How Tariffs Could Shake Up Canada’s Housing Market: What Homebuyers & Homeowners Need to Know

New and proposed tariffs on goods like lumber, steel, and appliances could raise construction costs and slow down housing supply in Canada. This article breaks down how these trade moves could ripple through the housing market — and what buyers, builders, and homeowners should expect in 2025.

If you’re house-hunting or holding a mortgage in 2025, there’s a new economic twist you need to watch closely: U.S. tariffs on Canadian imports. With former U.S. President Donald Trump reinstating tariffs on Canadian goods as of March 4th, a wave of trade uncertainty is hitting the Canadian economy—and by extension, the housing and mortgage markets.

This isn’t just political noise. The return of trade barriers could directly impact your mortgage rate, your home affordability, and your future renovation costs. And while some parts of the country may feel it more than others, the effects are expected to ripple across the nation.

In this guide, we’ll break down exactly how these tariffs could affect Canadian homebuyers, homeowners, and real estate investors—and how to adapt your mortgage strategy to stay protected.

Trade Turbulence: How Tariffs Disrupt the Housing Market

At the heart of the issue is unpredictability. When tariffs go up, business investment usually goes down—and that uncertainty starts to undermine job growth, consumer confidence, and real estate demand.

According to financial analysts, provinces that rely heavily on exports—like Ontario, Quebec, and the Atlantic region—could see housing demand dip, especially in cities where manufacturing is a major employer. For example, if a local auto plant cuts jobs due to rising material costs, fewer people will be eager (or able) to take out a mortgage.

And this isn’t a short-term hiccup. With USMCA renegotiations looming in 2026, Canadian homeowners may need to brace for several years of market instability.

📆 Timeline of Trade Events Impacting Canadian Housing (2024–2026)

Key policy changes, tariff announcements, and economic shifts to watch

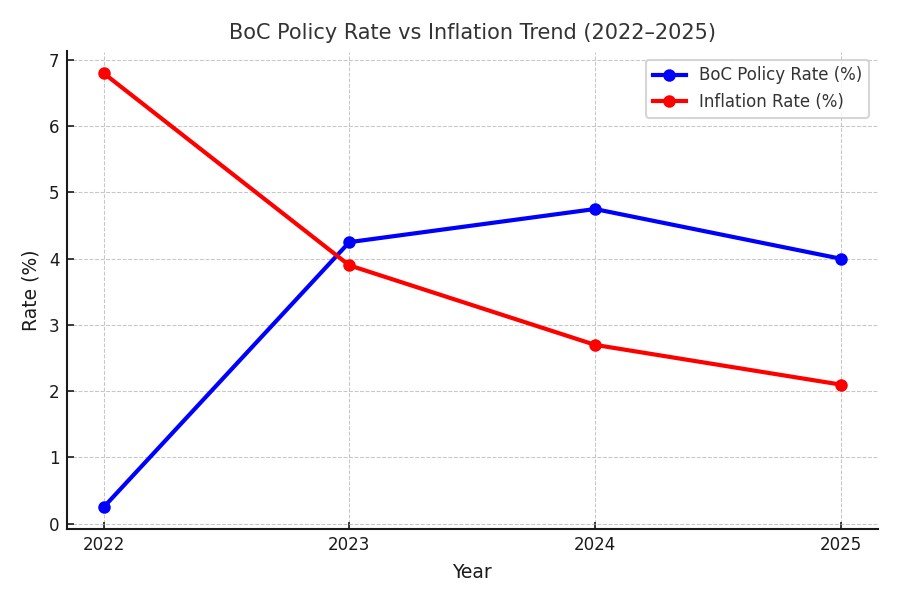

Will the Bank of Canada Keep Cutting Rates to Counter Tariffs?

To support the economy during uncertainty, the Bank of Canada has already been cutting its policy interest rate. This typically leads to lower variable mortgage rates, helping Canadians qualify for larger mortgages or reduce monthly payments.

But there’s a catch.

If the cost of imports rises due to tariffs—think gas, groceries, and construction materials—inflation could spike, forcing the Bank of Canada to pause or reverse its rate cuts.

This creates a tug-of-war between stimulus and stability: lower rates could help offset housing slowdowns, but too much inflation might force policymakers to tighten again, especially if consumer prices soar faster than wages.

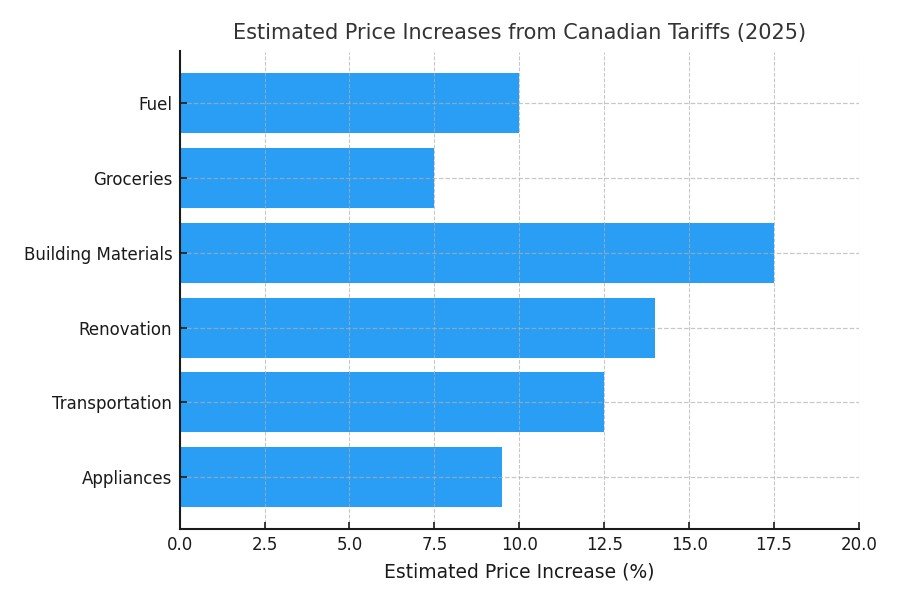

Tariffs Mean Higher Prices on Everything—Including Housing Costs

If Canada retaliates with its own tariffs on American goods (a likely outcome), everyday costs are going to climb—starting with:

- Gasoline and transportation (especially in Ontario and Quebec)

- Grocery essentials like fresh produce and packaged foods

- Construction and renovation materials such as steel, aluminum, and lumber

This could be a double hit for homeowners: even if your mortgage rate drops, your monthly budget might still get squeezed by rising costs. If you’re planning renovations, for instance, you may see contractors raise prices to cover tariff-inflated material costs.

Which Provinces Will Feel the Biggest Impact on Housing?

Ontario and Quebec, with their heavy dependence on U.S. trade and manufacturing, are likely to experience slower job growth and reduced housing demand. First-time homebuyers in cities like Windsor, Hamilton, or Montreal may need to be more cautious with long-term affordability.

In Alberta and Saskatchewan, oil exports are targeted with a 10% tariff—but global demand for energy remains strong. As a result, their housing markets may remain relatively stable or even grow, depending on how global commodity prices trend.

British Columbia and Nova Scotia, with more diversified economies, are likely to weather the storm better than manufacturing-heavy regions. However, rising consumer prices could still impact overall buyer sentiment across all provinces.

🗺️ Regional Housing Sensitivity to Tariffs Across Canada

Which provinces are more vulnerable to housing market impacts from trade disruptions?

- Ontario – manufacturing & auto exports

- Quebec – aerospace, aluminum, and trade reliance

- Atlantic Canada – seafood and manufacturing exports

- British Columbia – mixed economy with U.S. lumber exposure

- Nova Scotia – diversified trade but vulnerable ports

- Alberta – resilient due to global energy demand

- Saskatchewan – strong in agriculture & energy exports

- Manitoba – diversified, stable local economy

📌 Actual map visualization to be embedded or linked here

What Will the Government Do to Support Homeowners?

In anticipation of economic headwinds, federal and provincial governments are already exploring support measures:

- Mortgage affordability incentives for first-time buyers may be adjusted or expanded

- Targeted relief for impacted industries and regions could stabilize local housing markets

- Stimulus programs could return to help balance cost-of-living pressures

However, homeowners shouldn’t wait for government help. It’s better to proactively secure a flexible mortgage strategy and plan for volatility in your household finances now.

📌 What Relief Programs Are Likely in 2025?

Expected government responses to ease pressure on homebuyers and homeowners

Expect updates to down payment assistance, shared equity programs, or tax credits for new buyers.

Governments may reintroduce temporary mortgage deferral programs or interest relief if job losses rise.

Rebates or subsidies for green upgrades and home improvement projects may expand to offset material cost spikes.

Some provinces could offer temporary interest subsidies to keep mortgage payments affordable during inflation.

Sector-specific aid for workers in export-heavy jobs (e.g., auto, steel, energy) to prevent housing distress.

How to Adjust Your Mortgage Strategy for 2025’s Trade Volatility

This is not the time to wing it with your mortgage. Whether you’re buying your first home, refinancing, or coming up for renewal, being proactive is your best protection.

First, pay attention to the type of mortgage you choose:

- Fixed-rate mortgages offer predictable payments, ideal if inflation or rate hikes return

- Variable-rate mortgages (VRMs) can offer short-term savings, but only if the BoC keeps cutting—and they carry risk if inflation returns

- Adjustable-rate mortgages (ARMs) see your payment amount fluctuate with prime rate changes—these are riskier in volatile economic periods

If you’re unsure, a hybrid strategy (like a short-term fixed mortgage or split mortgage) may provide more flexibility.

Second, consider your location. If you’re buying in a region tied heavily to U.S. trade, you may want to prioritize affordability and equity-building over speculative appreciation. In stable provinces, however, you may have room to take more risk or invest more confidently.

Lastly, if you’re planning renovations, secure your materials and labour now. Tariffs can cause supply chain slowdowns and price spikes for everything from drywall to light fixtures. Locking in costs now protects your budget.

📌 Smart Mortgage Moves to Make During Trade Uncertainty

Protect your budget and housing goals with these expert-backed strategies

BoC cuts may help, but inflation could reverse them. Stay alert and be flexible with your timing.

If inflation rises again, locking in a fixed rate now can protect you from payment shocks later.

Avoid areas at high risk of job loss due to trade impacts. Choose stable, diversified markets.

With materials and appliances set to rise, now is the time to get firm quotes and buy in bulk.

Stay informed on federal or provincial mortgage assistance if your income is disrupted.

Stay Ready: The Best Defense is a Solid Plan

The return of U.S. tariffs brings more than just a bump in grocery bills—it could reshape the Canadian housing landscape for the next several years. From slower job growth to higher inflation and uneven regional housing markets, uncertainty will be the new normal.

But with the right information and a flexible mortgage plan, you can still move forward with confidence.

The key? Stay informed, consult a mortgage expert, and plan your finances based on what’s likely—not just what you hope. Whether you’re buying your first home or managing an existing mortgage, now is the time to tighten your strategy and stay ahead of potential shocks.

📞 Talk to a Mortgage Expert

Let’s build a personalized mortgage strategy that protects your budget—no matter what the market throws your way.

Get Your Free Mortgage StrategyStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts