Toronto Home Prices Slip Slightly in July — Is It a Seasonal Dip or Start of a Trend?

After months of modest gains, Toronto’s average home price dipped 1.2% month-over-month in July, according to data from the Toronto Regional Real Estate Board (TRREB). Detached homes and townhouses saw the most notable softening, especially in the outer suburbs. While condo prices held relatively steady, sales volume in that segment also dropped by about 3.5%.

So what’s going on? Is this typical for summer, or a hint that buyers and sellers are shifting course?

A Typical Summer Cool-Off — Or Something Deeper?

Historically, the summer months in Toronto bring a mild price dip. Buyers go on vacation. Sellers wait for fall. The market catches its breath.

But this year’s decline comes on the heels of growing uncertainty around interest rate cuts, inflation stickiness, and the return of tighter mortgage conditions for some buyers. Add in recent global trade concerns, and you’ve got a market that’s tiptoeing rather than sprinting.

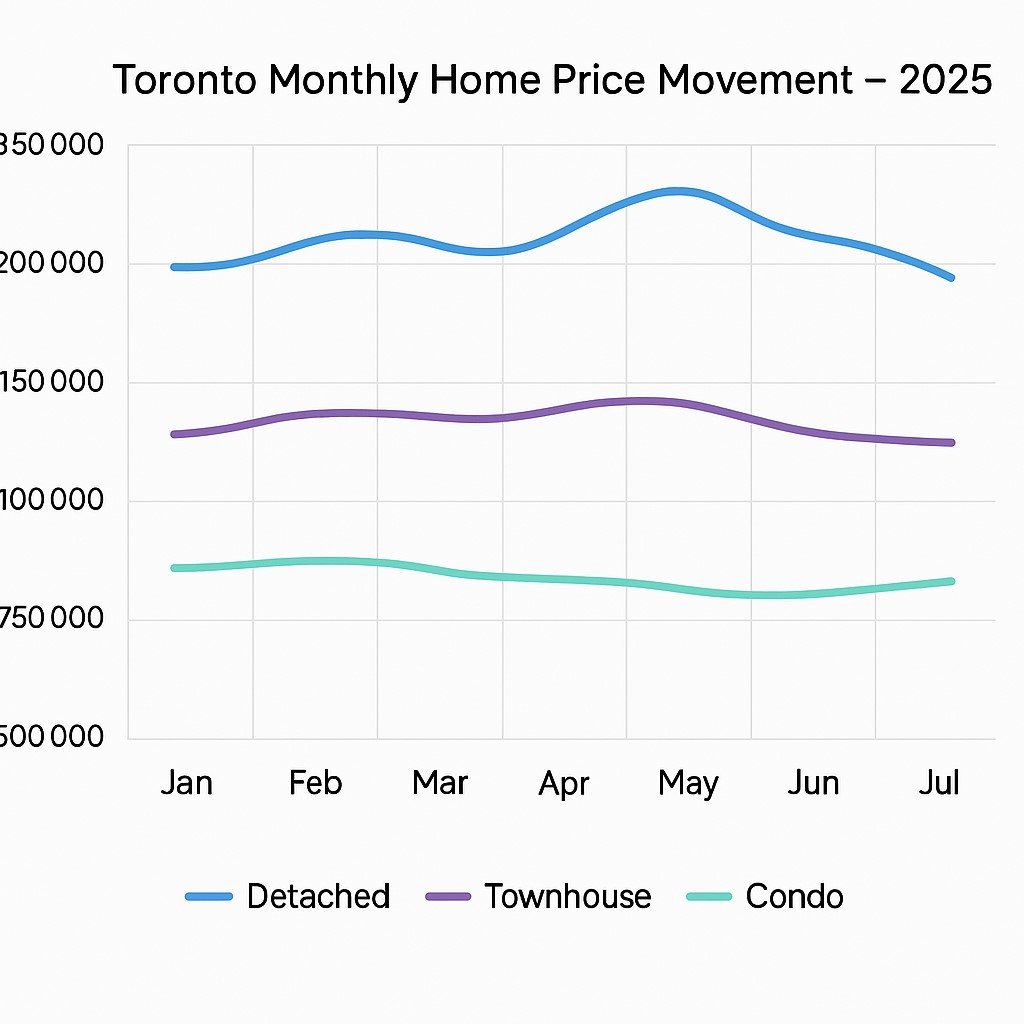

📊 Toronto Monthly Home Price Movement – 2025

Line chart showing price trends from January to July 2025 across detached homes, townhouses, and condos in Toronto.

Buyers May Hold More Power… Briefly

For the first time in months, buyers might feel like they have a bit of leverage. Homes are sitting slightly longer on the market. Price expectations are adjusting. And bidding wars, while still around, aren’t quite as cutthroat.

For those in the market, this could be a small window of opportunity — especially if you’re pre-approved at a competitive rate or have flexibility with closing timelines.

“We’re not seeing panic, just a bit of hesitation,” says one Toronto-based mortgage advisor. “But if rates drop again in fall, this pause could end quickly.”

| 🏘️ Property Type | 📅 Avg Days on Market | 📉 Change vs June |

|---|---|---|

| Detached | 24 days | +4 days |

| Townhouse | 21 days | +3 days |

| Condo | 26 days | +2 days |

What to Watch Heading into Fall

As we move into late summer, all eyes are on three major signals:

- Will the Bank of Canada deliver another rate cut in September?

- Will inventory rise as more sellers list in September?

- Will buyers jump back in with confidence — or continue to wait?

The answers to those questions will determine whether July’s cooling is just a seasonal dip or the start of a broader slowdown in Canada’s biggest housing market.

Final Word for Buyers and Sellers

If you’re thinking of buying, now might be a good time to negotiate — but make sure your mortgage pre-approval is up to date.

If you’re selling, be realistic about pricing and work closely with a Realtor who understands your neighbourhood dynamics.

Because in a market like this, timing and flexibility could mean thousands saved — or lost.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts