Canada’s Mortgage Market Shifts From Shock to Adjustment Phase

Canada’s mortgage market is moving from rate shock to a slower adjustment phase as borrowers, lenders, and housing markets adapt.

Refinancing Activity Remains Muted as Higher Rates Reduce Home Equity Access

Canadian refinancing activity stays muted as higher rates and stress tests limit equity access. What homeowners should know.

Mortgage Renewals Set to Surge in 2026 as Borrowers Face a New Rate Reality

Millions of Canadian mortgages renew in 2026. What higher rates mean for payments, renewals, and borrower strategy.

Home Prices Expected to Rise in 2026, Reshaping Mortgage Demand and Affordability

Home prices in Canada are forecast to rise in 2026. How higher prices could affect buyers, renewals, and mortgage strategy.

Household Debt Hits 174.8% in Q3 2025, Keeping Mortgage Affordability Under Pressure

Canada’s household debt-to-income ratio climbs to 174.8%. Why high debt keeps mortgage affordability under pressure in 2026.

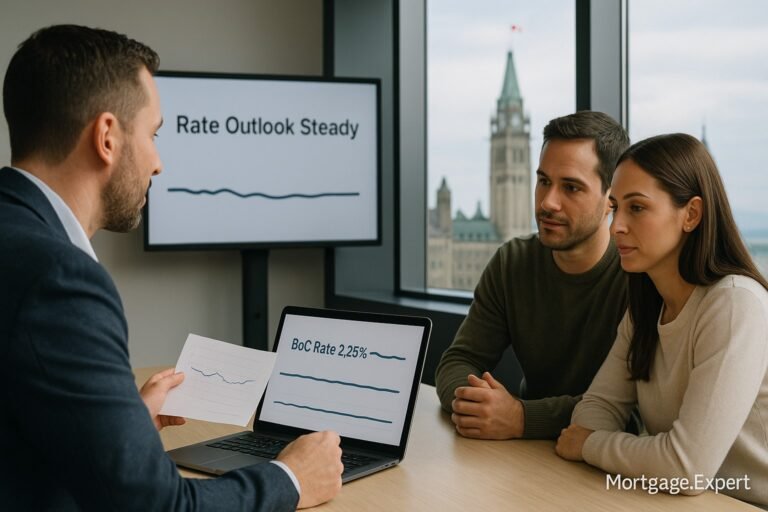

Bank of Canada Holds Policy Rate at 2.25%, Signalling Stability for Mortgage Borrowers

Bank of Canada holds its policy rate at 2.25%. What the decision means for variable mortgages, renewals, and 2026 rate outlook.

Rent Growth Slows in 2025 as Vacancy Rates Rise, CMHC Data Shows

CMHC data shows rent growth cooled in 2025 as vacancy rates rose. What this means for renters, buyers, and mortgage decisions.

CMHC Funds 104 New Affordable Homes in Vancouver — A Targeted Boost to Housing Supply

CMHC announces funding for 104 affordable homes in Vancouver. Here’s how this project may influence supply, affordability, and mortgage-market conditions in late 2025.

Canadian Lenders Expect Steady Rates as Growth Cools — BoC Policy Seen on Hold Through 2025

A new survey shows lenders see the Bank of Canada’s policy rate staying at 2.25 % through 2025. Fixed and variable mortgage rates likely to remain stable as growth slows.

Canadian Mortgage Market Steady as Fixed Rates Hold and Variable Offers Stay Flat

WOWA.ca and Altura Financial show Canada’s 3-year fixed ≈ 3.69 % and 5-year variable ≈ 3.45 %, as the BoC holds policy rate at 2.25 %. Rates stay flat but competitive.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts