CMHC Warns: High Debt Loads Could Worsen If Rates Stay Elevated

CMHC Issues Mortgage Renewal Warning Amid Persistently High Rates

Canada’s housing watchdog is sounding the alarm. According to the latest CMHC report, elevated interest rates are putting pressure on a growing number of homeowners — especially those nearing mortgage renewal.

With hundreds of thousands of fixed-rate mortgages set to renew over the next 18 months, the Canada Mortgage and Housing Corporation says household debt servicing costs could spike, leading to greater financial stress, reduced consumer spending, and even higher default risk if rate relief doesn’t arrive soon.

Mortgage Renewals Are the Ticking Time Bomb

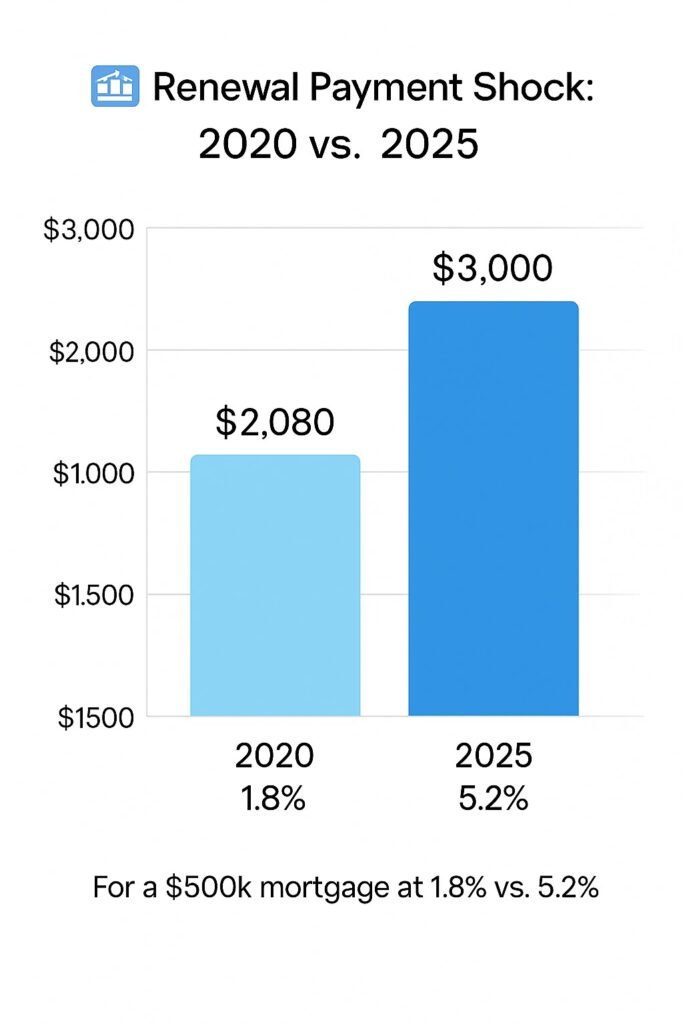

In its latest Housing Market Insight, CMHC highlighted that most Canadians who locked in historically low rates between 2020 and 2021 will now face rates that are 2–3% higher upon renewal in 2025. This could mean an increase of $400 to $1,000 or more in monthly mortgage payments, depending on the loan size and term.

Debt Loads Are Already Among the Highest in the World

CMHC noted that Canadian households carry among the highest levels of debt globally, with much of it tied to real estate. In fact, over 70% of household debt in Canada is mortgage-related.

And while delinquency rates are still low for now, the agency warns that more Canadians could fall behind if interest rates stay high and wage growth slows. Variable-rate borrowers, in particular, have already been hit — but fixed-rate borrowers are next.

What Can Homeowners Do?

Experts say planning early is key. If your mortgage is up for renewal in the next 12 to 18 months:

- Request a renewal quote early (up to 120 days in advance)

- Consider switching lenders for better rates or terms

- Explore amortization adjustments if cash flow is tight

- Reach out to a mortgage broker to review your options

💬 Talk to a Mortgage Expert

Need help planning your renewal strategy? Get personalized advice to avoid payment shock.

BoC Rate Cuts May Help — But Timing Matters

While the Bank of Canada is widely expected to cut rates by the end of 2025, there’s no guarantee of significant relief before many renewals hit. That’s why CMHC and economists alike are urging Canadians to proactively budget, get ahead of their renewal window, and avoid deferral or default traps.

“Rising delinquencies are part of a broader warning from CMHC about how elevated rates may intensify financial stress for households.”

CMHC’s recent analysis also highlights how much of today’s housing growth is being driven by rentals, not ownership — read this housing supply breakdown for more insights.

Final Thought

This isn’t a message of doom — but it is a wake-up call. With mortgage rates still elevated and debt levels high, now’s the time to take a hard look at your financial runway. Whether you’re six months or 16 months from renewal, the earlier you take action, the more options you’ll have.

📉 Feeling the Pressure of Rising Rates?

If you’re worried about mounting debt or rising mortgage payments, you’re not alone. CMHC’s latest warning signals tougher times ahead for many Canadians — but smart planning can help you stay in control. 📞 Talk to a Mortgage Expert Now

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts