How Could Election Promises Impact Canadian Mortgage Rates?

As Canadians gear up for the next federal election, one question is top of mind for homeowners and homebuyers alike: how will campaign promises impact mortgage rates?

While the Bank of Canada ultimately controls the policy rate that influences variable and fixed mortgage rates, the policies put forward by political parties shape the broader economic landscape — and that can steer inflation, interest rates, and borrowing costs. Let’s break down how the Liberals and Conservatives differ on housing, spending, and economic strategy — and what it might mean for your mortgage.

The Liberal Vision: Investment-Driven Growth and Housing Relief

Liberal leader Mark Carney’s plan is focused on targeted tax relief, major infrastructure and tech investments, and a commitment to solving Canada’s housing affordability crisis. It’s a strategy built on long-term growth — and the hope that strategic spending will eventually bring inflation down.

Tax Relief to Boost Disposable Income

The Liberals propose cutting the lowest federal tax bracket from 15% to 14%. That could save dual-income households around $825 per year — money that could ease affordability pressures and support consumer spending.

Building a Resilient “New Economy”

From investments in artificial intelligence to funding clean energy and expanding Canada’s digital infrastructure, the Liberal platform focuses on boosting productivity and making the economy more competitive.

The idea is that a more efficient, innovation-driven economy would bring down inflation by strengthening supply chains and reducing dependence on volatile U.S. markets. In theory, this kind of structural growth could give the Bank of Canada more room to lower interest rates over time.

Direct Housing Affordability Measures

- $6 billion National Housing Affordability Fund

- Removal of GST on homes up to $1 million

- Expanded First-Time Home Buyer supports

- Crackdown on speculation and foreign ownership

These housing-focused promises aim to reduce costs for buyers and renters alike — and increase supply through funding partnerships.

Will Liberal Spending Lower Mortgage Rates?

In the short term, no. Heavy spending can fuel inflation, which keeps interest rates elevated. But if investments increase GDP, housing supply, and national productivity, they could ease inflation pressures in the long run — possibly opening the door to lower rates.

It’s a “spend now to save later” approach — one that hinges on execution and timing.

The Conservative Strategy: Housing Supply and Fiscal Discipline

The Conservatives are betting on supply-side reform and tighter budgets to ease inflation and cool borrowing costs. Their strategy: reduce red tape, unlock land for housing, and balance the books within five years.

Unlocking More Homes

The Conservative plan includes:

- Releasing underutilized federal land for residential development

- Fast-tracking permit approvals

- Financial incentives for cities that speed up construction

This could help solve Canada’s housing shortage — and reduce price pressure over time.

Balancing the Budget

Conservatives are also pushing to bring the federal budget into balance, which would reduce national debt and government borrowing. That could ease inflation expectations and create favourable conditions for mortgage rate cuts.

| 🏗️ Policy Initiative | 🔵 Liberal Plan | 🔴 Conservative Plan | 📉 Projected Impact |

|---|---|---|---|

| 🏠 New Home Construction | Build 1.4M homes over 4 years | Fast-track 1.5M homes in 3 years | Moderate price relief in urban cores |

| 🏘️ Rezoning Incentives | Offer funds to municipalities for rezoning | Bypass local zoning with federal overrides | Could speed up builds in key zones |

| 💰 Developer Incentives | $4B Housing Accelerator Fund | Tax credits + permit fast-tracking | More builder activity, quicker supply |

| 🚧 Use of Federal Land | Make surplus federal land available | Require housing on federal land within 18 months | Short-term bump in housing starts |

| 🏦 Affordability Mandates | Tie funds to affordability benchmarks | Remove affordability conditions | Could reduce affordable options if mandates removed |

Risks of Speed Over Sustainability

Faster development and reduced red tape could boost growth — but if environmental oversight is weakened, the long-term costs of climate damage, insurance losses, and infrastructure strain could fuel inflation in other areas. And that would work against efforts to lower mortgage rates.

Will Conservative Austerity Help Rates Fall?

It could — if inflation responds to reduced government spending and housing supply ramps up fast enough. But if affordability doesn’t improve quickly, Canadians might still struggle with high costs, even if inflation cools.

Beyond Politics: What Actually Drives Mortgage Rates?

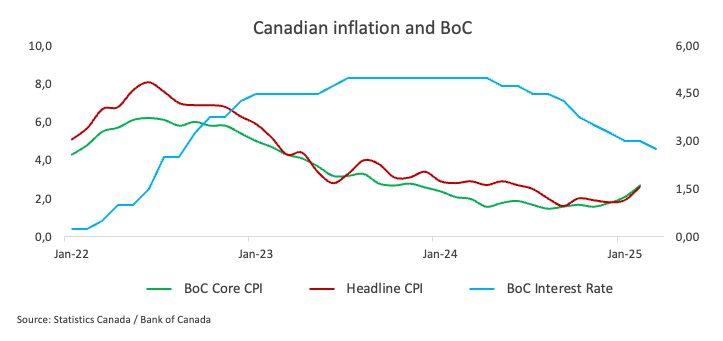

The Bank of Canada uses the policy interest rate to manage inflation — and that ultimately determines mortgage costs. While election outcomes don’t directly set rates, they influence the economy in ways the BoC monitors closely.

Here’s what really drives rate decisions:

- Inflation data (CPI)

- Wage growth and employment levels

- Government deficits and fiscal policy

- Bond yields (especially for fixed-rate mortgages)

- Global trade trends and U.S. interest rate moves

What Should Buyers and Homeowners Do?

Whether you’re a buyer looking to get into the market or a homeowner approaching renewal, staying informed is key. Rates won’t change overnight post-election — but the winning party’s policies will set the tone for the next several years.

Behind the rate changes: Many campaign promises affect interest rates indirectly — often through their influence on government borrowing and investor confidence. To understand this connection better, check out Here’s What You Should Know About the 5-Year Government of Canada Bond Yield.

Mini Verdict:

If you believe in long-term investment, the Liberal strategy may align with your outlook. If you’re focused on fast fiscal control and supply-driven growth, the Conservative platform might be more appealing. Either way, now is a good time to get pre-approved or lock in your rate before post-election economic shifts take hold.

🗳️ Worried About Election Impact on Your Mortgage?

Campaign promises can shift mortgage trends fast — especially if they influence rates or inflation. Want expert help navigating what this election could mean for your mortgage plans?

🧠 Talk to a Mortgage Expert NowFinal Thoughts

Campaign promises don’t set mortgage rates — but they shape the economic environment that does. By paying attention to each party’s strategy on spending, taxation, and housing, you can better understand where rates might be headed next.

Still unsure how this election might impact your mortgage journey?

Talk to a nesto expert today and let us help you navigate your options in a shifting economy.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts