RRSP Home Buyers’ Plan (HBP): How It Works, Who’s Eligible, and If It’s Right for You

For many Canadians, buying a home isn’t just a dream — it’s a major financial milestone. But with housing prices soaring (Rising) and down payments harder to save for, even well-prepared buyers are looking for creative ways to make their first home purchase work. That’s where the RRSP Home Buyers’ Plan (HBP) can play a key role.

This federal program lets eligible Canadians withdraw money from their Registered Retirement Savings Plan (RRSP) to help buy or build a qualifying home — and the best part? You can do it tax-free as long as you repay the funds on schedule.

Let’s know how the HBP works, who can qualify, how much you can withdraw, and what it really means for your mortgage strategy.

What Exactly Is the RRSP Home Buyers’ Plan?

The Home Buyers’ Plan (HBP) is a Canadian government initiative that allows eligible first-time homebuyers to borrow from their own RRSP savings — without triggering income tax — to fund the purchase or construction of a home.

Essentially, it functions like an interest-free loan from your future self. You get to access your retirement savings now, when you really need it, and repay it gradually over time.

As of 2024, the withdrawal limit has increased to $60,000 per person, meaning couples can access up to $120,000 combined. These funds can be used for your down payment, closing costs, or even construction-related expenses, giving you more financial breathing room when entering the housing market.

Who’s Eligible for the HBP?

The HBP is geared primarily toward first-time homebuyers — but that definition is a little more flexible than you might think.

To qualify, you must:

- Be a Canadian resident at the time you withdraw from your RRSP and up until the home is purchased or built.

- Be considered a first-time buyer, which means you haven’t owned a home — or lived in a home owned by your spouse or partner — during the four calendar years prior to the withdrawal.

- Plan to live in the home as your principal residence within one year of purchase or completion.

- Have a signed agreement to buy or build a qualifying home.

There’s also an important exception: if you’re buying or building a home for a relative with a disability, you may qualify even if you’ve owned a home before. And if you’ve previously used the HBP but fully repaid your balance, you may be eligible to use it again.

How Much Can You Withdraw?

The maximum you can withdraw under the HBP is $60,000 per individual.

For couples, that means a total of $120,000 can be accessed tax-free — a significant amount that could easily cover your down payment in many Canadian cities outside Toronto and Vancouver.

That said, there are a few conditions:

- The funds must have been in your RRSP for at least 90 days before withdrawal.

- You must complete the withdrawal within the same calendar year or by the following January.

- You need to use CRA Form T1036 to start the withdrawal process through your RRSP provider.

Once approved, your provider will issue a T4RSP slip that documents the amount withdrawn. You’ll need this for your tax return the following year — but remember, the withdrawal itself won’t be taxed, as long as you repay it properly.

How Does the HBP Work, Step by Step?

Using the HBP is straightforward once you understand the timeline.

First, you complete CRA Form T1036 and submit it to your RRSP issuer. This tells them you’re requesting a withdrawal under the Home Buyers’ Plan. They’ll process the form and issue the funds, which you can then use toward your home purchase.

You must then buy or build your home by October 1 of the year after your withdrawal. If you don’t, your participation may be cancelled and the withdrawn amount becomes fully taxable.

And this is where repayment comes in: you must begin paying back what you withdrew starting the second year after your withdrawal. However, if you withdrew funds between January 1, 2022 and December 31, 2025, the government has extended that repayment grace period to five years, giving you extra time to get financially settled before repayments begin.

How Repayment Works (And Why It Matters)

Repayment under the HBP isn’t optional — it’s a key part of the program. Starting in year two (or five, under the temporary relief rules), you’ll need to repay 1/15 of the total amount you withdrew each year.

So, if you withdrew $60,000, your annual minimum repayment would be $4,000. You can pay more if you’d like, which would reduce future obligations, but you must hit at least that minimum every year for 15 years.

If you don’t repay the required amount, the shortfall is added to your taxable income for that year — meaning you’ll owe income tax on that unpaid portion. And unlike regular RRSP contributions, HBP repayments don’t count toward your RRSP contribution room, so there’s no additional tax deduction benefit.

📋 Year-by-Year Repayment Schedule: $60,000 RRSP Withdrawal

This table shows how you’d repay a $60,000 Home Buyers’ Plan withdrawal over 15 years, starting in year 2, with $4,000 repaid each year and no interest added:

| Year | Repayment Amount | Cumulative Repaid | Balance Remaining |

|---|---|---|---|

| 1 (Grace Year) | $0 | $0 | $60,000 |

| 2 | $4,000 | $4,000 | $56,000 |

| 3 | $4,000 | $8,000 | $52,000 |

| 4 | $4,000 | $12,000 | $48,000 |

| 5 | $4,000 | $16,000 | $44,000 |

| 6 | $4,000 | $20,000 | $40,000 |

| 7 | $4,000 | $24,000 | $36,000 |

| 8 | $4,000 | $28,000 | $32,000 |

| 9 | $4,000 | $32,000 | $28,000 |

| 10 | $4,000 | $36,000 | $24,000 |

| 11 | $4,000 | $40,000 | $20,000 |

| 12 | $4,000 | $44,000 | $16,000 |

| 13 | $4,000 | $48,000 | $12,000 |

| 14 | $4,000 | $52,000 | $8,000 |

| 15 | $4,000 | $56,000 | $4,000 |

| 16 (Final) | $4,000 | $60,000 | $0 |

💡 Reminder: HBP repayments must begin the second year after withdrawal. Missed annual repayments are added to your taxable income.

This repayment model gives you flexibility — but it also means you’re reducing the growth potential of your RRSP in the long run. That’s why the HBP should be treated as part of a bigger financial plan, not just a quick fix.

Is the HBP Right for You? Pros and Cons to Consider

The Home Buyers’ Plan offers clear benefits, but it isn’t for everyone. Let’s look at the real-life upsides — and the tradeoffs.

On the plus side, the HBP gives you access to funds you might otherwise be saving for decades. It’s interest-free, and you don’t need to qualify through a bank. That’s especially helpful in markets where a bigger down payment means avoiding costly CMHC insurance or getting better mortgage terms.

It also helps boost affordability for first-time buyers struggling to get into the market — which is becoming more common across Canada.

But there are downsides too. The biggest one is opportunity cost. Withdrawing from your RRSP means pulling money out of a tax-sheltered investment account. That money could’ve grown significantly over 15 years. If your home doesn’t appreciate at the same pace, you may come out behind in the long run.

And then there’s the rigid repayment schedule. Even if your income changes or other life expenses pop up, you’re still expected to repay each year — or face a tax penalty.

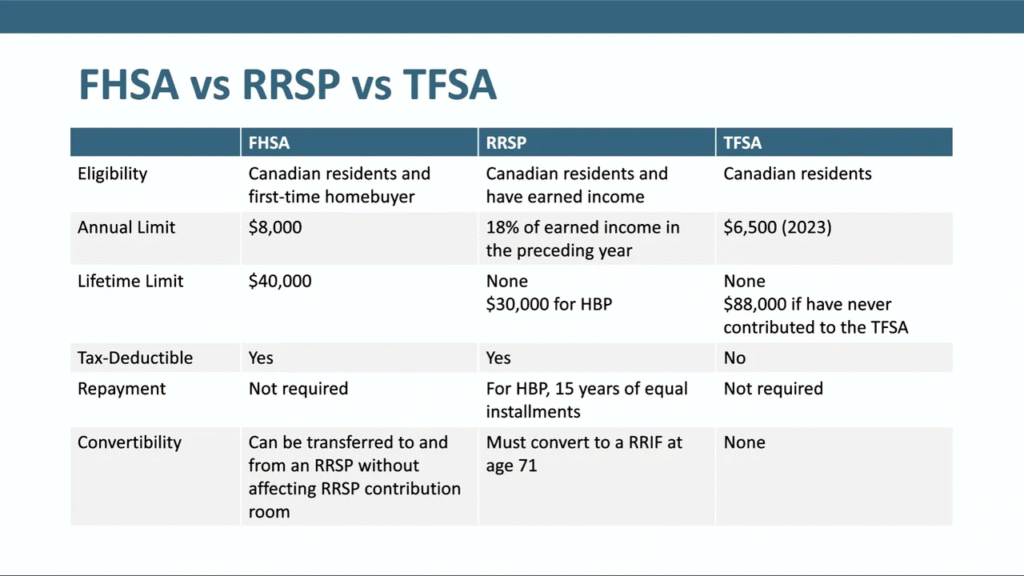

RRSP vs TFSA vs FHSA: Which One’s Best for First-Time Buyers?

If you’re planning to buy a home soon, you may be wondering whether the HBP is better than other savings options like the Tax-Free Savings Account (TFSA) or the new First Home Savings Account (FHSA).

Here’s how they compare:

- The HBP lets you tap into your RRSP with a withdrawal limit of $60,000 — but you must repay it within 15 years. If not, it’s taxed as income.

- The TFSA is completely flexible. You can withdraw anytime, for any reason, with no tax or repayment required. But the growth potential is lower if you haven’t contributed consistently.

- The FHSA is a hybrid — offering tax deductions like an RRSP but tax-free withdrawals like a TFSA. It’s limited to first-time buyers and capped at $40,000 total contributions.

In an ideal world, you’d use all three together — saving in the FHSA and TFSA while also building RRSP contributions for an HBP withdrawal. This combo gives you the most purchasing power while maintaining tax efficiency.

Can You Cancel Your HBP Participation?

Sometimes life doesn’t go as planned. If you don’t end up buying or building a qualifying home — or you become a non-resident before doing so — you may be able to cancel your participation in the HBP.

In special cases, such as a relationship breakdown where you no longer plan to move into the purchased home, the CRA allows cancellation. But keep in mind, if the conditions aren’t met and you don’t cancel properly, the full amount withdrawn may be added to your income and taxed.

Additional Programs for First-Time Buyers

The HBP isn’t your only option. Other first-time buyer programs include:

- The GST/HST New Housing Rebate, which helps recover taxes paid on new construction

- The Home Buyers’ Tax Credit, which provides a $1,500 tax rebate

- The First Home Savings Account (FHSA), which allows tax-deductible savings up to $40,000 for your first home

Depending on where you live, provincial and municipal programs may also offer rebates or grants — like land transfer tax refunds or first-time buyer assistance funds.

Final Thoughts: Should You Use the Home Buyers’ Plan?

The RRSP Home Buyers’ Plan can be a game-changer for Canadians with retirement savings and a dream of homeownership. It offers an interest-free, tax-deferred way to access your RRSP — and if repaid correctly, won’t impact your long-term taxes.

But it’s not one-size-fits-all. Before withdrawing, ask yourself: Can I realistically repay this over 15 years? Am I sacrificing future investment growth to buy now? Do I have other savings tools like the FHSA or TFSA to combine with the HBP?

If the answer is yes — or you’re unsure — it’s worth speaking to a mortgage expert who can guide you through your options.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts