How To Buy A Home in Canada: A Step-by-Step Guide

Thinking about buying your first home in Canada? Maybe you’ve been scrolling through listings, imagining life in your dream house — but you’re not sure where to begin. Buying a home is one of the biggest milestones (and financial decisions) you’ll ever make, and it helps to know exactly what you’re getting into before diving in.

This guide will walk you through the entire home-buying process — from saving up to moving in — so you can move forward with confidence.

How Do You Know You’re Ready To Buy a Home?

Before you even look at listings, take a good look at your finances. Homeownership comes with a lot of responsibility — and upfront costs.

1. Do You Have Enough for a Down Payment?

In Canada, you need at least:

- 5% down for homes up to $500,000

- 5% on the first $500K + 10% on the remainder for homes up to $999,999

- 20% minimum for homes $1 million and above

You’ll also need 1.5–4% of the home price set aside for closing costs like legal fees, land transfer tax, and adjustments.

2. Is Your Income Stable?

You’ll need consistent income and paperwork to back it up — recent pay stubs, T4s, NOAs, or business financials. Lenders use your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios to decide how much mortgage you can handle.

- GDS should stay under 32–39%

- TDS should stay under 40–44%

3. Is Your Credit Score In Shape?

A strong credit score can help you get a lower rate and qualify with more lenders. Most lenders prefer a score above 680 for the best rates. If you’re below that, consider paying off debts and fixing any errors on your credit report.

Step-by-Step: How To Buy a Home in Canada

Step 1: Save for Your Down Payment

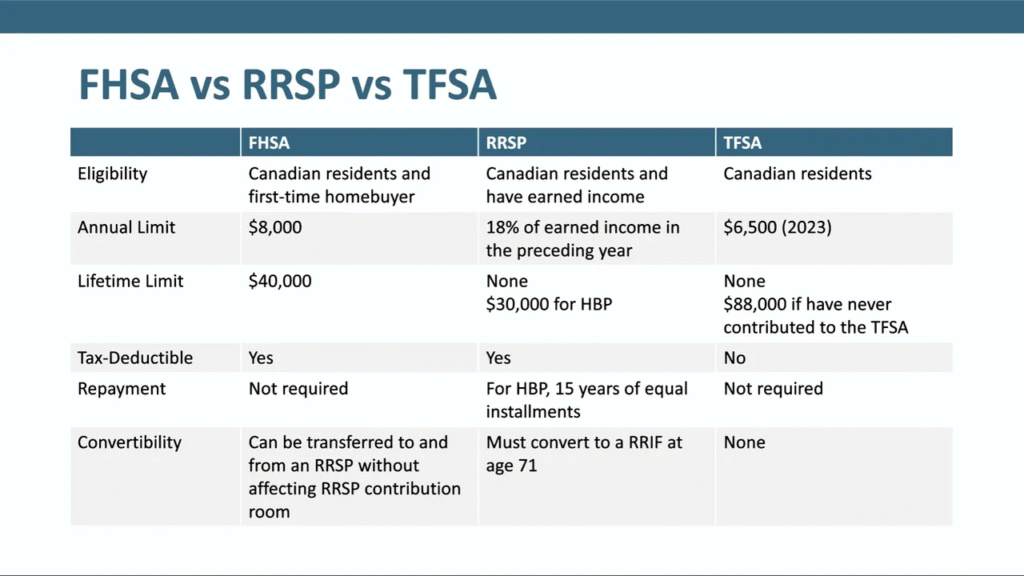

Start with a budget. Use a TFSA or FHSA (the new First Home Savings Account) to grow your savings tax-free. You can also withdraw up to $35,000 from your RRSP using the Home Buyers’ Plan (HBP) without tax penalty.

Step 2: Pay Down Debt

Lower debt = better mortgage approval chances. Focus on high-interest debt first. Reducing debt also improves your TDS ratio, which directly affects how much mortgage you qualify for.

Step 3: Get Pre-Approved for a Mortgage

A mortgage preapproval gives you a realistic home-buying budget. It also locks in a rate for 60–120 days, depending on the lender. You’ll need:

- Proof of income

- Bank statements

- Government ID

- Credit history

Step 4: Explore First-Time Buyer Incentives

Look into federal and provincial programs like:

- First-Time Home Buyer Incentive (shared equity loan)

- FHSA (save up to $40,000 tax-free)

- Land Transfer Tax rebates

- GST/HST new housing rebates

[Placeholder: List of current first-time homebuyer programs by province]

Step 5: Shop Around for the Best Mortgage

Compare offers from banks, credit unions, and mortgage brokers. Don’t just focus on the rate — check for prepayment privileges, penalties, and portability.

Step 6: Stick to a Budget and Start House Hunting

Work with a trusted realtor to find homes in your approved price range. Stick to your budget to avoid stretching yourself too thin.

Step 7: Make an Offer

Once you find the one, your realtor will help you make a formal offer. Be prepared for a counteroffer or a bidding war, especially in hot markets. Include conditions like a home inspection or financing clause to protect yourself.

Step 8: Schedule a Home Inspection

Never skip this step. A qualified inspector checks the home’s foundation, plumbing, roof, electrical, and more. It can save you from expensive surprises down the road.

Step 9: Finalize Your Mortgage

After your offer is accepted, send the signed purchase agreement to your lender. They’ll issue a final mortgage approval. You’ll need to sign final documents with a lawyer or notary before closing.

Step 10: Prepare for Closing Day

A few days before closing, you’ll:

- Pay your down payment balance

- Pay closing costs

- Sign legal paperwork

- Transfer home insurance and utility accounts

📋 Moving Checklist for New Homeowners

Use this step-by-step guide to make your move stress-free—from paperwork and packing to settling in and updating your address.

- ✅ Book your movers or truck rental 3–4 weeks in advance

- ✅ Collect all legal and closing documents in one folder

- ✅ Update address with Canada Post, CRA, banks, and insurance providers

- ✅ Set up new utilities: electricity, water, gas, internet, and garbage collection

- ✅ Transfer home and content insurance to the new address

- ✅ Pack a “first night” essentials box: toiletries, snacks, charger, tools

- ✅ Label boxes by room and priority—color coding helps!

- ✅ Back up and unplug electronics at least 24 hours before moving

- ✅ Clean your old place (or hire a move-out cleaner)

- ✅ Inspect your new home on arrival—note damages or issues

- ✅ Re-key or replace door locks for security

- ✅ Say hello to neighbours and explore your new neighbourhood!

Final Thoughts: Make Your Move With Confidence

Buying your first home in Canada can feel overwhelming, but breaking it down into steps makes it manageable. With a solid plan, the right professionals, and a bit of patience, you’ll be moving into your new place before you know it.

To know about How Much Will a $300,000 Mortgage Cost in Canada? Click Here

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts