Mortgage Deferral Requests Rise Again as Canadians Struggle with Renewals

As mortgage renewals trigger steep payment hikes in 2025, more Canadians are requesting deferrals and relief programs to stay afloat.

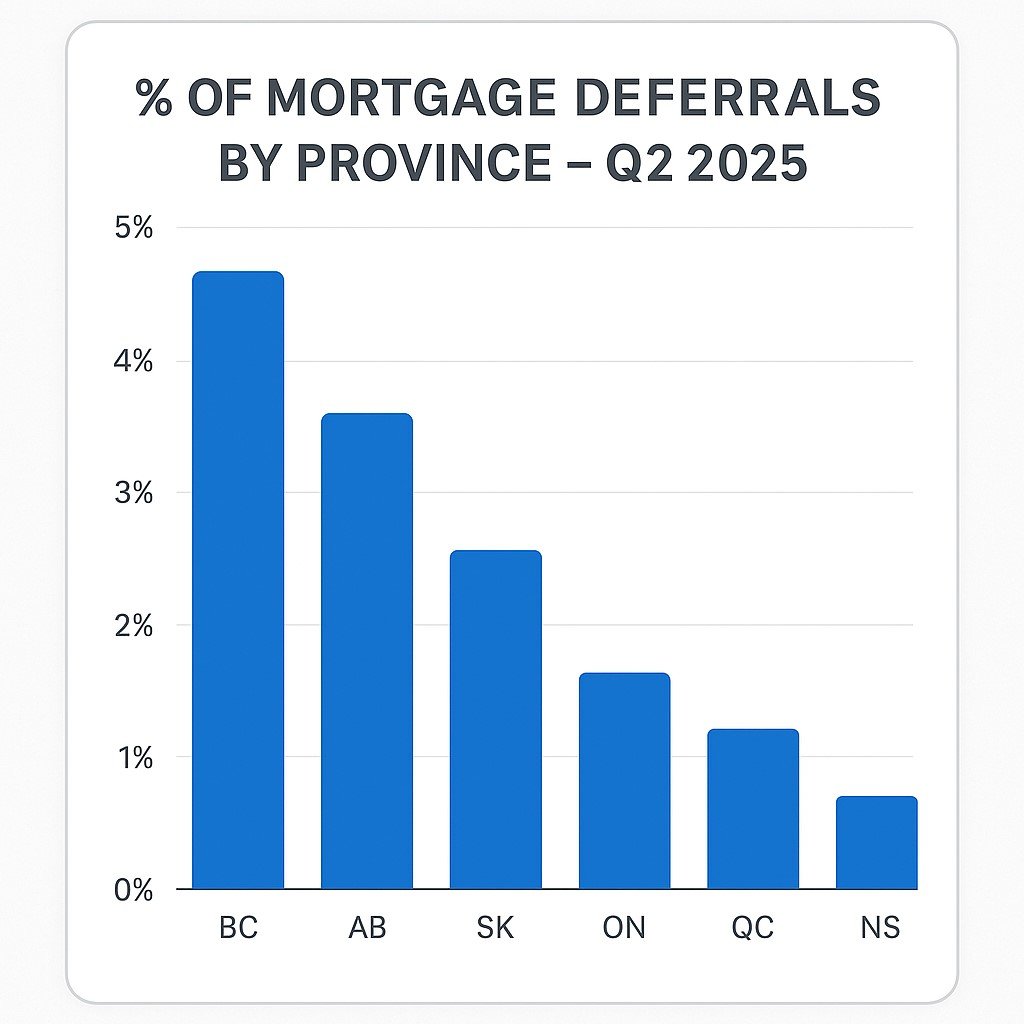

Canada is seeing a renewed surge in mortgage deferral requests, particularly from homeowners facing higher payments at renewal. According to new insights from mortgage brokers and credit unions, the trend is growing most sharply among variable-rate borrowers whose rates have climbed since their original term began.

Why Deferrals Are Back on the Table in 2025

While mortgage deferrals became a household term during the COVID-19 pandemic, they had largely faded from the spotlight—until now. As borrowers come up for renewal in 2025, many are discovering that their monthly payments have jumped by $600 to $1,000 or more. For families already stretched thin by inflation, food costs, and high fuel prices, this payment shock is pushing them toward financial strain.

Brokers report that many Canadians are requesting deferrals or restructuring from their existing lender, while others are seeking relief through alternative lenders offering interest-only or extended amortization options.

Who’s Most Impacted?

The hardest-hit borrowers tend to be those who:

- Took out 5-year variable-rate mortgages in 2020–2021 at ultra-low rates

- Purchased homes near peak market values

- Have maxed-out debt service ratios

- Lack the equity cushion needed for refinance approval

In urban centres like Toronto, Vancouver, and Montreal, where average mortgages exceed $500,000, payment hikes have been most severe. A growing number of homeowners are now relying on credit lines and savings just to stay afloat.

“With renewals approaching, many Canadians are turning to refinancing as a way to manage higher payments.”

Lender Approaches: From Case-by-Case to Formal Policies

Some banks are quietly offering 1–3 month deferral programs or restructuring options like 40-year amortizations, especially for borrowers in good standing with prior payment history. However, there’s no blanket deferral policy like the one seen during COVID.

Industry experts warn borrowers not to wait until they miss a payment. “If you see trouble ahead at renewal, speak with your lender early,” one Ontario-based broker said. “You’ll have more options if you’re proactive.”

What This Means for You

If you’re up for renewal this year, don’t assume your lender will automatically offer relief. Review your budget, know your new payment amount in advance, and explore your lender’s support options. And if you’ve already missed a payment, reach out immediately—delaying can impact your credit and limit your refinancing choices.

“Before deferring, some borrowers are exploring whether they can switch lenders without triggering the stress test again.”

📞 Struggling With Payments? Speak to a Mortgage Expert About Your Options Today

Talk to an ExpertStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts