Canadians’ Wealth Is Rising Thanks to the Stock Market—But Housing Pain Persists

While rising equities are boosting household wealth on paper, many Canadians are still struggling with housing affordability, high mortgage payments, and stagnant supply. This article explores the growing disconnect between market-driven wealth gains and the persistent financial pressure in Canada’s housing market in 2025.

It’s been a rough few years for Canadian homeowners, with soaring interest rates, tight lending rules, and mortgage renewals looming. But there’s some surprising good news: Canadians’ net worth is rising, and it has almost nothing to do with the housing market.

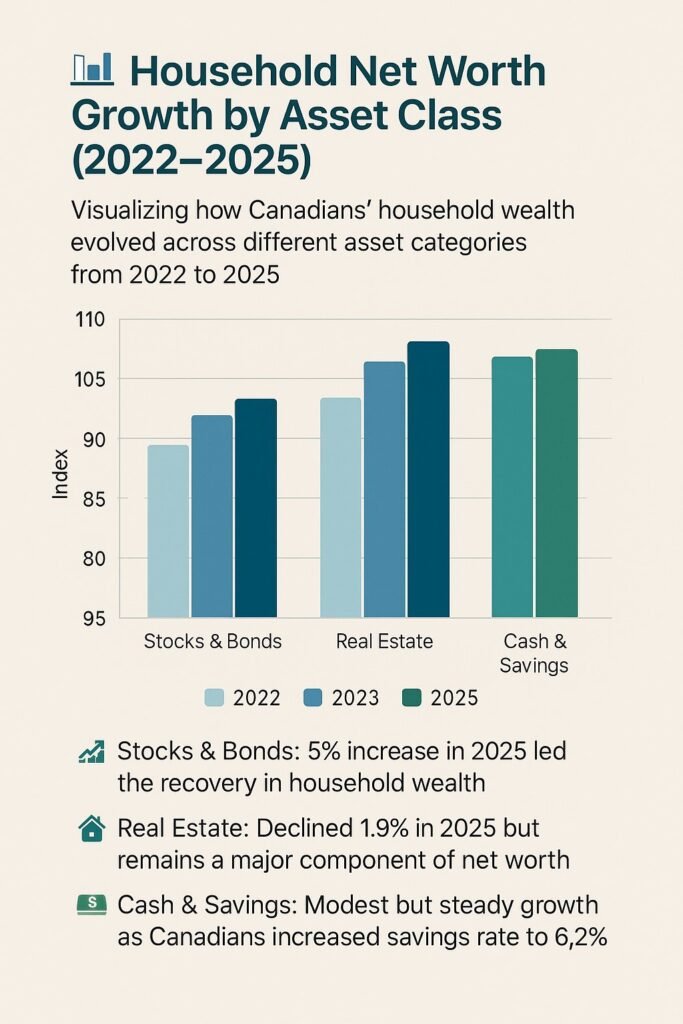

According to the latest data from Statistics Canada, household net worth jumped by 1.8% in Q4, adding nearly $290 billion in value nationwide. But here’s the twist—most of that wealth came from financial assets like stocks and bonds, not from homes.

Why the Stock Market Is Giving Canadians a Boost

Thanks to a strong equity market rally, financial assets grew by 5%, while residential real estate values dropped by 1.9% over the same quarter.

So even though home values have dipped in many parts of Canada, diversified investors—especially those holding ETFs, mutual funds, or direct stocks—are seeing serious gains. It’s a silver lining in a market that’s otherwise been dominated by mortgage anxiety.

But let’s not sugar-coat things…

Mortgage Payments Are Still Crushing Canadian Budgets

Even with rising investment gains, debt remains a heavy burden for most Canadians. The household debt service ratio—a measure of how much of your income goes toward debt—is stuck at 15%, the same level we saw before the 2008 crisis.

In fact, mortgage interest payments have nearly doubled since 2022. As of Q4, nearly two-thirds of a typical mortgage payment is going toward interest, not principal.

💰 Where Your Mortgage Payment Goes (2022 vs 2025)

Compare how rising interest rates have shifted the balance between interest and principal in typical mortgage payments.

| Payment Category | 2022 | 2025 |

|---|---|---|

| Interest Portion | ~35% | ~65% |

| Principal Portion | ~65% | ~35% |

| Monthly Mortgage Payment* | $2,000 | $2,300 |

*Example based on a $450,000 mortgage with a 25-year amortization.

Most Canadians Haven’t Renewed Yet — But They Will Soon

Rising interest rates have already made life more expensive, but many Canadian homeowners still haven’t felt the full impact—because their mortgages haven’t come up for renewal yet.

When they do (between 2025 and 2026 for most 5-year terms signed during the pandemic), many borrowers will face payment shocks of 30–40% increases, especially if they’re moving from fixed rates around 2% to new rates above 5%.

The Good News? Debt Is Still Manageable for Most

Despite the pressure, Canadians are adapting. Household savings rates climbed to 6.2% in Q4—the highest since pre-pandemic. And Canada’s household debt-to-income ratio actually fell to 178.7%, meaning income growth is (finally) outpacing debt.

Plus, many Canadians are shifting toward more conservative, low-fee investment strategies, with money market and ETF holdings rising sharply in the last two years.

But Wealth Is Still Unevenly Distributed

While net worth is rising on paper, only 20% of Canadian households hold the majority of the wealth. That means most middle-income families are still heavily mortgage-reliant and sensitive to interest rate fluctuations.

And the rise in consumer insolvencies suggests that for many, rising costs and stagnant wages are pushing budgets to the brink.

Final Thoughts: Mortgage Strategy Still Matters

The stock market may be booming, but for most Canadian homeowners, managing mortgage costs is still the #1 priority. Whether it’s refinancing, locking in a better rate, or exploring prepayment options, your mortgage strategy matters more than ever.

At Mortgage.Expert, we believe that the best way to build wealth in any market is by cutting down on high-interest debt and optimizing your housing costs. A simple mortgage switch, or even a better rate on renewal, could free up hundreds—if not thousands—per year for savings, investments, or debt repayment.

📞 Let’s Explore How You Can Pay Less on Your Mortgage

Speak with a licensed mortgage expert and discover how to reduce your monthly payments or get a better rate in today’s market.

Talk to an Expert NowStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts