a bit of a shock this week. Despite hopeful signs that rates might soon ease, fixed mortgage rates unexpectedly jumped—and the culprit wasn’t the Bank of Canada. Instead, rising bond yields south of the border, driven by the strength of the U.S. economy, are creating ripple effects that Canadians can’t ignore.

So what exactly is happening? Why are our rates being pulled up by a foreign economy? And what does this mean for your next home purchase or mortgage renewal?

Let’s break it all down.

What Sparked the Rate Jump?

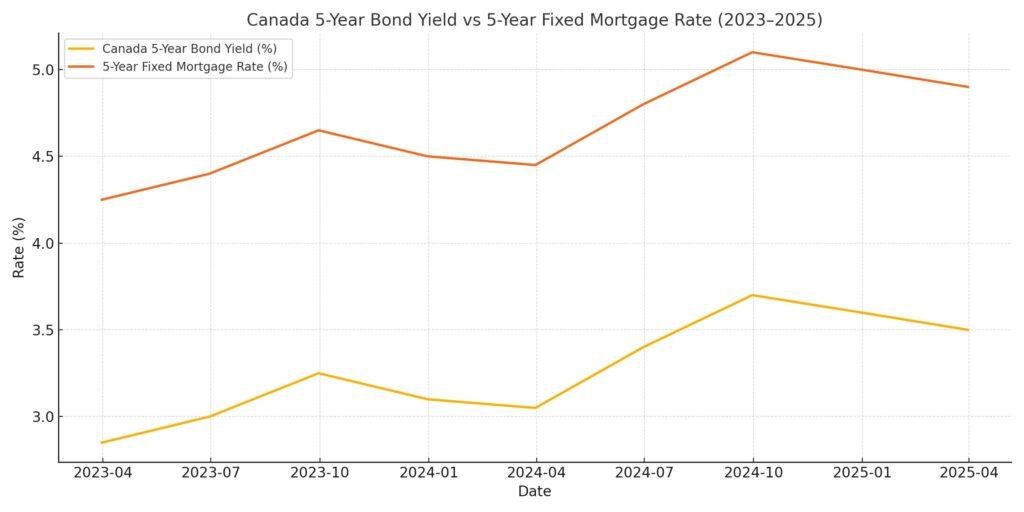

In short: U.S. bond yields surged, and Canadian yields followed suit. Since fixed mortgage rates are closely tied to government bond yields, especially 5-year bonds, this led to a sudden spike in fixed rates across Canadian lenders.

This surge was driven by stubbornly strong U.S. economic data. Despite high interest rates from the Federal Reserve, the American economy continues to power ahead—with strong job growth, consumer spending, and business investment.

And when yields rise in the U.S., Canada often gets swept along. Investors seeking higher returns start demanding more from Canadian bonds too, pushing yields—and mortgage rates—higher.

Why Are U.S. Mortgage Rates Less Sensitive?

American borrowers typically sign up for 25- or 30-year mortgages, often locking in rates for the full term. So even if short-term bond yields jump, most U.S. homeowners aren’t affected right away.

In contrast, Canadian borrowers face much shorter mortgage terms—usually five years or less. That means a far greater percentage of mortgages in Canada are constantly renewing. Any rise in rates hits us much harder and faster.

Canadian Debt Levels Amplify the BoC’s Power

Another key difference? Debt levels.

Canadians carry more household debt, much of it tied up in mortgages. That gives the Bank of Canada outsized influence. When it raises (or cuts) rates, Canadian households feel the effects almost immediately.

The U.S., by contrast, has spent the past decade deleveraging. Americans now carry far less debt relative to income, and their housing market wasn’t as overheated during the pandemic as ours. That’s why Canada is more vulnerable to rate shifts—and why higher borrowing costs bite harder here.

The Productivity Divide

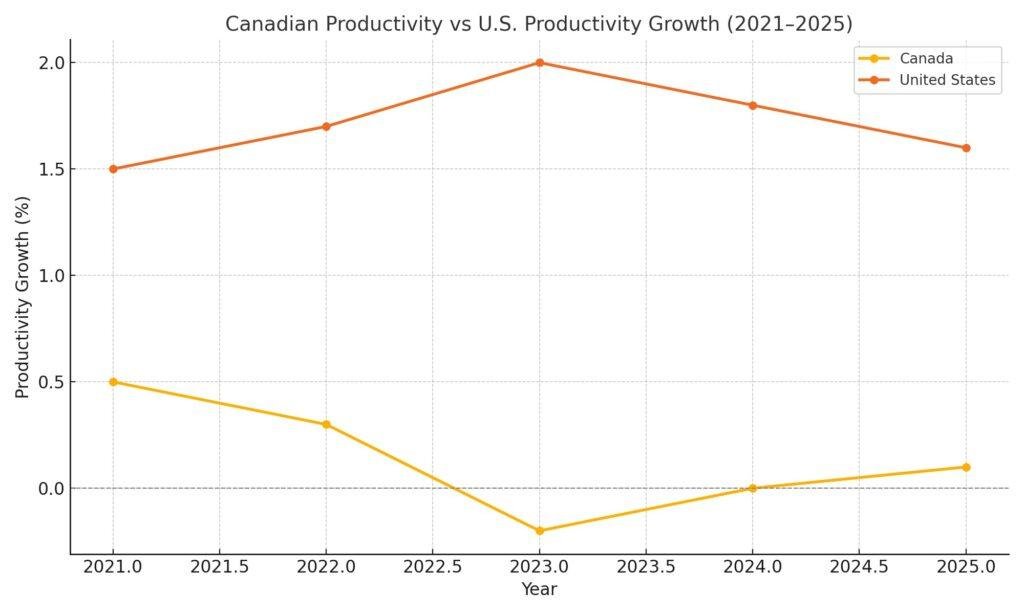

Another big factor is productivity. In the U.S., companies are investing in technology, automation, and innovation. That means the debt they take on helps boost future output and economic growth.

In Canada, much of the recent borrowing has gone into real estate—not productivity-enhancing business investment. While our population is growing quickly, thanks to immigration, this expansion is masking deeper inefficiencies. Our per-worker productivity is actually shrinking.

U.S. Stimulus Is Still Fueling Growth

During the pandemic, both countries deployed massive stimulus—but what they spent it on differs.

The U.S. backed high-tech industrial policies like the CHIPS and Science Act, funneling cash into semiconductor manufacturing and AI research. That spending is now paying dividends, as U.S. companies ramp up hiring and investment.

In contrast, Canada’s stimulus was more focused on emergency relief, housing, and climate programs—important, yes, but with less long-term economic payoff.

This divergence in strategy is now showing up in bond markets. The U.S. economy is running hot, and markets are demanding higher returns on debt. That pressure is bleeding into Canada.

Why This Matters for Canadian Mortgage Holders

It’s frustrating—but true: our mortgage rates are being pulled up by an economy that isn’t ours.

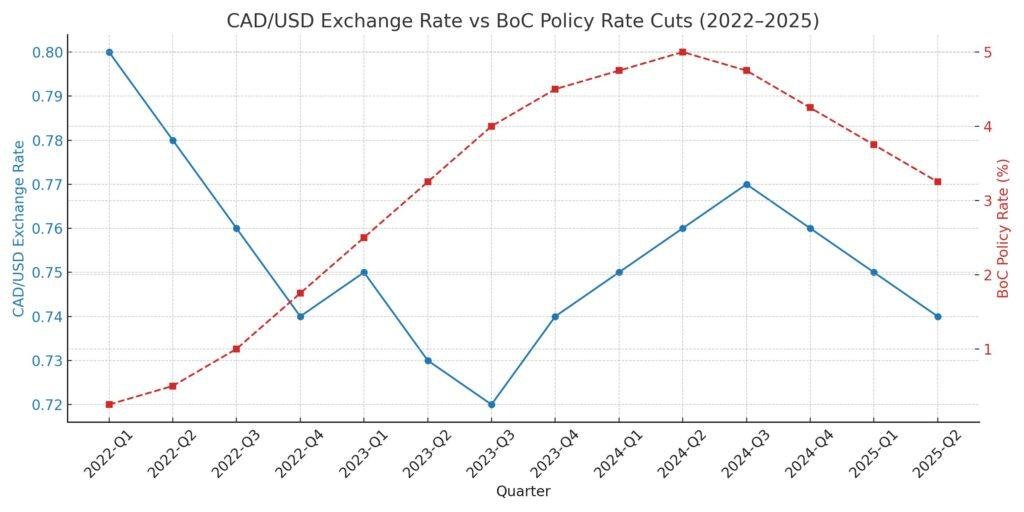

While the Bank of Canada has signaled rate cuts are coming, U.S. bond yields are working against them. The BoC’s hands are tied—cut too fast, and the loonie tanks, making inflation worse.

So even though Canada’s economy is slowing, our mortgage rates are stuck in a tug-of-war between domestic weakness and international market pressure.

What’s Coming Next?

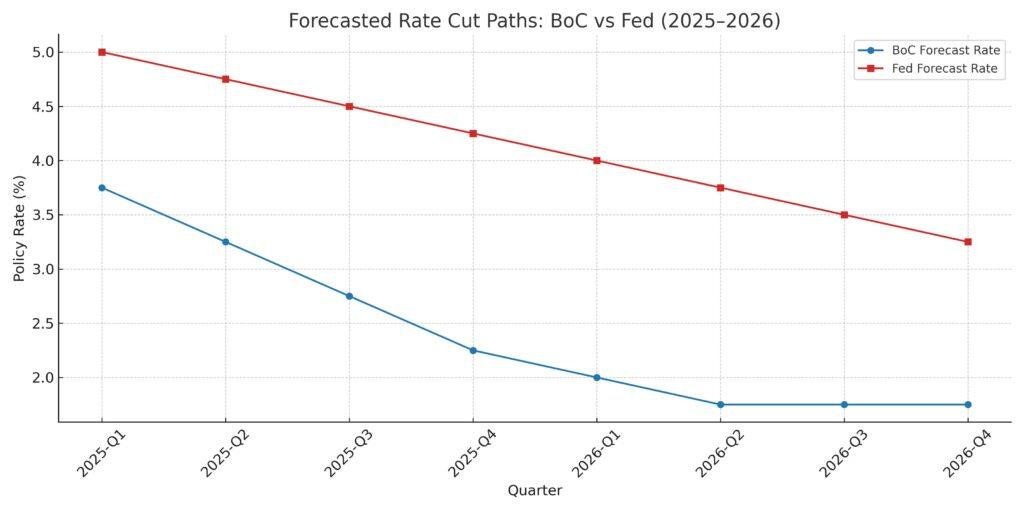

Markets expect the BoC to begin cutting rates later this year—potentially by 150 basis points (1.50%) in the second half of 2025. The U.S. is projected to cut by around 100 bps in the same period.

The difference is that Canada has more urgency. Our economic growth is stalling, and shelter inflation—driven by mortgage interest and rent—is now the biggest component of overall CPI.

In fact, Governor Macklem has admitted that mortgage rates themselves are part of the inflation loop. That’s one more reason the BoC may move sooner than the Fed.

What Should You Do as a Borrower?

If your mortgage is up for renewal in the next 4–6 months, now’s the time to act.

Talk to your broker. Get preapproved. Lock in a rate.

Even if rates go down later, you’ll have protected yourself from any surprise rate hikes—or another round of U.S. inflation driving our rates higher again.

The key takeaway? Rates won’t fall in a straight line. The market is too volatile, and too many factors are at play—most of them outside Canada’s control.

Final Thoughts

Canadian mortgage rates are being pulled in opposite directions. On one hand, our economy is slowing, and inflation is easing. On the other, the U.S. is booming, and global bond markets are pricing in higher borrowing costs.

This week’s rate jump shows just how tightly Canada is tethered to global trends—especially U.S. ones. And unless you’re paying close attention, you might get caught off guard.

The best move? Stay informed, plan ahead, and speak with a mortgage expert who can help you navigate this complex landscape.

📞 Talk to a Canadian Mortgage Expert

Lock in your best rate today and make smarter mortgage decisions with expert advice tailored to your needs.

🔒 Lock In My RateWhy Choose Mortgage.Expert?

At Mortgage.Expert, we’re not here to sell—we’re here to support. Our team of licensed, salaried mortgage experts offers unbiased advice to help you find the best mortgage strategy for your goals. Whether you’re buying, renewing, or refinancing, we’re your guide in this fast-changing market.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts