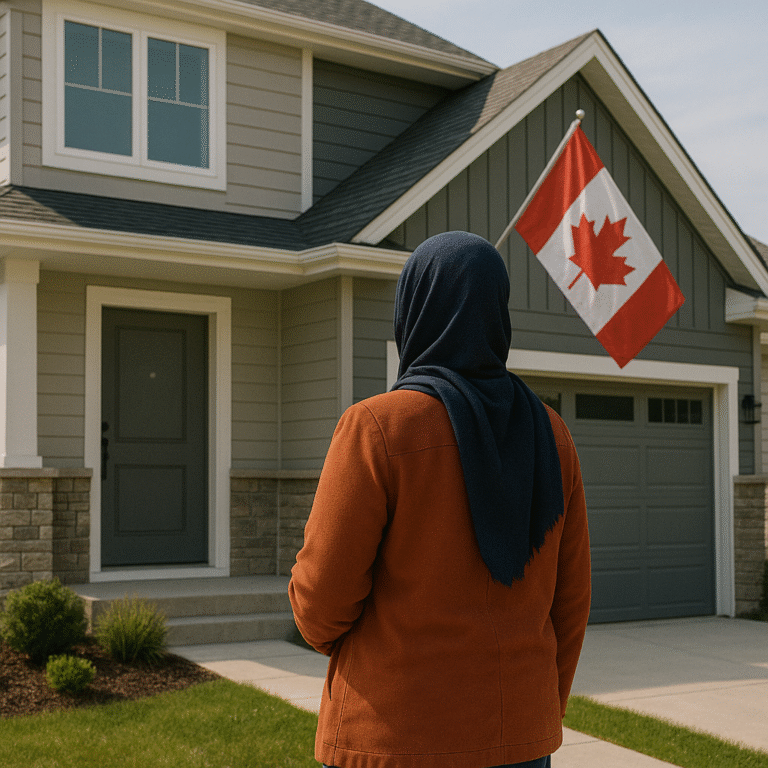

Mortgage Options for Permanent Residents in Canada

Explore mortgage options for permanent residents in Canada, including eligibility criteria, down payment requirements, and expert tips to secure your dream home.

Permanent Residents (PRs) in Canada have many of the same mortgage options available as Canadian citizens. However, understanding the nuances and lender expectations is vital to successfully securing a mortgage. This article explores mortgage options for PRs, eligibility criteria, down payment requirements, and tips to improve approval chances.

Mortgage Eligibility for Permanent Residents

Lenders generally treat PRs similarly to citizens. You need to provide:

- Proof of PR status (PR card or immigration documents)

- Stable employment and income proof

- Credit history, preferably Canadian but some lenders accept foreign credit references

- Adequate down payment (usually minimum 5% for first-time buyers)

Down Payment Requirements

- For homes up to $500,000: minimum 5% down payment

- For the portion above $500,000: minimum 10% down payment

- If down payment is less than 20%, mortgage default insurance (CMHC insurance) is required

Types of Mortgages Available

Conventional Fixed-Rate Mortgage

- Fixed interest rate over the term

- Predictable payments, good for budgeting

Variable-Rate Mortgage

- Interest rate fluctuates with market rates

- Potential for savings if rates fall, but risk of increase

Insured Mortgage

- Required if down payment is less than 20%

- Insurance premium added to mortgage cost

Tips for PRs Applying for a Mortgage

- Maintain a good credit score by paying bills on time

- Save for a larger down payment to reduce CMHC premiums

- Get mortgage pre-approval before house hunting

- Work with mortgage brokers who understand newcomer financing

Conclusion

As a Permanent Resident in Canada, you have a strong position to obtain mortgage financing. Understanding lender requirements and preparing your documents can smooth your path to homeownership. With competitive mortgage products available, PRs can find financing that suits their budget and goals.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts