U.S.–Canada Trade Tensions Could Delay Mortgage Rate Cuts in 2025

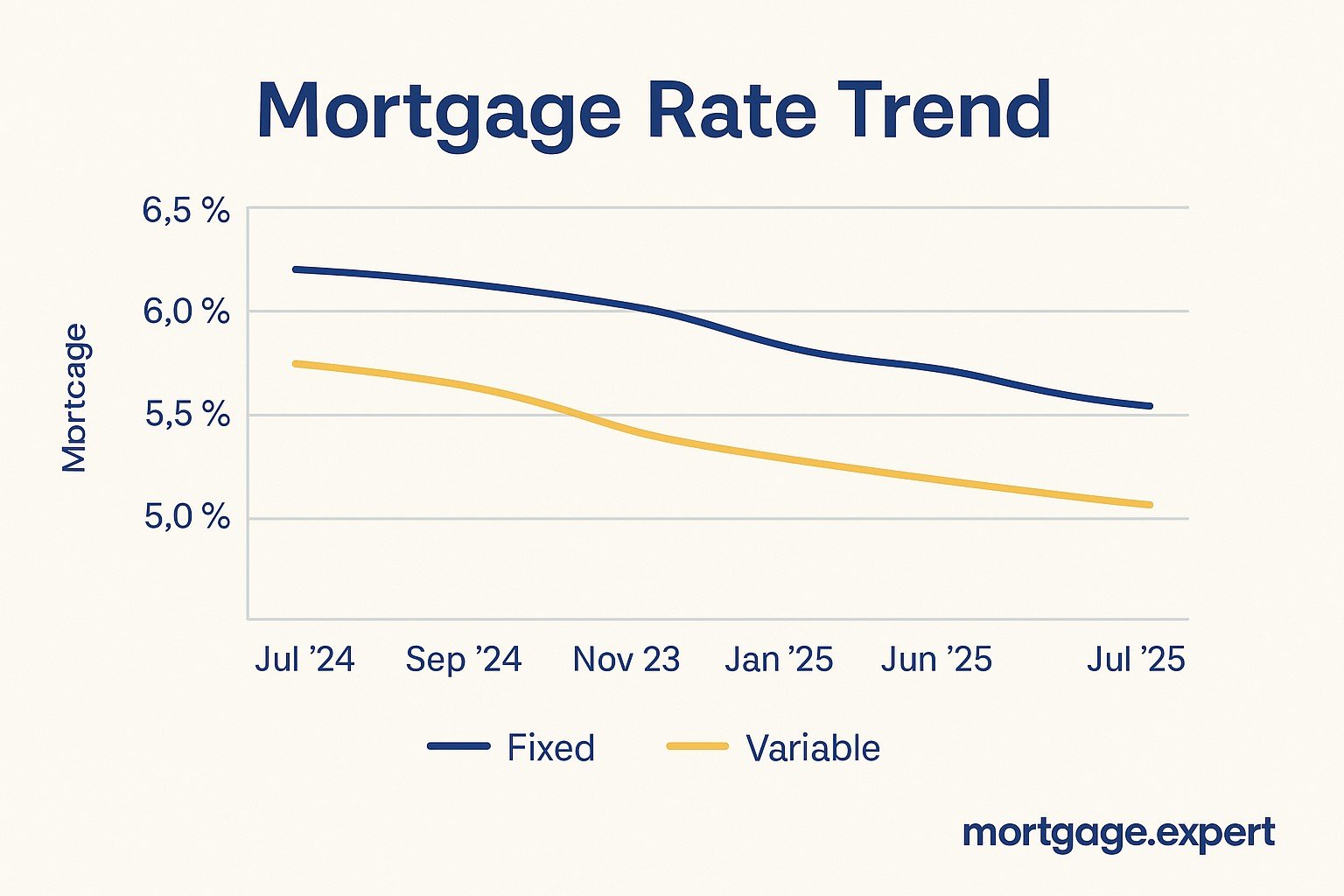

Ongoing trade tensions between the U.S. and Canada are weighing on bond yields and adding uncertainty to rate cut expectations. Here's how that could impact mortgage rates and homebuyers in 2025.

As inflation trends downward and global economies adjust to post-pandemic realities, one big question remains for Canadian borrowers: When will mortgage rates start to drop?

According to economists and rate strategists, the answer may depend less on inflation — and more on international trade tensions, particularly those simmering between Canada and the United States.

What’s Happening?

In late July 2025, U.S. authorities introduced a new round of tariffs on Canadian steel, aluminum, and select agricultural exports, citing concerns over trade imbalances. Canada responded with matching retaliatory duties. The standoff has spooked markets, driven uncertainty in global trade flows, and lowered investor appetite for long-term risk.

In response, Canadian 5-year bond yields dipped, even as the Bank of Canada held its overnight rate at 2.75%. Lower bond yields usually translate to cheaper fixed mortgage rates, but lenders are holding off — awaiting clarity on whether this dip is temporary or the start of a new cycle.

What It Means for Mortgages

Here’s the key takeaway: Mortgage rates may not fall as quickly as expected, even if the central bank is ready to ease policy. That’s because lenders and investors are nervous about the ripple effects of a prolonged trade war.

Three things are currently influencing mortgage rate trends:

- Bond market volatility: Yields are dropping, but inconsistently.

- Currency weakness: The Canadian dollar hit a two-month low in July, making imports pricier and complicating inflation forecasts.

- Central bank uncertainty: The BoC is sending cautious signals, but not committing to a timeline for cuts.

Outlook for the Rest of 2025

Many analysts had expected the Bank of Canada to begin cutting rates by fall 2025, potentially bringing the overnight rate closer to 2.25% by year-end. But if trade conflict intensifies, we may see:

- Slower rate cut timelines

- Stickier fixed mortgage rates

- Renewed economic anxiety among buyers

Variable-rate borrowers may not see meaningful relief until Q1 2026 if these geopolitical issues persist.

Mortgage.Expert Advice

If you’re shopping for a mortgage in late 2025:

- Monitor 5-year bond yield trends — not just BoC announcements.

- Ask your broker about rate holds or early renewals if fixed rates are dropping temporarily.

- Don’t assume a deep rate cut is around the corner. It could take longer than expected.

Final Word

The Bank of Canada may be ready to lower rates — but global headlines are still in the driver’s seat. If you’re a homeowner or homebuyer, it’s more important than ever to stay informed, act strategically, and keep a flexible plan in place.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts