The Ultimate Guide to Mortgage Terms Every First-Time Homebuyer in Canada Should Know

Feeling lost in a sea of mortgage terms like LTV, amortization, or trigger rate? This simple, no-fluff guide breaks down the most important mortgage language every Canadian first-time buyer should know — with real examples and plain English.

Buying your first home in Canada is exciting — but let’s be real, it can also feel like stepping into a confusing new world filled with words like “amortization,” “rate hold,” and “collateral charge.” If you’ve ever found yourself nodding along while secretly Googling mortgage lingo, don’t worry — you’re not alone.

This guide is here to break it all down in a simple, friendly way. Whether you’re just starting to dream about owning a home or already talking to mortgage professionals, understanding the basic terms can make the whole process smoother, less stressful, and a lot more empowering.

🧠 Quick Take: Why Knowing These Terms Matters

Understanding mortgage terms helps you:

- Compare offers and make informed decisions

- Save money by understanding rate differences and amortization periods

- Navigate the homebuying journey with confidence

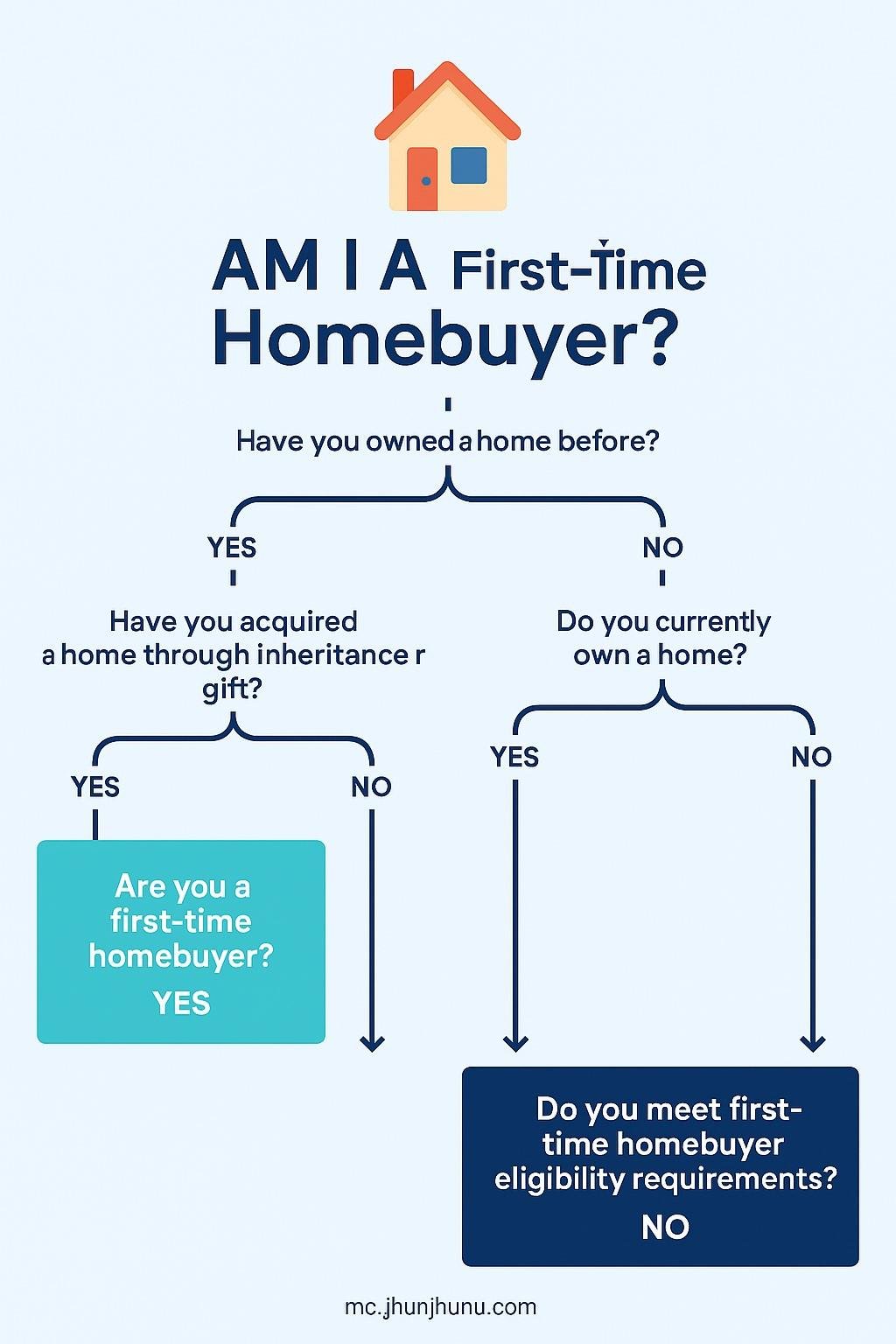

What Does “First-Time Homebuyer” Really Mean in Canada?

The definition of a first-time homebuyer can vary depending on which program or incentive you’re applying for. But here’s a general rule: if you haven’t owned a home (or lived in one owned by you or your spouse/common-law partner) in the past four years, you’re likely eligible.

Some programs, like the RRSP Home Buyers’ Plan or First-Time Home Buyer Incentive, may have extra criteria. If you’re unsure, it’s smart to talk to a mortgage broker or lawyer to confirm your eligibility.

What Is a Mortgage, Anyway?

A mortgage is just a fancy word for a home loan. You borrow money from a lender (like a bank or credit union), and they lend it to you using your house as collateral. You agree to repay it — with interest — over a set time period.

There are two main types in Canada:

- Standard Charge Mortgage: Offers flexibility when switching lenders

- Collateral Charge Mortgage: Makes it easier to borrow more in the future but harder to switch lenders

The Down Payment: Your First Big Hurdle

In Canada, the minimum down payment depends on the price of your home:

- 5% for homes up to $500,000

- 5% of the first $500,000 + 10% of the portion above $500,000 (for homes between $500K–$999K)

- 20% for homes $1 million or more

If you’re putting down less than 20%, you’ll need mortgage default insurance (more on that in a minute).

Some first-time buyers try to save up to hit the 20% mark, but waiting can cost you if home prices rise. Talking to a mortgage expert can help you decide what’s right for your budget and timeline.

Preapproval: Your Mortgage Shopping Passport

Getting pre-approved means a lender has reviewed your finances and given you a ballpark figure of how much they’d lend you. It’s not a guarantee, but it’s the best way to shop with confidence and know your budget.

Key benefits of a preapproval:

- You’ll know your price range

- Sellers take your offer more seriously

- You can lock in a mortgage rate for 90–120 days

Note: A “prequalification” is more casual and doesn’t involve full document checks.

📋 What Happens During Mortgage Pre-Approval in Canada

- Initial Chat: You speak with a mortgage advisor or lender to share your goals, income, and basic info.

- Document Collection: You provide proof of income, employment, debts, and savings (e.g., T4, pay stubs, credit report).

- Credit Check: The lender pulls your credit score to assess risk and eligibility.

- Pre-Approval Amount: You’re told how much you qualify to borrow and at what rate (often locked for 60–120 days).

- Letter Issued: You receive a pre-approval letter confirming your budget — often needed before shopping for a home.

- You’re Ready: You can now confidently search for homes within your pre-approved price range.

Fixed vs Variable Mortgage Rates: What’s the Difference?

This is one of the most important decisions you’ll make as a buyer:

- Fixed Rate: Your interest rate stays the same throughout the term. Great if you want predictable payments.

- Variable Rate: Your interest rate changes based on your lender’s prime rate. Payments may fluctuate but can save money if rates stay low.

There’s also something called an adjustable-rate mortgage (ARM), where your payment changes as the rate changes.

Mortgage Term vs Amortization: Know the Difference

These two terms are often confused:

- Term: The length of time your mortgage agreement is in effect (often 1–5 years in Canada). At the end, you can renew or switch lenders.

- Amortization: The total length of time it will take to pay off your mortgage (usually 25 or 30 years).

A longer amortization means lower monthly payments — but more interest paid over time.

📆 Term vs Amortization: How They Differ on the Timeline

🕓 Example Timeline:

Year 0 → 5 → 10 → 15 → 20 → 25

|────── Term 1 ──────|

|────── Term 2 ──────|

…

Full 25-Year Amortization

What is Mortgage Default Insurance (and Do You Need It)?

If your down payment is under 20%, you’ll need to pay for mortgage default insurance. This protects the lender in case you can’t make payments. It’s provided by CMHC, Sagen, or Canada Guaranty.

The cost is added to your mortgage (unless you choose to pay it upfront) and depends on your down payment size.

Bonus Tip: If you’re putting down 19.99%, you’ll still need insurance — but your premium could be way lower than someone putting down just 5%.

A Few More Must-Know Mortgage Terms

Frequently Asked Questions

Q: Can I get a mortgage if I have a low credit score?

Yes, but you may need a larger down payment or work with a B lender or alternative lender.

Q: Will I pay more interest if I choose a longer amortization?

Yes. Your monthly payments are lower, but you pay more interest over the life of the loan.

Q: Is preapproval required to start looking at homes?

Not required, but highly recommended. Sellers and realtors prefer serious buyers with pre-approvals.

Looking to build your dream home instead of buying? Start here — here’s what it costs to build a house in Canada.

Final Thoughts

Buying your first home is a journey, and knowing the language is half the battle. By understanding these mortgage terms, you’re one step closer to making confident, informed decisions. Don’t be afraid to ask questions or lean on a licensed mortgage broker — that’s what they’re there for.

Remember: the best mortgage isn’t just about the lowest rate. It’s about finding a solution that fits your life, your budget, and your goals.

🤔 Still Confused by Mortgage Terminology?

Don’t let complicated terms hold you back from buying your first home. Whether you’re stuck on “amortization,” “LTV,” or “trigger rate” — we’ll explain it in simple language. 💬 Talk to a Mortgage Expert

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts