Understanding Collateral Charge Mortgages in Canada

Collateral charge mortgages are different from traditional loans — they offer flexibility for future borrowing but can make switching lenders harder. This 2025 guide explains how they work, pros, cons, and when they’re a smart move.

If you’ve recently applied for a mortgage—or are planning to—there’s a term you might hear thrown around that isn’t often explained clearly: collateral charge mortgage. On the surface, it might sound like just another banking technicality. But the truth is, this small detail can have a big impact on your ability to borrow money in the future, switch lenders, or access home equity without refinancing.

In this article, we’ll unpack everything in plain language. We’ll show you how collateral charge mortgages work, what makes them different from standard charge mortgages, and whether this kind of structure is the right fit for your financial journey.

What Is a Collateral Charge Mortgage?

A collateral charge mortgage is a home loan that your lender registers against your property for more than the actual amount you borrow. This means your mortgage paperwork might say $400,000, but the lender registers it for $500,000—or even more. Why? So you can potentially borrow more later on, without having to refinance.

Real-World Example: How It Works in Practice

Let’s say Lina buys a home for $450,000 and takes a $360,000 mortgage. With a standard mortgage, the loan is registered as $360,000. But with a collateral charge, the bank may register $562,500 (125% of the home value). Over time, as Lina pays down her mortgage, she can potentially borrow back some of that $202,500 in registered room without refinancing—maybe through a HELOC, top-up loan, or blended product.

Why Lenders Love Collateral Charges

Collateral charge mortgages give lenders flexibility. When your mortgage is registered for more than you owe, they can offer you other products—like personal loans or credit lines—without going through the hassle of refinancing. It also means you’re more likely to stay with them longer, since switching to a different lender becomes more complex and costly.

Benefits: When It Works in Your Favour

If you’re the kind of homeowner who plans renovations, debt consolidation, or big financial moves down the road, a collateral charge could make sense. It gives you borrowing flexibility without requiring a reappraisal or legal restructuring every time. And in some provinces, it also provides a legal barrier—making it harder for third parties to place a lien on your home.

Drawbacks: What You Might Not Realize Until Renewal

Let’s say your five-year term ends and you want to shop for better rates. If you have a standard mortgage, transferring to a new lender is usually easy. But with a collateral charge, you’ll need to legally discharge the existing mortgage and re-register a new one—which comes with fees, legal steps, and sometimes stress-test requalification.

There’s also a psychological trap: just because you can borrow more, doesn’t mean you should. It’s easy to rack up extra debt tied to your home without realizing you’re overleveraging yourself. In a falling market, that can lead to real financial risk.

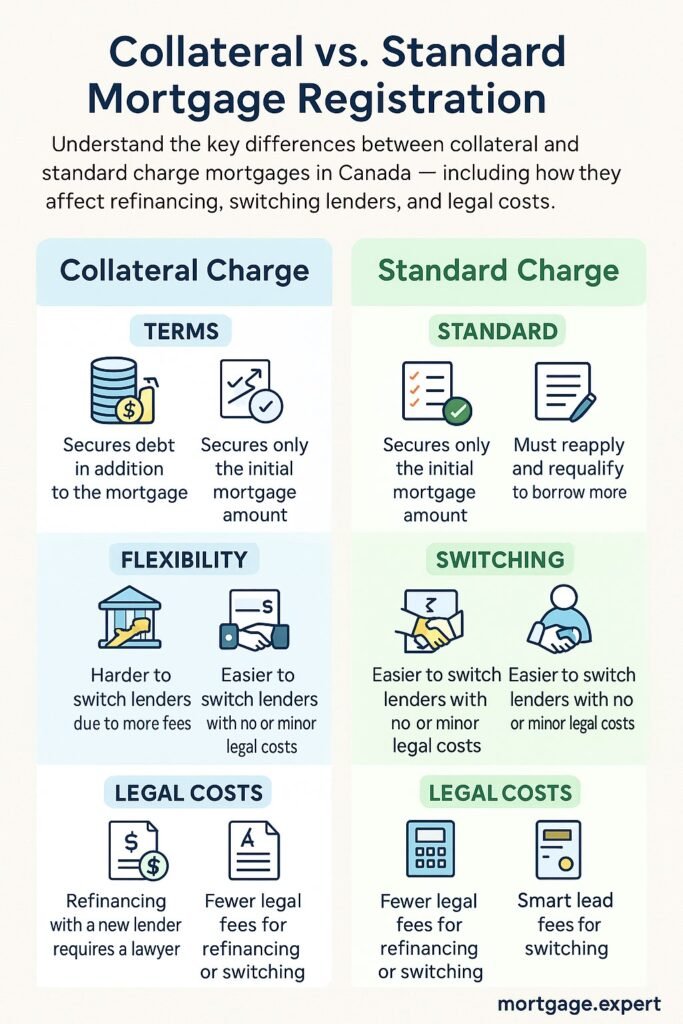

Collateral vs Standard Charge: The Big Differences

Standard charge mortgages are simple. They’re registered for exactly what you borrow, and as you pay it down, that number reduces. If you want to borrow more later, you need to refinance and requalify.

Collateral charge mortgages are more flexible but come with trade-offs. They’re harder to transfer to other lenders and can open the door to more borrowing than you might be comfortable managing.

| 🔍 Feature | 🏦 Standard Mortgage | 🧾 Collateral Mortgage |

|---|---|---|

| Refinance Flexibility | Limited — often requires requalification | High — allows top-up without requalification |

| Switching Lenders | Easier — portable with minimal legal cost | Harder — must discharge and re-register |

| Registration Amount | Exact loan amount | Up to 125% of home value |

| HELOC Setup | Requires re-registration | Often built-in automatically |

| Prepayment Penalties | Can vary by lender | Often more restrictive |

Should You Choose a Collateral Charge Mortgage?

It depends on your goals. If you’re confident you’ll stay with your current lender, and you want the flexibility to borrow more over time—then it can work well. But if you value the freedom to shop rates at every renewal and prefer clear limits on borrowing, you may be better off with a standard charge mortgage.

TD uses them by default. Others, like RBC or CIBC, may offer both options—ask upfront.

How to Negotiate When You’re Offered a Collateral Charge

If a lender offers you a mortgage with a collateral charge, don’t just accept it blindly. Ask questions. First, clarify if you have a choice—some banks offer both standard and collateral options, even if one is their default. Second, find out the percentage your mortgage will be registered for. Is it 100%, 125%, or something else? This will impact how much flexibility you have down the road.

Also, ask whether this flexibility comes with bundled products. Some banks use collateral charges to tie in other lending like credit cards or lines of credit—meaning your mortgage and consumer debt could be cross-collateralized. That might limit your ability to switch products or lenders later.

Lastly, get clarity on discharge costs and switching limitations. If your lender can’t provide this upfront, that’s a red flag. A good advisor will help you evaluate whether the added flexibility is worth the constraints—especially if you might want to refinance or switch lenders in the near future.

Related FAQs

- What does collateral charge mean on a mortgage?

It means your mortgage is registered for more than you initially borrow—usually up to 125% of the home value. This gives the lender room to lend you more money later without refinancing, like offering you a home equity line of credit or personal loan under the same umbrella.

- Can I switch lenders with a collateral charge?

Yes, but it’s harder than with a standard mortgage. You’ll likely need to discharge the existing mortgage legally and re-register a new one, which comes with legal fees and possibly requalification under stricter lending rules. For many homeowners, this becomes a hidden barrier to finding better rates.

- Are collateral charge mortgages more expensive?

Initially, they often look the same—or even cheaper. But they can cost more later by making it harder to switch lenders or shop for lower rates. Plus, the convenience of borrowing more might lead to overleveraging, which increases your interest burden over time.

- Which banks use collateral charges?

TD Bank uses collateral charges by default. Other major banks like RBC, CIBC, and Scotiabank may give you a choice between standard and collateral registration. It’s important to ask upfront, because once the paperwork is signed, switching can get expensive.

For example, Sarah—a freelancer in Mississauga—knew she might need flexibility during slower income months. Her broker recommended a collateral charge mortgage with room to borrow more if needed. Meanwhile, David, who had a stable 9–5 job and plans to switch banks at renewal, chose a standard charge to keep his options open.

🔍 Not Sure If a Collateral Mortgage Is Right for You?

Collateral charge loans can unlock more borrowing power — but they come with tradeoffs. Speak with a licensed mortgage expert to find out if it fits your goals.

📞 Get Personalized Advice on Collateral MortgagesStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts