RRSP Home Buyers’ Plan (HBP): How It Works & Eligibility in Canada

Thinking of buying your first home in Canada? You’ve probably heard about the RRSP Home Buyers’ Plan (HBP) — a government-backed way to dip into your retirement savings tax-free to make that down payment dream a little more real. But how exactly does it work? Who qualifies? And what’s the catch when it comes to paying it back?

Let’s break it all down in plain English so you can decide if the HBP is the right move for your homebuying journey.

What Is the RRSP Home Buyers’ Plan (HBP)?

The Home Buyers’ Plan (HBP) lets first-time homebuyers in Canada withdraw up to $60,000 from their Registered Retirement Savings Plan (RRSP) — or $120,000 for a couple — without paying income tax on it. The idea is simple: you “borrow” from your own retirement to buy a home, then gradually pay yourself back over 15 years.

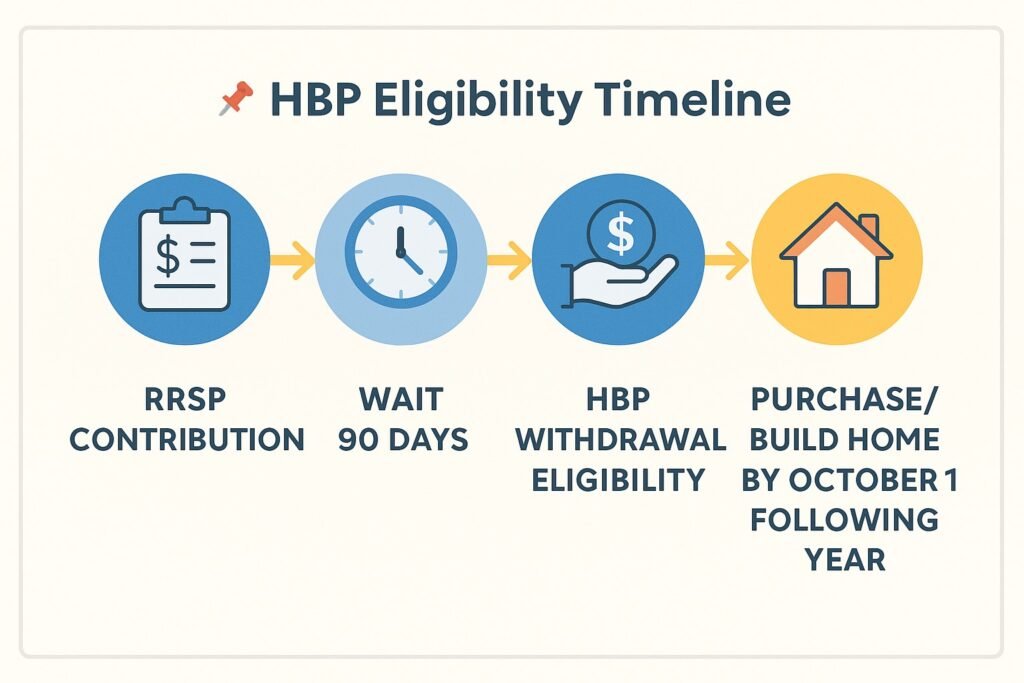

HBP Flowchart: Step-by-Step Process

Make a lump-sum contribution to your RRSP to build eligible funds.

Hold funds in RRSP for at least 90 days before withdrawal.

Withdraw up to $60,000 tax-free under the Home Buyers’ Plan.

Purchase or build your home by Oct 1 of the next year.

Begin RRSP repayment 2 years later, over 15 years.

The money can be used for a down payment, closing costs, or construction expenses if you’re building a qualifying home.

Here’s the kicker: you don’t need to start repaying for two years (or five, in some cases — more on that below).

Who Is Eligible for the HBP?

To qualify for the HBP, you must:

- Be a Canadian resident

- Be a first-time homebuyer, meaning you haven’t owned (or lived in a home owned by your spouse/common-law partner) in the past four years

- Be buying or building a principal residence in Canada

- Have a signed agreement to purchase or build

- Intend to live in the home within one year of buying/building

Exception: You can also use the HBP if you’re buying for a relative with a disability, even if you’re not a first-time buyer.

How Much Can You Withdraw With the HBP?

As of 2024, individuals can withdraw up to $60,000 from their RRSP under the HBP. Couples can each withdraw up to $60,000, for a combined $120,000.

To be eligible, the money must have been in your RRSP for at least 90 days before withdrawal.

How Does the Home Buyers’ Plan Work?

Here’s how to use the HBP in real life:

- Fill out CRA Form T1036 (“Home Buyers’ Plan Request to Withdraw Funds”)

- Submit it to your RRSP provider – they’ll process your withdrawal and send you a T4RSP slip for tax reporting

- Buy or build your home before October 1 of the following year

- Start repaying after 2 years (or after 5 years, if you qualify for the COVID-era extension)

RRSP Withdrawal to Repayment Timeline

HBP Withdrawal → Purchase Deadline → Grace Period → Repayment Start

Take out up to $60K from RRSP under the HBP.

Complete purchase/build by Oct 1 of next year.

No payments required for 2 years after withdrawal.

Start annual RRSP repayments in Year 3.

You can make multiple withdrawals — just make sure they all happen in the same calendar year and the January following it.

Repaying Your RRSP Under the HBP

The repayment schedule is pretty simple:

- You have 15 years to repay your RRSP

- Repayment starts 2 years after you withdraw

- You must repay at least 1/15 of the amount per year

- Missed payments get added to your income and taxed that year

Let’s say you withdraw $60,000. That’s a minimum of $4,000 repayment per year. You can always repay more to reduce future obligations.

📊 HBP Repayment Chart

$60,000 Example Over 15 Years

Annual minimum: $4,000. Year 5 includes an extra $10,000 repayment.

Temporary relief alert: If you withdrew under the HBP between Jan 1, 2022, and Dec 31, 2025, your repayment grace period is 5 years instead of 2.

Pros and Cons of the RRSP Home Buyers’ Plan

Here’s the real talk:

Pros:

- You’re borrowing from yourself, interest-free

- You can boost your down payment

- Repayments are flexible as long as you meet the minimums

Cons:

- You must already have RRSP savings

- Your retirement growth slows down while that money is out

- Missed repayments become taxable income

- Not everyone qualifies — first-time buyer status is required

📊 HBP Pros vs Cons: A Quick Comparison

✅ Pros

- 📥 Tax-free withdrawal up to $60,000 for your first home

- 💸 No interest charged on HBP amount

- 🔄 15 years to repay with flexible annual contributions

- 📉 Can lower your taxable income when RRSP contributions are timed well

⚠️ Cons

- 📆 Strict deadlines to buy/build after withdrawal

- ⏳ Missed repayments are taxed as income

- 💼 Reduces future retirement savings growth

- 🧾 You must track repayments annually on tax returns

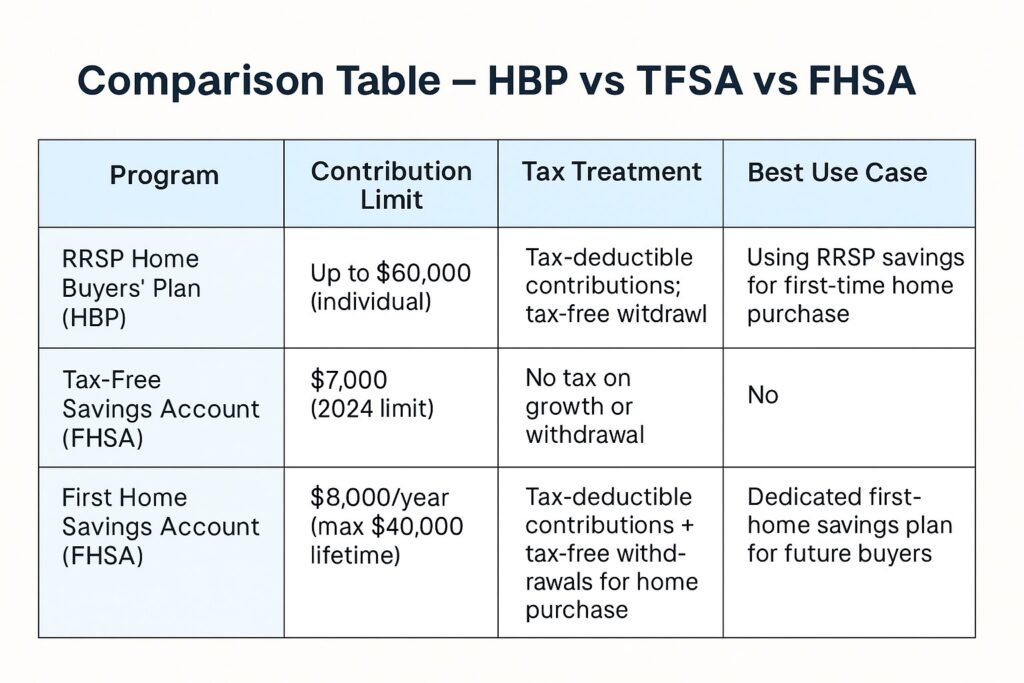

How Does the HBP Compare With Other Savings Programs?

Let’s compare it with the TFSA and the new FHSA (First Home Savings Account).

| Program | Contribution Limit | Withdrawal Tax | Repayment? | Notes |

|---|---|---|---|---|

| HBP | Based on RRSP limits | Tax-free (if repaid) | Yes – 15 years | Must repay or it’s taxed |

| TFSA | $7,000/year (2024) | None | No | Flexible, no home link |

| FHSA | $8,000/year, $40,000 lifetime | None | No (if used for first home) | First-time buyers only |

You can actually combine the HBP with the FHSA for more buying power.

Can You Cancel the HBP?

Yes, but only in special cases:

- If you don’t buy or build the home by the deadline

- If you become a non-resident

- If there’s a relationship breakdown and the property wasn’t transferred/sold

Can You Cancel the HBP?

Step 1: Did you or your disabled relative buy/build a qualifying home by the October 1st deadline of the following year?

- 👉 No: You may be eligible to cancel your HBP participation.

- 👉 Yes: Continue to Step 2.

Step 2: Did you become a non-resident of Canada before buying/building the home?

- 👉 Yes: You may need to cancel the HBP and report the withdrawal as income.

- 👉 No: Continue to Step 3.

Step 3: Was there a marital breakdown and you did not retain ownership or did not sell your home within 2 years?

- 👉 Yes: You may qualify to cancel your HBP under relationship breakdown exceptions.

- 👉 No: Your HBP stands and repayment must begin in the designated year.

📣 If you qualify for cancellation, you must notify the CRA using the appropriate form (usually Form RC471) and report your situation accurately during tax filing.

Additional Support for First-Time Buyers

Besides the HBP, you may also qualify for:

- GST/HST New Housing Rebate (on pre-construction homes)

- Home Buyers’ Tax Credit (up to $1,500)

- First Home Savings Account (FHSA) – a great supplement

- Provincial & municipal programs – rebates vary across Canada

– First-Time Buyer Programs in Canada Overview

- RRSP Home Buyers’ Plan (HBP): Withdraw up to $60,000 tax-free; repay over 15 years.

- First Home Savings Account (FHSA): Contribute up to $8,000/year (max $40,000); tax-free growth and withdrawal for home purchase.

- GST/HST New Housing Rebate: Recover a portion of GST/HST paid on new or substantially renovated homes.

- Home Buyers’ Tax Credit: Claim up to $10,000 for a $1,500 rebate on your tax return.

- Provincial Land Transfer Tax Rebates: Rebates available in Ontario, BC, PEI, and municipal level (e.g., Toronto).

- Shared Equity Programs: (e.g. First-Time Home Buyer Incentive) – Government shares ownership in exchange for reduced borrowing.

🎯 Tip: Some of these programs can be combined to maximize benefits. Always verify current limits and conditions with your lender or CRA.

Frequently Asked Questions

How much can I withdraw under the HBP?

Up to $60,000 per person. Couples = $120,000 total.

Can I use the HBP and FHSA together?

Yes — they’re separate programs and can be combined.

When do I start repayments?

2 years after withdrawal (or 5 years with temporary relief).

What happens if I don’t repay on time?

Any unpaid amount for that year becomes taxable income.

Can I reuse the HBP?

Yes, but only if your first HBP is fully repaid and you meet the other conditions again.

Final Thoughts

The HBP can be a powerful tool if you’re sitting on RRSP savings and need help making your first home more affordable. But it’s not a freebie — you’re borrowing from your future, and you’ll need to plan for repayment.

Still, with careful budgeting, pairing the HBP with other programs like the FHSA, and the right mortgage strategy, it can get you into your first home sooner than you thought.

📌 Get Help With Your HBP Strategy

Not sure how to use the Home Buyers’ Plan to your advantage? Let a licensed mortgage expert walk you through your options.

Talk to a Mortgage Expert Today →Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts