How Tariff Threats and Bond Yields Could Impact Bank of Canada’s Decision

With global trade tensions rising and bond yields responding to market uncertainty, the Bank of Canada faces increasing pressure ahead of its next rate decision. This article breaks down how U.S. tariff threats and fluctuating Canadian bond yields could influence the BoC's monetary policy stance in 2025 — and what it means for borrowers across the country.

When politics and markets collide, mortgage rates get caught in the middle. And right now, with renewed tariff threats from the U.S. and Canada’s bond market flashing warning signs, Canadian borrowers are once again navigating a shifting landscape.

In this article, we unpack how global trade tensions, U.S. tariff moves, and bond yield reactions could influence the Bank of Canada’s next steps—and what that means for your mortgage strategy in 2025.

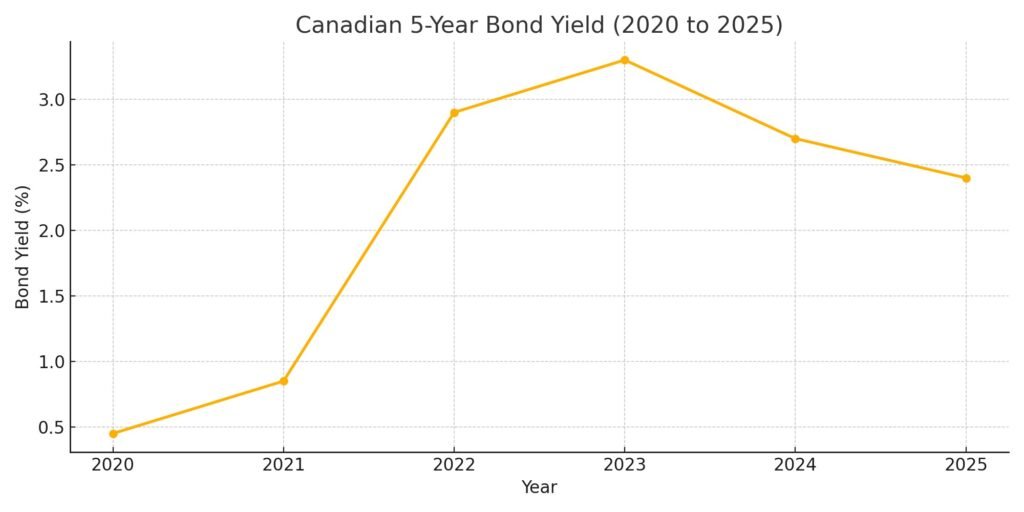

| 📅 Year | 💰 Federal Spending ($B) | 📈 5-Year Bond Yield (%) |

|---|---|---|

| 2020 | 508 | 0.42% |

| 2021 | 541 | 0.89% |

| 2022 | 496 | 2.87% |

| 2023 | 467 | 3.12% |

| 2024 | 489 | 3.45% |

| 2025 (Est.) | 505 | 2.75% |

Trump’s Tariff Pause: A Temporary Relief?

In what has become a recurring theme, President Trump recently pulled back on proposed 25% tariffs on Canadian goods. This pause, reportedly influenced by market instability and political pressure, is set to last only until April 2. But few expect the ceasefire to hold.

So what does that mean for Canadian mortgage holders?

In the short term, it’s actually good news. When global tensions rise, investors flee to safe assets like government bonds. This demand pushes bond prices up—and yields down. Since fixed mortgage rates in Canada are influenced by Government of Canada bond yields, this dynamic often leads to temporary rate relief.

But there’s a flip side: prolonged tariffs could drive up the cost of imported goods, pressure supply chains, weaken the Canadian dollar, and stoke inflation. That could eventually lead to higher rates—especially if the Bank of Canada (BoC) is forced to act.

Volatility in the Bond Market: Why It Matters

Canada’s 5-year bond yield recently hit a near three-year low. That’s a big deal.

Bond yields are one of the clearest forward-looking signals in the economy. When they fall, it suggests investors are betting on slower growth, or at least more rate cuts. And they’re not wrong: Canadian banks have already started trimming fixed mortgage rates in response.

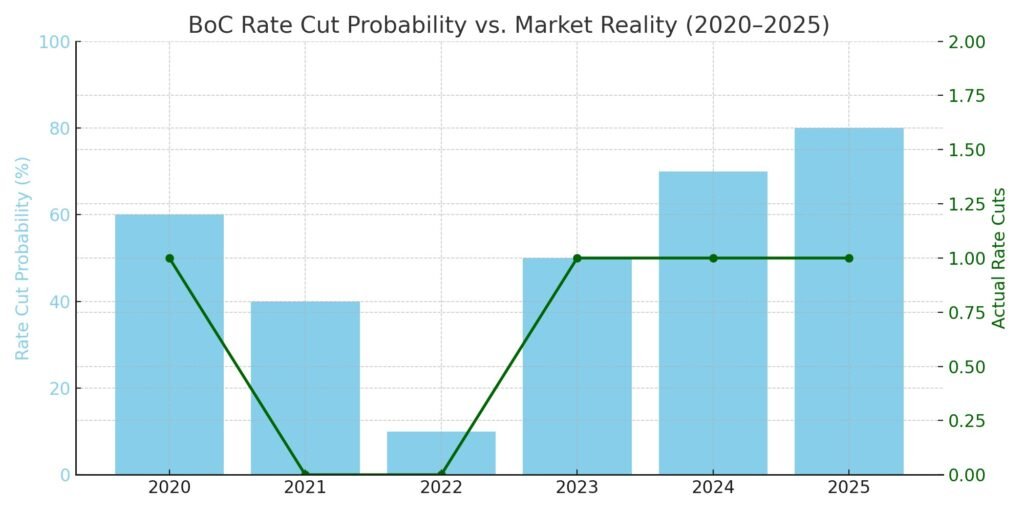

Will the Bank of Canada Cut Rates?

The market thinks so. As of now, there’s an 80% probability that the BoC will trim its policy rate at the next meeting, bringing it to 2.75%—smack in the middle of its neutral range.

But the BoC is facing a delicate balancing act. On one hand, inflation is cooling. On the other, global instability and fiscal spending could drive prices back up. Especially if the U.S. Federal Reserve holds its policy rate steady in response to new tariff-related inflation.

That’s why many experts believe the BoC may proceed with caution, even if markets expect faster cuts.

What Borrowers Should Consider

With rate direction less predictable than ever, Canadians are asking: what’s the right mortgage move?

Fixed-Rate Borrowers: If you prefer predictability, now might be a smart time to lock in a short-term (2–4 year) fixed rate. Bond yields suggest room for further rate drops, but don’t expect lenders to slash deeply.

Variable-Rate Borrowers: With BoC cuts still expected, variable rates could remain a better long-term value—but only if inflation stays under control. Remember: variable rates come with more risk, but easier exit penalties.

Renewals: If your mortgage is up for renewal in 2025, consider strategies that offer flexibility. You might choose a shorter fixed term to wait out rate uncertainty or lean into a variable product with a lower break fee.

Final Thoughts: Don’t Let Trade Wars Derail Your Mortgage Strategy

The headline? Tariff threats and bond yield reactions will continue to sway Canadian mortgage rates. But just because the market is volatile doesn’t mean you have to be.

With the right advice, you can choose a mortgage product that protects you from unnecessary cost—while leaving room to benefit if rates drop further. Whether it’s a fixed rate, a variable option, or something in between, the best strategy is the one that fits your personal goals.

📞 Explore Your Mortgage Options

Speak to a licensed mortgage expert today and get personalized advice for your situation.

Talk to an Expert NowStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts