RBC vs. TD: Which Bank Offers the Better 5-Year Fixed Rate This Week?

As of the second week of July 2025, homebuyers across Canada are watching mortgage rates like hawks — and the biggest showdown is happening between RBC and TD. If you’re in the market for a 5-year fixed mortgage, chances are you’re comparing what the big banks are offering. But which one truly gives you the better deal right now?

What’s on the Table This Week?

The 5-year fixed mortgage is still the most popular term in Canada — offering a balance of stability and manageable payments. But rates haven’t budged much in recent weeks, and subtle differences between lenders can still cost (or save) you thousands over the life of your mortgage.

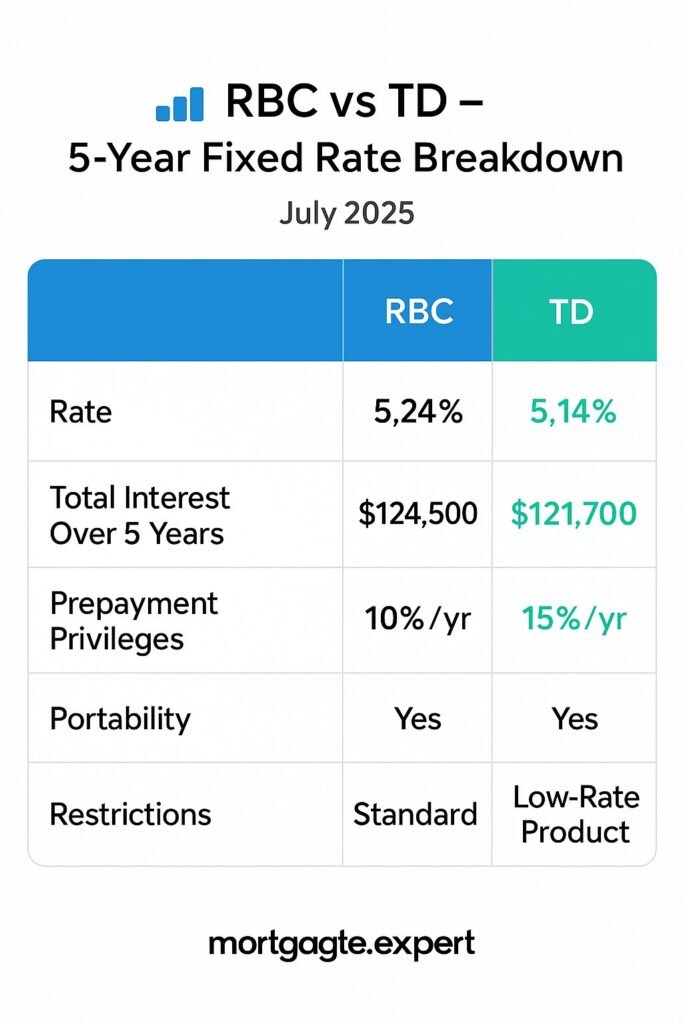

According to current lender data:

- RBC is offering a 5-year fixed rate of 5.24% for prime borrowers.

- TD Bank comes in slightly lower with a 5.14% promotional fixed rate on select insured mortgages.

At first glance, that 0.10% difference might not seem like much. But on a $500,000 mortgage, it could mean over $2,800 in additional interest over 5 years.

What Else Should You Compare Besides Just the Rate?

While rate is king, it’s not the only thing you should be paying attention to. Here’s where RBC and TD differ behind the scenes:

- Prepayment Privileges

TD offers 15% annual lump-sum prepayment, while RBC offers 10%. If you’re planning to pay extra each year, TD gives you a bit more wiggle room. - Portability & Flexibility

Both lenders offer decent options to port your mortgage if you move — but RBC has slightly more flexible timelines for completing the move. - Rate Hold

RBC allows a 120-day rate hold. TD’s is generally 90–120 days depending on the channel you use (branch vs broker).

Are There Hidden Trade-Offs With the Lower Rate?

TD’s lower rate often comes with conditions — such as locking into a “low-rate mortgage” product that limits your ability to refinance or switch providers without paying penalties. RBC, on the other hand, tends to offer more flexibility, albeit with slightly higher pricing.

If you’re the type who may want to refinance mid-term or switch lenders at renewal, this matters more than you’d think.

“RBC’s limited-time 4.89% offer for select clients adds a twist to this week’s battle of fixed rates.”

Mortgage Expert Tip: Ask for Rate Matching

Don’t assume you need to choose one lender’s rate over another. If you like RBC’s service but prefer TD’s rate, ask your mortgage broker or advisor if RBC will match it. Often, they will — especially if you’re a strong borrower with good credit.

Want to Know How It Impacts You?

Try our interactive 5-Year Fixed Rate Savings Calculator to see how a 0.10% difference can affect your total payments, interest paid, and mortgage flexibility.

“With RBC signaling that we’ve likely reached the bottom for rates, locking in now might be more strategic than waiting.”

Final Thoughts: RBC vs TD — Who Wins?

If we had to pick a winner based on rates alone, TD currently edges out RBC — but it depends on your long-term goals.

- Go with TD if you’re comfortable with less flexibility and want to save more upfront on interest.

- Choose RBC if you value mortgage flexibility, plan to prepay, or might need to make changes down the line.

Better yet, talk to a broker who can negotiate with both on your behalf — and potentially find you an even better offer from a monoline lender or credit union.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts