Co-signing a Mortgage in Canada: Everything You Need to Know Before You Sign

Co-signing a mortgage sounds simple: you help someone you care about qualify for a loan. But the truth? It’s a big financial and legal commitment that can have ripple effects on your credit, your borrowing power, and even your relationships.…

Contingent vs. Pending in Real Estate: What’s the Difference in Canada?

Understand the key differences between contingent and pending home listings in Canada. Learn what each status means and how it impacts your homebuying decision.

Common Mistakes When Renewing Your Mortgage: 6 Expert Tips

Table of Contents Most Canadian homebuyers will go through the renewal process at least once during the lifetime of their mortgage. But despite being a shared experience, many don’t realize how much money can be saved—or lost—depending on the choices…

What Closing Costs Should Buyers Expect in Canada?

Wondering how much you really need to close on a home in Canada? From legal fees to land transfer tax, this guide breaks down all the key closing costs homebuyers should plan for in 2025.

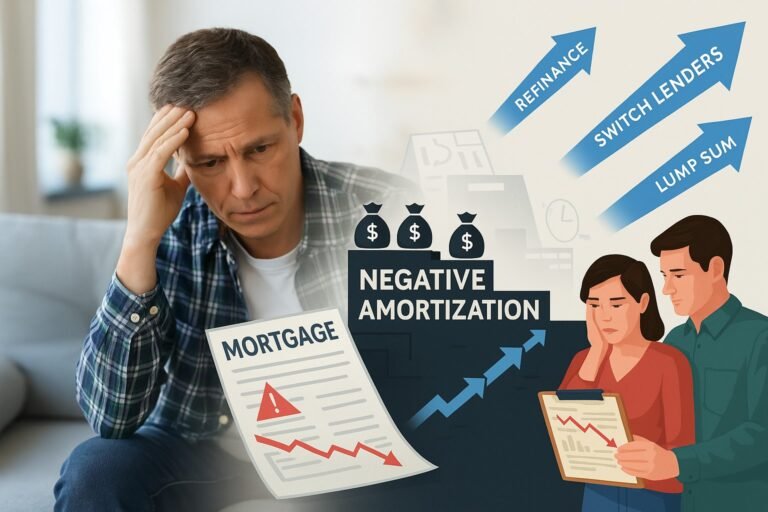

5 Ways to Get Out of Negative Amortization on Your Mortgage

Struggling with negative amortization? Discover 5 smart ways Canadian homeowners can stop their mortgage balance from growing in 2025.

5 Money Tips for Millennials To Pay Down Credit Card Debt (Canada 2025)

Category: Financial WellnessTags: Millennials, Credit Card Debt, Budgeting Tips, Debt Consolidation, Canadian Finances Let’s be real — if you’re a Canadian millennial drowning in credit card debt, you’re far from alone. Between rising living costs, sky-high tuition, and stagnant wages,…

HELOC in Canada: Pros, Cons & Smart Strategies to Use It Right

A Home Equity Line of Credit (HELOC) can be a smart financial tool — if used right. Learn the pros, cons, rules in Canada, and how to make your HELOC work in 2025 without risking your home.

What is the Amortization Period for Mortgages in Canada?

Your amortization period affects how long it takes to pay off your mortgage — and how much interest you’ll pay over time. Here’s how it works in Canada and how to choose the right timeline in 2025.

Should You Rent or Buy a House in Canada? A Complete Breakdown

Wondering whether to rent or buy a home in Canada in 2025? This guide breaks down the costs, risks, lifestyle factors, and long-term value of each path — to help you make the smartest move.

What is the Mortgage Pre-Approval Process in Canada?

Getting pre-approved for a mortgage is the first step toward buying a home in Canada. This guide explains what it means, why it matters, and how to get pre-approved in 2025 — with confidence.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts