Should You Lock In for 3 Years or 5? A 2025 Guide to Fixed-Rate Mortgages in Canada(Updated July 2025)

You can almost feel the tension in every conversation about mortgages this year. After three years of rapid-fire rate hikes and wild predictions about where borrowing costs might land, Canadian homebuyers are once again facing a fork in the road. One side offers the familiar comfort of the classic five-year fixed term; the other promises the shorter commitment of a three-year deal that could let you renegotiate sooner if the Bank of Canada begins cutting more aggressively. Deciding which path to take is more than a simple rate-shopping exercise—it’s a personal finance decision that will shape your monthly budget, your risk exposure, and even your sleep quality for the next few years.

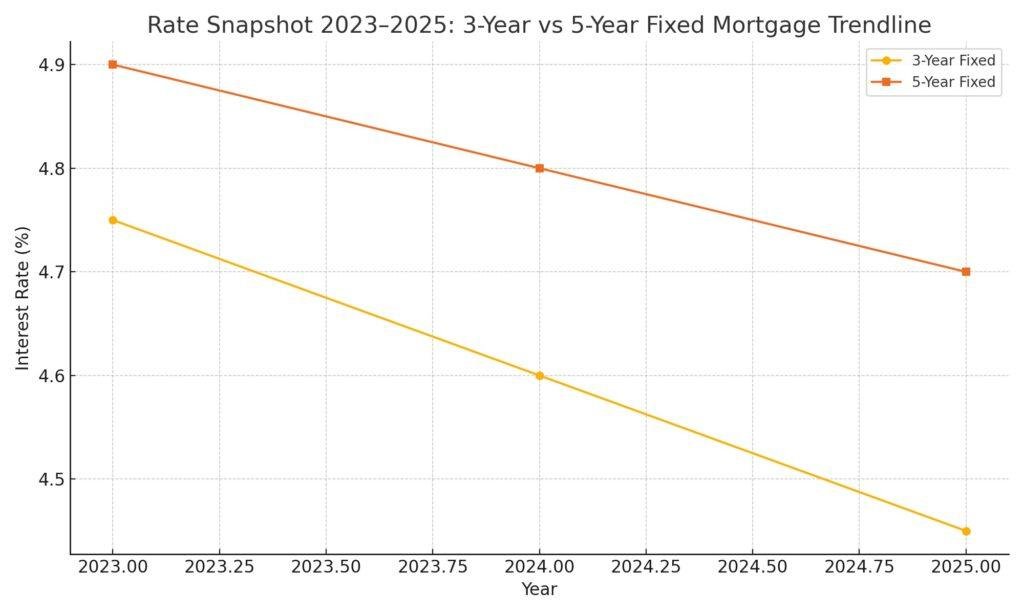

A Quick Look at Where Rates Stand in 2025

Five-year fixed rates peaked above five per cent in late 2024 and have since drifted into the high-four territory. Three-year fixed loans, meanwhile, have edged lower more quickly, settling in the mid-to-high fours. Variable rates are still elevated, which means the traditional fixed-versus-variable debate has temporarily shifted to a fixed-versus-fixed one. Analysts remain split on timing: some see a rate-cut cycle beginning before the end of this year, while others expect a slower path back toward pre-pandemic pricing over the next two years. That uncertainty explains why so many borrowers are giving the three-year term a closer look.

Understanding Fixed-Rate Mortgages Without the Jargon

A fixed-rate mortgage does exactly what the name suggests: it freezes your interest rate for the entire length of your term. During that period, your monthly payment will not change, which brings two immediate benefits. First, you can plan your budget with confidence. Second, you are shielded from sudden upticks in the Bank of Canada’s benchmark rate. In 2020–2021, that predictability felt almost boring—in a good way. But when overnight rates shot up from 0.25 per cent to 5 per cent in just twenty-one months, the advantages of a fixed mortgage moved from “nice to have” to “absolute lifesaver.” Today, the question is no longer whether a fixed term makes sense; it’s which fixed term best reflects the reality you expect to live in over the next few years.

The Three-Year Fixed: A Shorter Leash With More Agility

A three-year term is the sprinter of the mortgage world. You commit for just thirty-six payments, secure a known rate, and then line up at the renegotiation start-line again in early 2028. Borrowers who believe rates will decline—or who anticipate a life change like selling, upgrading, or starting a family—often lean toward this term because it keeps the penalty window much smaller and lets them reposition sooner if the market turns friendly.

Imagine you locked in a three-year at 4.65 per cent today. If analysts calling for a full one-percentage-point drop by 2027 prove correct, you could slide into your next term at 3.65 per cent without paying a stiff interest-rate-differential penalty. You also shave down the cost of breaking the mortgage if you decide to move before the term ends—because penalties on fixed loans are calculated on the months remaining. The trade-off is obvious: if economists are wrong and rates climb again, you will renegotiate from a weaker position.

The Five-Year Fixed: Canada’s Comfort Blanket

The five-year term is a cultural touchstone—partly because the big banks have been marketing it since the 1990s and partly because it lines up neatly with how Canadians tend to plan their lives. Five years is long enough to settle into a home, welcome a child, or renovate a kitchen, all while ignoring headlines about rate swings. If you choose a five-year at, say, 4.95 per cent in mid-2025, you could keep that payment steady until the summer of 2030. That stability is priceless if your household budget is tight or your risk tolerance is low.

However, locking for five years may feel like strapping yourself into a roller-coaster seat long after the scary part of the ride is over. Should rates retreat to the low fours—or even high threes—by 2027, you’ll still be paying a premium unless you break the term and swallow a potentially eye-watering penalty. Payment stability comes at the cost of agility.

Real-Life Scenarios: Which Term Fits Your Story?

Scenario One: The First-Time Buyer in Vancouver

Sasha just bought a two-bedroom condo and stretched their finances to make it happen. A single missed paycheque would cause sleepless nights. For Sasha, minimizing uncertainty outranks the chance to shave a few basis points off the rate in three years. The five-year term offers a mental-health premium no spreadsheet can fully quantify.

Scenario Two: The Toronto Family Planning a Move

Jamal and Priya expect to outgrow their starter home within three years. They favour the three-year term, accepting a modestly higher rate now in exchange for a smaller payout penalty and the option to reset at renewal.

Scenario Three: The Calgary Investor With a Diversified Portfolio

Alison owns a rental property and has significant holdings in ETFs and dividend stocks. She chooses a three-year fixed because rising portfolio gains can offset a temporary rate uptick, and she likes the flexibility to refinance sooner if real estate prices pull back.

What Do the Numbers Say?

Economists at major Canadian lenders predict the five-year Government of Canada bond yield—a key driver of five-year fixed rates—will slide from roughly 3.4 per cent to the high-twos by late 2026. If that happens, borrowers who pick a three-year term today could renew into a significantly lower rate. Those with a 4.9 per cent five-year, though, would still have two years left at the higher cost. That future savings has to be weighed against the possibility that forecasts miss the mark.

No One-Size-Fits-All Answer—So Test Your Comfort Level

Choosing between a three- or five-year term is less about predicting the macroeconomy and more about knowing yourself. Reflect on three questions:

How stable is my income? … Do I expect to move, refinance, or require extra funds within three years? … How will I feel if rates fall and I’m locked in higher, or if rates rise and I’m forced to renew sooner?

Answer honestly, and you’ll often find the term that fits like a glove.

Speak to a Pro Before You Sign

Even the savviest borrowers can miss fine print about prepayment penalties, portability clauses, or blend-and-extend options. A seasoned mortgage expert can simulate best- and worst-case rate paths, quantify potential penalties, and recommend the term that limits your total cost under multiple scenarios.

Mini Verdict

A three-year fixed in 2025 is the agile choice for Canadians betting on lower rates or planning life changes inside thirty-six months. A five-year fixed remains the “sleep-at-night” option for those prioritizing payment stability through the next rate cycle. Either way, the smartest move is to compare offers, understand penalties, and align your mortgage term with your real-world plans rather than chasing the perfect forecast.

What it will show: A guided flowchart helping readers decide between a 3-year or 5-year mortgage term, based on interest rate expectations, housing plans, and financial flexibility.

This infographic will walk you through a series of simple Yes/No questions to determine which term may be better suited to your goals.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts