Capitalizing on Variable Mortgage Trigger Points in Canada (2025 Update)

Feeling the Pressure from Your Variable-Rate Mortgage? You’re Not Alone.

If you’re one of the thousands of Canadians with a variable-rate mortgage (VRM) and your budget’s been stretched this year, welcome to the club. After a year of rapid Bank of Canada interest rate hikes — moving from 0.25% to 4.25% in under 12 months — many homeowners have hit what’s known as their trigger point. And if your mortgage payment hasn’t gone up yet, it might soon.

But don’t panic — there are solutions. In this article, we’ll walk you through what a trigger point really means, which mortgages are impacted, what options your bank or insurer might offer you, and how to get ahead of this situation without putting your homeownership dreams at risk.

What Is a Trigger Point? (And Why Should You Care?)

Let’s break it down simply: every mortgage payment you make includes interest + principal. But when rates go up, more of your payment goes toward interest — and less toward principal.

Eventually, you might hit your trigger rate — the point where 100% of your payment is covering only interest. That’s already a tough spot.

But it gets worse: if interest keeps rising and your mortgage balance starts growing instead of shrinking, you hit your trigger point. That means you now owe more than your original loan amount — and that’s when the lender has to act.

Which Mortgages Are Affected Most?

Not all mortgages are in danger. The ones most at risk are variable-rate mortgages with fixed payments. These were popular during the low-rate years, as they offered stability in monthly payments even if rates changed.

But here’s the catch: while your payments stayed the same, the interest portion kept growing. And if your loan-to-value (LTV) was high to begin with — say, you put less than 20% down — you’re more likely to reach your trigger point faster.

What Are Lenders Like RBC, TD, BMO, CIBC, and Scotiabank Offering?

Big banks are handling this differently. Some proactively reach out to borrowers once the trigger rate is hit, while others wait until the trigger point is breached. But once it’s breached, action is required.

Here’s what they might ask you to do:

📌 Your Options After Hitting the Trigger Point

💸 Raise Monthly Payments

Increase your regular payment to cover both interest and principal again. Helps reduce amortization back on track.

💰 Make a Lump-Sum Payment

Use savings to prepay part of your mortgage and reduce your balance to avoid negative amortization.

🔁 Switch to Adjustable Rate

Consider refinancing to an adjustable-rate mortgage (ARM) where your payments adjust with the prime rate, avoiding trigger risk.

📆 Extend Amortization

Your lender may allow a longer amortization period to ease monthly payment pressure. Default insurers may allow up to 40 years.

📞 Speak to Your Lender

Lenders often provide custom options depending on your mortgage type and insurance. Contact them before reaching renewal.

Tip: Don’t wait for your renewal date. Being proactive can save you thousands in interest. ✔️

- Increase Your Monthly Payment – to cover the extra interest.

- Make a Lump Sum Payment – to bring your balance down.

- Switch to a Fixed-Rate Mortgage – which may have a different amortization schedule.

- Extend Your Amortization Temporarily – to reduce monthly costs (if eligible).

Banks must ensure that when you renew, your amortization resets correctly (e.g., a 25-year mortgage should become 20 years after a 5-year term). Some variable mortgages are now amortizing beyond 100 years — which is not sustainable and needs correction.

What About Mortgage Insurers Like CMHC, Sagen, and Canada Guaranty?

For borrowers with insured mortgages (i.e., those who put down less than 20%), the default insurers are stepping in too.

- CMHC allows capitalization of missed payments up to 105% of the original loan amount.

- Sagen offers flexibility by extending amortization up to 40 years — but only if the borrower’s gross debt service ratio stays under 39%.

This means if you’re struggling to cover mortgage + taxes + heat + condo fees under your income level, you may still qualify for assistance — but you must act fast.

📌 Trigger Point Options: Insured vs Uninsured Mortgages

| Option | Insured Mortgage | Uninsured Mortgage |

|---|---|---|

| Capitalization (Negative Amortization) | Allowed up to 105% of original loan amount (CMHC) | Dependent on lender; typically more restricted |

| Amortization Extension | Allowed up to 40 years (Sagen, CMHC) | Varies by lender policy; generally limited |

| Payment Restructure | Allowed with insurer oversight | Allowed at lender discretion |

| Eligibility Requirements | Must meet 39% GDS/TDS threshold | Stricter, lender-specific criteria |

| Support Agency | CMHC, Sagen, Canada Guaranty | Not backed by default insurance |

💡 Tip: Insured mortgages tend to offer more flexibility during financial stress — but speak to your lender early!

FAQ – Your Top Trigger Point Questions Answered

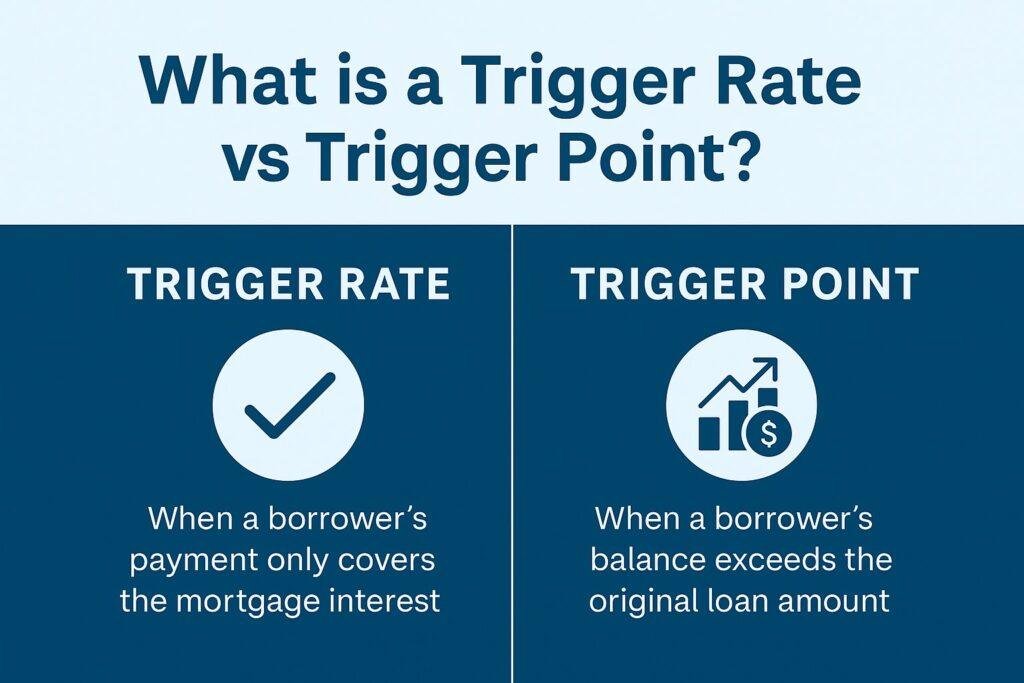

What is the difference between a trigger rate and a trigger point?

Trigger rate = your payment only covers interest.

Trigger point = you owe more than your original mortgage amount.

How do I know if I’m close to my trigger point?

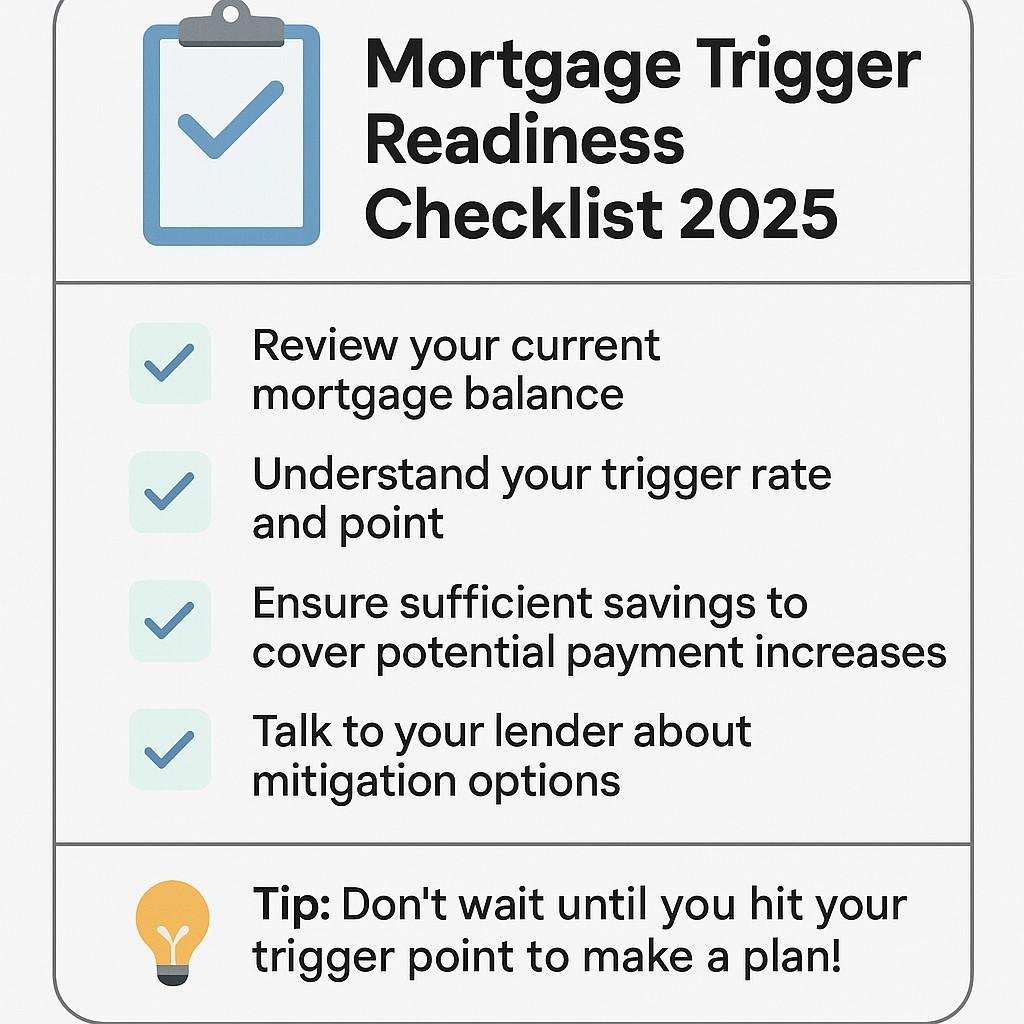

Check your amortization schedule. If your balance is growing instead of shrinking, call your lender.

Can I avoid hitting my trigger point?

Yes — by voluntarily increasing payments or switching to an adjustable-rate mortgage (ARM), which adjusts with prime.

What happens at renewal?

Your bank will likely require a return to proper amortization. Be ready to renegotiate terms or make a lump sum payment.

Final Thoughts – What You Should Do Now

If you have a variable-rate mortgage with fixed payments, don’t wait for a letter from your bank. Contact them before you hit your trigger point. You may still have options to refinance, adjust your amortization, or switch to a safer mortgage type — like an ARM or short-term fixed rate.

Also, as of November 21, 2024, the rules have changed — switching lenders no longer requires requalifying (as long as you don’t borrow more or extend amortization). This means you may find a better rate without jumping through the stress test hoops again.

💬 Ready to Talk?

The best strategy is a proactive one. Reach out to a Mortgage.Expert advisor today to understand how to protect your equity and budget, and whether it’s time to lock in a better rate or restructure your mortgage.

📞 Talk to a Mortgage Expert and Avoid Payment Shock

Concerned about rising payments or nearing your trigger point? Let our experts guide you toward a smarter mortgage strategy.

Book a Free Consultation →Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts