Ontario Homebuyers Now Paying 9% More Monthly Than 2022 Peak — Despite Lower Rates

Ontario homebuyers are now paying 9% more in monthly mortgage payments than they were at the 2022 peak — despite slightly lower interest rates. Here’s what’s driving the growing affordability gap in 2025.

While mortgage rates have slowly dipped in recent months, affordability in Ontario has worsened — not improved. According to fresh data compiled from lender reports and CMHC housing affordability metrics, the average monthly mortgage payment for a “New homebuyers in Ontario are now paying about 9% more each month on their mortgage than they did at the peak of the market in 2022.”

So, how is this possible when interest rates have cooled from their record highs?

Let’s break it down.

The Rate–Price Disconnect

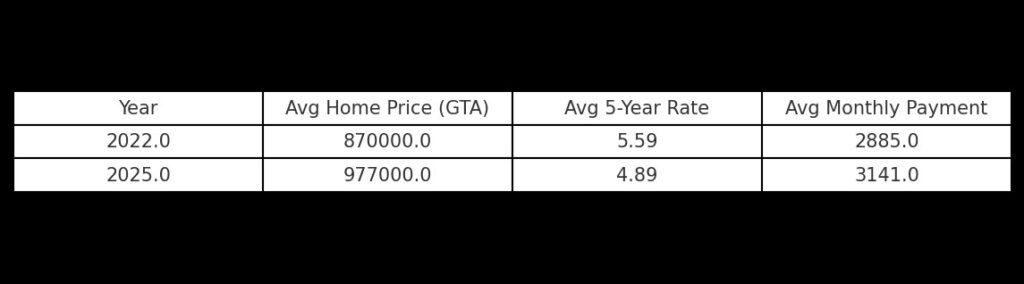

Many buyers expected lower rates in 2025 to ease their financial burden. And yes — 5-year fixed rates have dropped at some lenders to below 4.89%, compared to 5.59% or higher during the 2022 peak.

But the catch? Home prices in major Ontario cities like Toronto, Ottawa, and Hamilton have rebounded sharply in the first half of 2025. According to the Ontario Real Estate Association (OREA), the average home price in the GTA is now up 12.3% year-over-year, driven by low supply, population growth, and a spring buying surge.

So even though the rates are slightly lower, the loan amounts are higher — and so are monthly payments.

“At the same time, first-time homebuyer numbers have plunged 22% in Ontario, highlighting how affordability pressures are keeping new entrants on the sidelines.”

Why Ontario Buyers Are Feeling the Pinch

In Ontario, most new homebuyers are only able to put down 5 to 10% — just the minimum needed for insured mortgages. But when home prices rise and down payments stay low, that means buyers are taking on bigger mortgages. Even if today’s monthly payments feel a bit more manageable, the stress test still uses a qualifying rate above 5.25%, making it harder for many to actually qualify. So overall affordability is still a real challenge.

The typical buyer now faces a monthly payment of $3,141, up from $2,885 in 2022, even on similar-sized properties.

What This Means for Ontario Homebuyers

The biggest takeaway? Lower interest rates don’t guarantee better affordability. If home prices surge faster than rates drop, the net result for buyers is still a higher cost.

It’s crucial for buyers to look beyond rate headlines and focus on the full cost of borrowing — including total loan size, amortization, and upfront costs.

According to broker insights, more Ontario buyers are now choosing longer amortizations (30–35 years) to reduce monthly strain — but this leads to higher interest paid over time.

“Although monthly payments are up, the recent dip in home prices across Ontario and B.C. may offer only short-term relief, according to market analysts.”

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts