Should You Buy or Rent in Toronto in 2025? A Smart Canadian’s Guide

"Stuck between renting or buying in Toronto's challenging 2025 market? This smart Canadian’s guide breaks down the economics, lifestyle impact, and timing factors to help you decide what’s right for you."

Thinking of living in Toronto and torn between renting and buying? You’re not alone. With sky-high property prices and shifting interest rates, many Torontonians are asking the same question: “Is it smarter to rent right now, or should I just take the plunge and buy?”

Let’s break it down in simple, real-life terms — using actual data, relatable scenarios, and expert tips to help you make a confident decision that works for you.

📋 2025 Rent vs Buy Cheat Sheet – Toronto

| Factor | Renting | Buying |

|---|---|---|

| Average Monthly Cost | $2,632 | $3,200–$3,600 (Mortgage + Taxes + Maintenance) |

| Upfront Costs | First & Last Month’s Rent (~$5,000) | Down Payment + Closing Costs (~$45K+ on $600K condo) |

| Flexibility | High (Easy to move) | Low (Long-term commitment) |

| Stability | Low (Subject to rent increases/eviction) | High (You own the home) |

| Investment Potential | None | High (Equity + Capital Gains) |

🔍 *Estimates based on 2025 Toronto condo market and rental rates. Use this cheat sheet to evaluate your budget, lifestyle goals, and long-term financial plans when deciding whether to rent or buy in Toronto.

Renting in Toronto: Why It Still Makes Sense for Some in 2025

Renting a home in Toronto can often feel like throwing money away — but it isn’t that simple. For many people, especially those still figuring out their next steps or saving up, renting is the practical choice. Why? Because it offers flexibility. You’re not tied to a mortgage, you can move relatively easily, and you’re not shelling out tens of thousands in down payments and property taxes.

Take, for example, Sima and Rohan — a young couple living downtown. They pay $2,650/month for a 1-bedroom rental in Liberty Village. It’s not glamorous, but it works. They’re saving aggressively and watching the market before they make a long-term commitment. And with Toronto’s rental vacancy rate slowly recovering, they’ve got options.

Renting also means you don’t need to worry about leaky roofs or appliance repairs. A single call to the landlord, and it’s taken care of — no surprise costs, no stress. For anyone who values peace of mind and doesn’t want to be financially locked in, renting still has its perks.

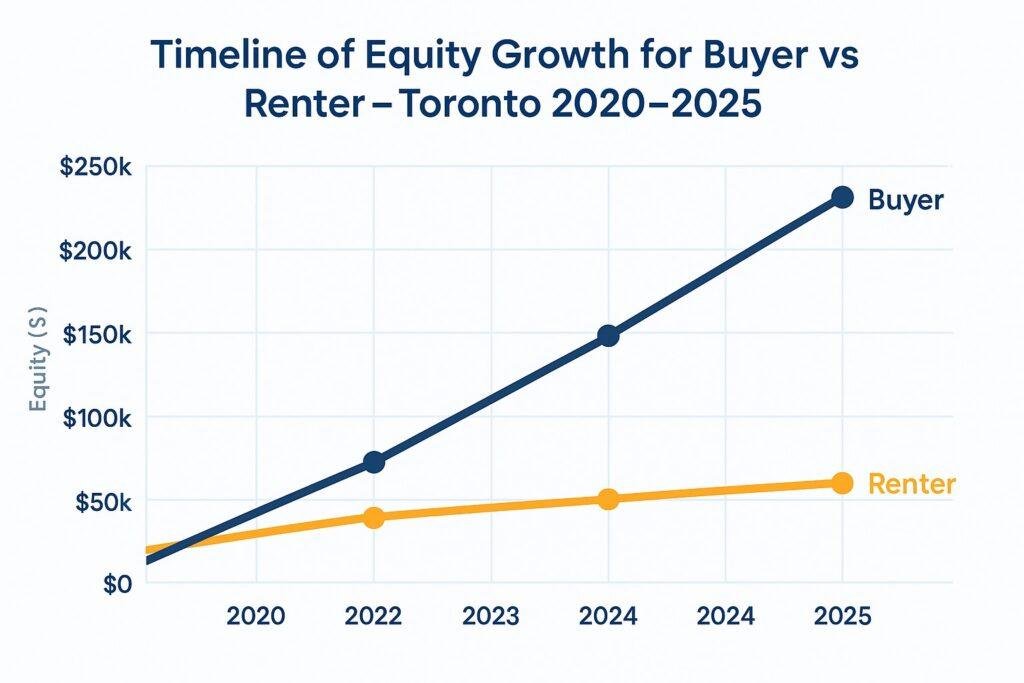

Buying in Toronto: A Long-Term Wealth-Building Move

On the flip side, buying a home helps you build equity, gain stability, and enjoy some control over your space. It’s like planting roots. You’re not just paying for shelter — you’re investing in an asset that (hopefully) grows over time.

Take James, a 35-year-old graphic designer who bought a condo in Scarborough in 2020 for $510,000. Even after the recent cooling in prices, his unit is still worth about $570,000 today. He’s also paying roughly $2,900/month in mortgage, maintenance, and taxes — not dramatically more than what he’d pay in rent. And that monthly payment? It’s going toward ownership, not someone else’s pocket.

With Canada’s principal residence exemption, Dev also won’t pay capital gains tax if he sells it later for a profit. That’s a huge benefit — one that renters never get to enjoy.

The 5% Rule: A Quick Formula to Guide Your Decision

A helpful rule of thumb in deciding whether to rent or buy is called the “5% rule.” It’s simple: if the annual rent you’re paying is less than 5% of the home’s value, renting might be the better financial move.

Here’s how it works:

Let’s say you’re eyeing a condo listed at $700,000 in Toronto. Five percent of that is $35,000 per year — or around $2,916 per month.

If you can rent a similar unit for less than that, renting may make more sense.

Right now, the average rent for a 1-bedroom unit in Toronto is around $2,650. That’s below the 5% threshold for many $700K properties, which tilts the scale slightly in favour of renting in the short term. But remember — that doesn’t account for rising rents, market appreciation, or your personal goals.

Toronto Example: Rent vs Buy Side-by-Side

Let’s take a realistic 2025 scenario:

- Average Condo Price: $681,000

- 5% of Value: ~$2,837/month

- Average Rent for Similar Unit: ~$2,632/month

In this case, renting seems cheaper. But if mortgage rates drop or property values begin climbing again (as many analysts expect by 2026), the ownership side of the equation may look far more attractive.

Pros of Renting (in 2025 Toronto)

- Shorter commitment, ideal for students, contract workers, or those unsure about staying

- No maintenance headaches

- Less upfront cash required

- Rent may still be lower than mortgage payments (depending on area and timing)

But…

- Rent can increase unpredictably

- You’re not building equity

- You have less control (no renovations, risk of eviction, etc.)

Pros of Buying (in 2025 Toronto)

- You build equity and potentially benefit from property appreciation

- You gain stability — no landlord surprises

- You can renovate, rent it out, or leverage home equity

- Mortgage payments, in the long run, may be lower than rent

But…

- You’ll need 5–20% down + closing costs

- Home maintenance becomes your job (and your expense)

- You’re locked in — moving isn’t always easy or cheap

When Renting Makes More Sense

If you’re new to Toronto, planning to move again within 3 years, or unsure about job stability, renting is likely your safer bet. It allows you to stay nimble and save up while watching market trends.

When Buying is the Smart Move

If you have a stable income, plan to stay in the GTA for 5+ years, and have saved for a down payment, buying can help you build wealth and lock in housing security in a city where rents are unlikely to fall significantly.

2025 Tip: Consider a “Rent-to-Own” Plan

With prices high and savings stretched thin, some Toronto buyers are exploring rent-to-own models, which let you live in the home you’ll eventually buy — while using part of your rent as future equity. It’s still niche, but growing in popularity across Ontario.

🏡 How Rent-to-Own Works in Ontario – 2025 Overview

- 💼 Agreement Signed: A rent-to-own contract is created between tenant-buyer and landlord-seller. It outlines the term (usually 1–5 years), monthly rent, and future purchase price.

- 💰 Option Fee Paid: The tenant pays an upfront “option fee” (typically 2%–5% of the home price), which goes toward their future down payment.

- 🏠 Move In & Pay Rent: The tenant moves into the home and begins paying monthly rent — part of which may be credited toward the eventual purchase.

- 📈 Build Equity Over Time: As rent credits accumulate, the tenant builds up a portion of the future down payment without needing a mortgage upfront.

- 🔑 Buy the Home: At the end of the term, the tenant has the exclusive option to purchase the home — using the credits and option fee toward their down payment.

📌 Key Benefits:

- ✔ Helps buyers with poor/no credit qualify later

- ✔ Locks in today’s price while building savings

- ✔ Combines renting flexibility with ownership goals

⚠️ Considerations:

- ❗ Option fee is non-refundable if purchase doesn’t happen

- ❗ Future mortgage preapproval still required

- ❗ Repairs and maintenance may be the tenant’s responsibility

📆 Updated for Ontario real estate regulations and market trends in 2025

Final Thoughts: Rent or Buy in Toronto?

There’s no one-size-fits-all answer. It’s a personal decision rooted in your lifestyle, finances, goals, and the current market.

But here’s the bottom line:

If you’re planning to stay put and can afford the upfront costs, buying can be a strategic, long-term investment.

If you need flexibility or aren’t financially ready, renting is perfectly smart — for now.

And remember: neither option is “wrong.” The right choice is the one that keeps you stable, happy, and growing financially.

📊 Renting vs Buying in Toronto – 2025 Snapshot

🏠 Renting

- ✅ Lower upfront costs (first & last month’s rent)

- ✅ More flexibility for relocation

- 🚫 No equity or investment return

- 🚫 Rent may rise annually

- 📈 Avg monthly rent: $2,632

🏡 Buying

- ✅ Builds equity over time

- ✅ Stability & ownership freedom

- 🚫 Higher upfront costs (down payment, closing)

- 🚫 Maintenance & taxes responsibility

- 💰 Avg condo price: $681,855

📌 Based on current trends, renting may cost ~$2,632/month vs unrecoverable ownership cost of ~$2,841/month (per 5% rule).

Mini Verdict: What Should You Do?

Short-term in Toronto?

Rent

Looking to build wealth long-term?

Buy — if you can afford it

Still unsure if renting or buying is the right move on a national scale? Here’s a Canada-wide rent vs. buy breakdown that goes beyond just Toronto.

And if you decide to take the buying route, this first-time buyer guide will walk you through every step.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts