What Closing Costs Should Buyers Expect in Canada?

Wondering how much you really need to close on a home in Canada? From legal fees to land transfer tax, this guide breaks down all the key closing costs homebuyers should plan for in 2025.

When you’re buying a home in Canada, you’re not just paying for the house itself. There’s a whole category of one-time expenses called closing costs that catch many first-time buyers off guard. These are fees that need to be paid upfront — and they can add up quickly if you’re not prepared.

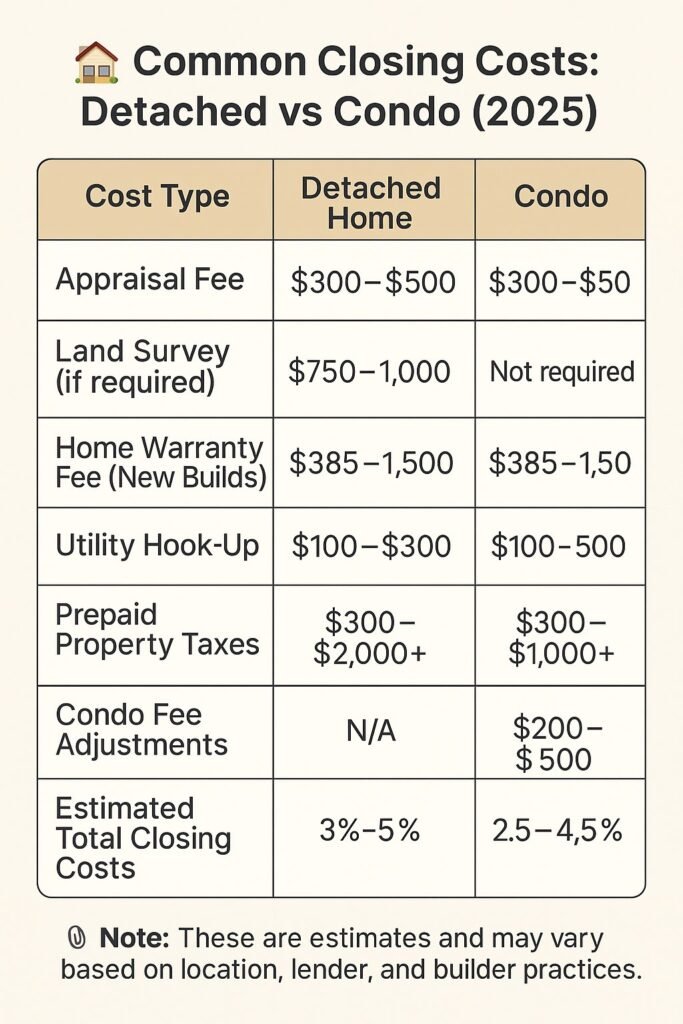

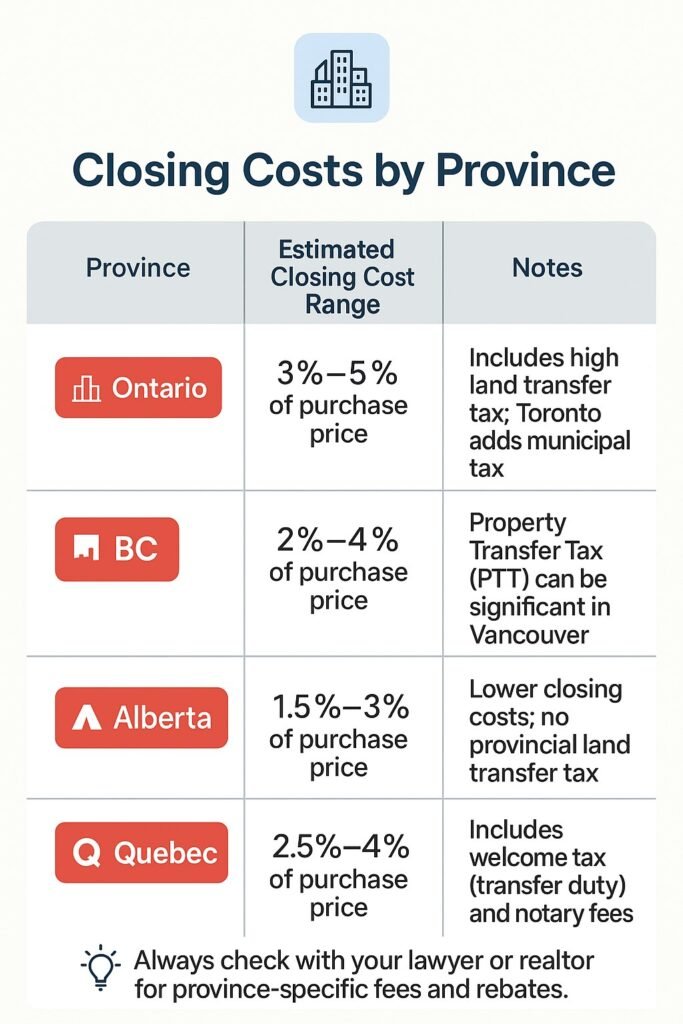

In simple terms, closing costs refer to all the additional charges you’ll pay on the day your home purchase is finalized — over and above your down payment and mortgage. They typically range from 3% to 5% of your home’s purchase price, depending on the province and type of property you’re buying.

So, what exactly are these costs, and how do you plan for them?

New Home Warranty Enrolment Fee

If you’re buying a newly built home, your builder must enroll it in a home warranty program before construction begins. While the builder usually handles the paperwork, the cost of enrolment is passed on to you — the buyer — at closing. Depending on the value of the home, this fee usually ranges from $385 to $1,500. Sometimes builders include it in the sale price, but not always — so be sure to ask.

This warranty is crucial because it protects you from future defects or structural problems. It’s a one-time payment, and your coverage lasts several years depending on the province.

Appraisal Fee

Your lender wants to ensure the home you’re buying is actually worth what you’re paying for it. That’s where an appraisal comes in. It determines the fair market value of the property — which reassures your bank that the collateral (your home) backs the loan.

Appraisal costs are typically between $300 to $500, depending on location, property size, and who performs the appraisal. Even if your lender covers the cost, it’s best to budget for it just in case.

Land Survey Fee

Some lenders may ask for a land survey that clearly outlines property boundaries — especially if you’re buying a detached home or land. While you might get lucky with an existing survey on file, many lenders want a current version, especially if the property was recently altered or subdivided.

Land surveys cost anywhere from $750 to $1,000, depending on the size and complexity of the land. It’s a smart step to avoid future boundary disputes or legal troubles with neighbours.

Utility Hook-Up Charges

Want your lights and gas running on move-in day? Don’t forget the connection fees.

Utility companies may charge hook-up or account activation fees when starting or transferring services — including hydro, gas, water, internet, and cable. These charges typically range from $30 to $100 per service, depending on the provider and whether they need to install new equipment.

Always call ahead to set these up and clarify any surprise fees.

Prepaid Property Taxes

When you buy a resale home, the seller may have prepaid property taxes to the city. At closing, you’ll need to reimburse them for the portion covering dates after you take ownership.

This adjustment will be included in your Statement of Adjustments — a legal document that itemizes shared costs. Property tax adjustments can range from a few hundred to several thousand dollars, depending on how much the seller has prepaid.

Prepaid Condo Fees

Buying a condo? Similar to property taxes, the seller may have paid monthly condo maintenance fees ahead of time.

You’ll be responsible for reimbursing them for any period beyond your possession date. This prorated amount also appears in the Statement of Adjustments and gets added to your closing costs. Always check the building’s fee schedule ahead of time.

Prepaid Utilities

Sometimes sellers also prepay utility bills — like water, electricity, or gas — in advance of your move-in. When this happens, you’ll need to pay them back for the unused portion of those bills.

Again, this will appear in your Statement of Adjustments, and payment is due on closing day. These are small amounts but can add up if you’re not expecting them.

Mini Verdict: Plan For These Costs Early

While your mortgage covers the bulk of your home purchase, closing costs are your responsibility — and they must be paid out of pocket. If you don’t plan for them, you could end up scrambling for thousands of dollars at the worst possible time.

These costs don’t repeat — once you pay them, you’re done (unless you move again). But that one-time nature makes them no less important. The smart move is to budget at least 3% to 5% of your home’s purchase price so you’re not caught off guard.

📊 Closing Costs Breakdown for First-Time Buyers – 2025

📝 Tip: Always keep a 5% cushion in your homebuying budget to cover these upfront closing expenses.

Why Closing Costs Matter for Canadian Buyers

If you’re house-hunting in Canada, it’s easy to focus on just your down payment and monthly payments. But ignoring closing costs can delay your purchase or even derail your mortgage approval. Lenders often want proof that you’ve budgeted for these expenses.

Whether you’re buying a brand-new build in Toronto or a rural home in Alberta, these fees will pop up — so factor them in early.

Final Thoughts

Buying a home is a huge milestone — but closing day comes with more than just signing papers. Understanding all the fees that come with transferring ownership puts you in control and prevents unwanted surprises. From warranty enrolment to prepaid taxes, each item serves a purpose, and knowing what to expect helps you avoid stress.

So when planning your budget, don’t stop at the down payment. Add that extra 3%-5% buffer and breathe easier on closing day.

💰 Confused About Closing Costs?

From land transfer tax to legal fees and inspection costs — we’ll help you understand every dollar before you sign. Get clarity and avoid surprises.

📞 Talk to a Mortgage Expert NowStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts