Toronto’s housing market unlikely to boom anytime soon despite brighter July

Toronto’s housing market saw a July sales uptick, yet oversupply, falling prices, and upcoming mortgage renewals temper optimism for the months ahead.

Broader Market Signs of Life Emerging in July — Canadian Housing Shows Resilience

July 2025 brought signs of recovery to Canada’s housing market, with sales rising in Toronto, Vancouver, Calgary, and Montreal despite global trade tensions. Here’s what it means for buyers and mortgage professionals.

Toronto Condos Hit Four-Year Lows While Montreal’s Housing Market Surges

Toronto’s condo prices have dropped to their lowest in four years, even as Montreal’s housing market records its strongest July since 2021. Here’s what it means for buyers, sellers, and mortgage professionals.

Greater Toronto Housing Market Sees Best July in Four Years

GTA home sales jumped 12.8% in July 2025, marking the best July in 4 years. Find out what’s driving the recovery and what it means for mortgage buyers.

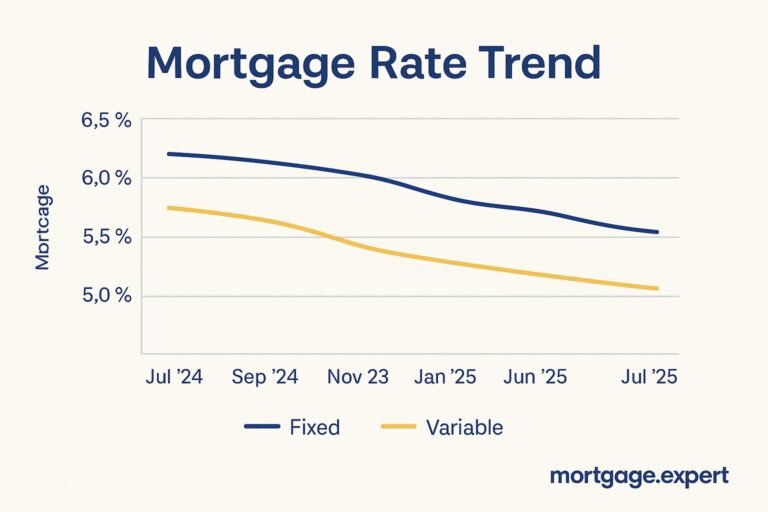

What’s Moving Canada’s Mortgage Market This Week — August 2025 Outlook

July home sales, June trade data, and the July Labour Force Survey will shape Canada’s mortgage rates this week. Here’s what borrowers need to know.

Vancouver Home Sales Dip 2% in July, Market ‘Turning a Corner’: Board

Greater Vancouver home sales dipped 2% in July 2025. Inventory up nearly 20%, prices flat to down slightly. What it means for buyers and sellers.

Mike Moffatt: If It’s a Housing Crisis, Why Are We Building Fewer Homes?

CMHC now sees housing starts sliding toward ~220k by 2027. Ontario & B.C. lead declines. Mike Moffatt asks: why aren’t we building more?

U.S.–Canada Trade Tensions Could Delay Mortgage Rate Cuts in 2025

Ongoing trade tensions between the U.S. and Canada are weighing on bond yields and adding uncertainty to rate cut expectations. Here's how that could impact mortgage rates and homebuyers in 2025.

How Election Promises Could Shape Canadian Mortgage Rates in 2025

As Canada approaches the next federal election, political promises around housing affordability, interest rate intervention, and mortgage relief could significantly influence market expectations. This article explores how party platforms might shape the future of Canadian mortgage rates in 2025 — from potential rate freezes to tax incentives for first-time buyers.

How Tariff Threats and Bond Yields Could Impact Bank of Canada’s Decision

With global trade tensions rising and bond yields responding to market uncertainty, the Bank of Canada faces increasing pressure ahead of its next rate decision. This article breaks down how U.S. tariff threats and fluctuating Canadian bond yields could influence the BoC's monetary policy stance in 2025 — and what it means for borrowers across the country.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts