Canada’s Mortgage MarketHolds Steady as 5-Year Fixed Averages 4.69% and Variables Sit Near 4.27%

Canada’s 5-year fixed averages 4.69% and variable sits near 4.27% as buyers navigate volatility. Rate holds surge as households plan cautiously.

Canadians Brace for Prolonged U.S. Trade Standoff as Homebuyers Adapt to Market Uncertainty

Canadian homebuyers adjust strategies as the U.S.–Canada trade standoff fuels market uncertainty. Fixed rates rise slightly; borrowers seek stability.

Canadian Mortgage Rates Mixed as 3-Year Terms Ease and Variable Nudges Higher

10 Nov 2025 data show Canada’s 3-year fixed rate down to 4.71 %, 5-year fixed steady at 4.69 %, and variable up to 4.27 %. Experts say the market is stabilizing after the BoC’s October rate cut.

Bank of Canada Holds Policy Rate at 5%, Says ‘Not Even Thinking’ About Cuts

The Bank of Canada kept its key rate steady at 5% on Nov 6 2025. Governor Macklem said he’s “not even thinking” about rate cuts as inflation stays above target.

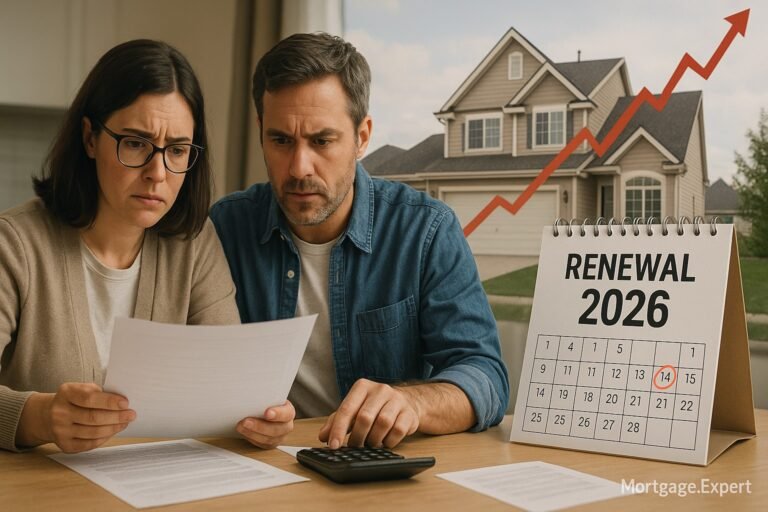

Mortgage Renewal Shock Looms for 2026, But Credit Quality Remains Resilient

CIBC Capital Markets projects that 2026 will bring Canada’s largest mortgage-renewal wave in a decade — a stress test for borrowers who locked in record-low pandemic rates. Learn why analysts see resilience now but caution for next year.

Bank of Canada Remains Cautious on Further Rate Cuts as Inflation Moderates

The Bank of Canada signals a pause after cutting rates to 2.25%, calling the level “about right.” Here’s what that means for variable-rate borrowers, fixed terms, and renewal strategies.

Bank of Canada Says 2.25 % Is “About the Right Level,” Signalling a Pause Ahead

The Bank of Canada lowered its overnight rate to 2.25 %, calling it “about the right level.” Markets read that as a pause signal, suggesting variable borrowers see relief while fixed-rate yields steady.

Variable-Rate Borrowers to See Immediate Relief as Big Six Banks Cut Prime to 4.45 %

Canada’s six biggest banks have dropped their prime rate to 4.45 % following the BoC’s latest cut, bringing long-awaited relief for variable-rate mortgage borrowers. Learn what this means for your payments and renewal plans.

Big Six Banks Lower Prime Rate to 4.45% After Bank of Canada’s Move

Canada’s Big Six banks reduce prime rate to 4.45% after BoC’s rate cut — easing borrowing costs for variable-rate mortgage holders.

Trump’s Tariffs Add New Uncertainty to Canada’s Housing Outlook

Canada’s housing market faces new challenges as U.S. tariffs escalate. Analysts warn the trade shock could dampen mortgage demand, delay rate relief, and increase risk aversion among lenders.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts