RRSP Home Buyers’ Plan (HBP): How It Works & Who Can Use It

If you’re a first-time homebuyer in Canada, there’s one financial tool you shouldn’t overlook: the RRSP Home Buyers’ Plan, or HBP. It’s a way to borrow from your own retirement savings — tax-free — to help cover the costs of buying or building your first home.

As of 2024, you can withdraw up to $60,000 individually or $120,000 as a couple. That’s a massive boost to your down payment potential — without triggering immediate taxes.

Let’s walk through how the HBP works, who’s eligible, what to watch out for, and how to use it strategically alongside other programs.

What Is the RRSP Home Buyers’ Plan (HBP)?

The Home Buyers’ Plan (HBP) lets you take money from your Registered Retirement Savings Plan (RRSP) to buy or build a home — without paying tax on the withdrawal, as long as you repay it over time.

It’s essentially an interest-free loan to yourself. You have to repay the withdrawn amount within 15 years, and you get a 2-year grace period before the repayments begin. That means more money upfront for your home purchase without sacrificing long-term tax benefits — as long as you follow the rules.

Who Is Eligible for the HBP?

The HBP is designed for first-time homebuyers, but that doesn’t mean you’ve never owned property. According to CRA rules, you’re considered a first-time buyer if:

- You haven’t lived in a home you owned (or that your spouse/common-law partner owned) in the last 4 years

- You’re buying or building a qualifying home (must become your principal residence within 1 year)

- You’re a Canadian resident at the time of withdrawal and when you buy/build the home

- You have a written agreement to buy or build the home

- You’re using the funds for yourself or for a relative with a disability who’ll live in the home

💡 You can use the HBP more than once if you’ve repaid your previous balance in full and still meet eligibility rules.

How Much Can You Withdraw Under the HBP?

You can withdraw up to:

$60,000 as an individual

$120,000 if you’re buying as a couple

There’s just one catch — the RRSP funds must have been in your account for at least 90 days before you withdraw them under the HBP. Recent deposits may not be eligible.

How Do You Use the HBP?

Here’s how to tap into your RRSP using the HBP:

- Fill out Form T1036 — the Home Buyers’ Plan Request to Withdraw Funds

- Submit it to your RRSP issuer, who completes their section and releases the funds

- Withdraw in one or multiple transactions, but they must all happen within the same calendar year or by January of the next

- Keep your receipts and tax slips — you’ll get a T4RSP, which must be reported on your tax return

- Buy or build the home by October 1 of the year after your first withdrawal

How Do You Repay the HBP?

You start repaying your RRSP two years after the withdrawal, with the full amount due over 15 years. Each year, you must repay at least 1/15th of the amount withdrawn.

Example:

If you took out $60,000, your minimum repayment is $4,000 per year.

If you skip a repayment or underpay, that year’s shortfall is added to your taxable income. That means more income tax owed for that year — so it’s important to stay on track.

Example Repayment Table:

| Year | HBP Balance | Required Repayment | Actual Repayment |

|---|---|---|---|

| 1 (Grace Period) | $60,000 | $0 | $0 |

| 2 (Grace Period) | $60,000 | $0 | $0 |

| 3 | $60,000 | $4,000 | $4,000 |

| 4 | $56,000 | $4,000 | $4,000 |

| 5 | $52,000 | $4,000 | $10,000 (extra) |

| 6 | $42,000 | $3,400 | — |

📝 Note: HBP repayments do not count toward your RRSP contribution room.

Pros and Cons of the RRSP Home Buyers’ Plan

Let’s weigh the trade-offs.

Pros

- Tax-free withdrawal with no immediate penalties

- Interest-free borrowing from yourself

- Helps boost down payment during affordability challenges

- Flexible repayment timeline

Cons

- You must already have RRSP savings

- Reduces your RRSP’s compound growth potential

- Missed payments = extra tax owed

- Only available to first-time buyers or those helping disabled relatives

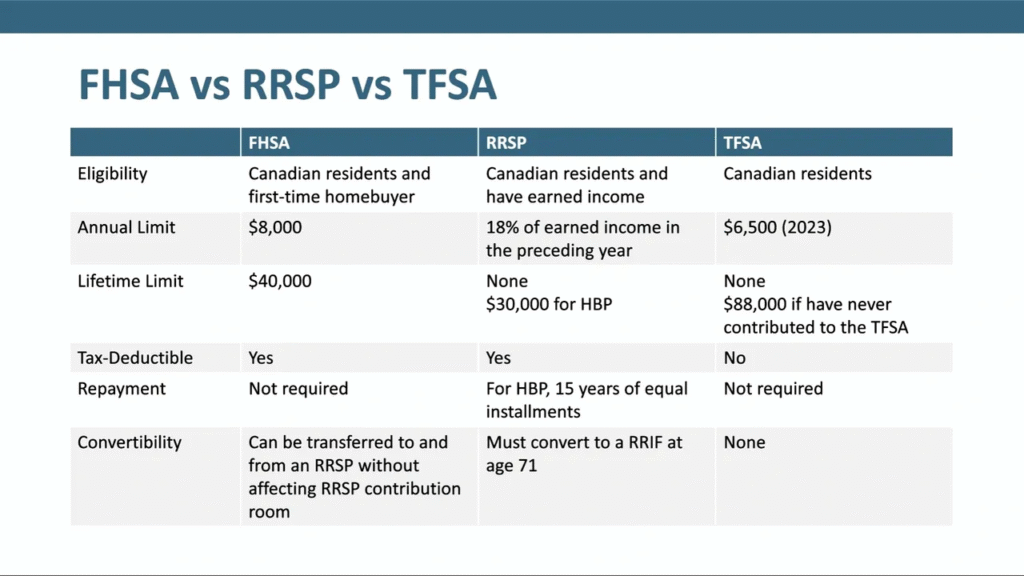

HBP vs TFSA vs FHSA: Which Is Better?

Here’s how the HBP compares to other savings tools for homebuyers:

| Program | Max Withdrawal | Tax-Free? | Contribution Limit | Repayment Required? | Best For |

|---|---|---|---|---|---|

| RRSP HBP | $60,000 (per person) | Yes (if repaid) | RRSP limits | Yes – over 15 years | First-time buyers with existing RRSP savings |

| TFSA | No limit | Yes | $7,000/year (2024) | No | Flexible saving (not home-specific) |

| FHSA | $40,000 total | Yes | $8,000/year | No | Long-term first-home saving with tax perks |

Can You Cancel the HBP?

Yes, in some cases.

You might be able to cancel your participation if:

- You don’t buy or build the home by the deadline

- You become a non-resident before buying

- Your marriage or relationship breaks down and you don’t take over the property

If cancelled, the withdrawn funds may become immediately taxable — unless recontributed in time.

Other First-Time Buyer Programs to Use With the HBP

Don’t stop at the HBP. You may also qualify for:

- GST/HST New Housing Rebate – Recover part of the tax on a new home

- First-Time Home Buyers’ Tax Credit – Get up to $1,500 as a tax refund

- First Home Savings Account (FHSA) – Save $8,000/year tax-free, up to $40,000

- Provincial incentives – Rebates and land transfer tax relief (varies by province/municipality)

Frequently Asked Questions (FAQ)

How much can I withdraw with the HBP?

Up to $60,000 per person, or $120,000 for couples.

Who qualifies as a first-time homebuyer for the HBP?

Someone who hasn’t owned (or lived in a spouse’s owned home) in the last 4 years.

How long do I have to repay the HBP?

15 years — with repayments starting after year 2. (Currently extended to 5 years grace if withdrawn between Jan 1, 2022, and Dec 31, 2025.)

Can I use both the HBP and FHSA together?

Yes. They can be combined for a larger total, but you can’t use FHSA funds to repay HBP amounts.

What if I miss a repayment?

The unpaid amount is added to your taxable income for that year.

Final Thoughts: Should You Use the HBP?

The RRSP Home Buyers’ Plan can be a smart way to unlock tax-free funds for your first home — especially if you already have RRSP savings and need a down payment boost. It’s flexible, familiar, and designed to work with your long-term goals.

But it does come with rules. The 15-year repayment timeline means you’re committing for the long haul, and missing payments could create tax headaches.

If you’re unsure whether to use the HBP, combine it with an FHSA, or lean on other incentives — our advisors can help you plan the smartest path.

Take the Next Step With Mortgage.Expert

Let us help you maximize your first home budget — and find a mortgage solution that works for your unique situation. Our team can walk you through rate comparisons, savings strategies, and pre-approval options that make sense for today’s market.

✅ Book your free consultation today

🔍 Compare today’s lowest mortgage rates

🧾 Explore first-time buyer guides and tools

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts