Are Canadian Mortgage Rates Finally Easing? The U.S. May Still Be Steering the Wheel

Canadian mortgage rates are slowly easing in July 2025, but U.S. economic forces may still hold the reins. Here's what homebuyers should know.

After a few years of skyrocketing rates, many Canadians are finally starting to feel hopeful. Inflation is easing. The Bank of Canada is slowly warming up to rate cuts. But even as these signs point toward potential relief, one big factor continues to dominate the conversation — the United States.

From Jerome Powell’s (Chief of the Federal Reserve of the United States) carefully worded statements to unexpected shifts in U.S. inflation data, Canadian mortgage rates are increasingly influenced by forces outside our borders. And while rate cuts may be approaching, the road to affordable borrowing is still full of twists.

Let’s break it all down — what’s actually happening with Canadian mortgage rates, what role the U.S. plays, and what today’s borrowers need to know to stay ahead.

Inflation Is Cooling, But Housing Costs Are Holding Back Progress

There’s no denying that Canada’s inflation situation is improving. As of July, inflation had dropped to 2.5%, its lowest level since March 2021. That’s a strong signal that the Bank of Canada’s aggressive rate hikes over the past two years are finally working.

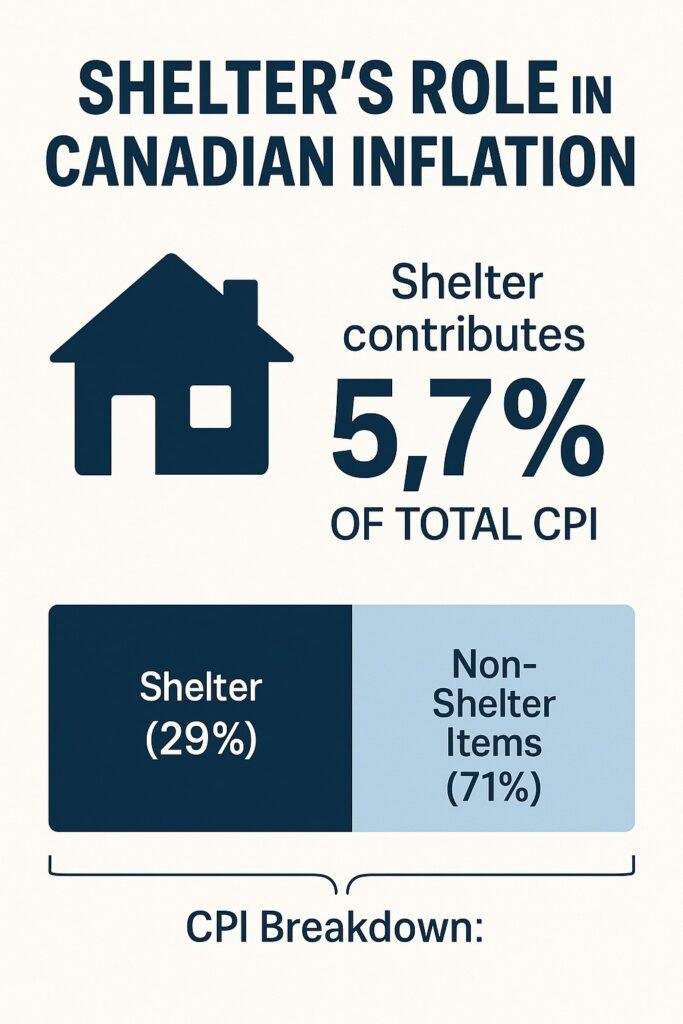

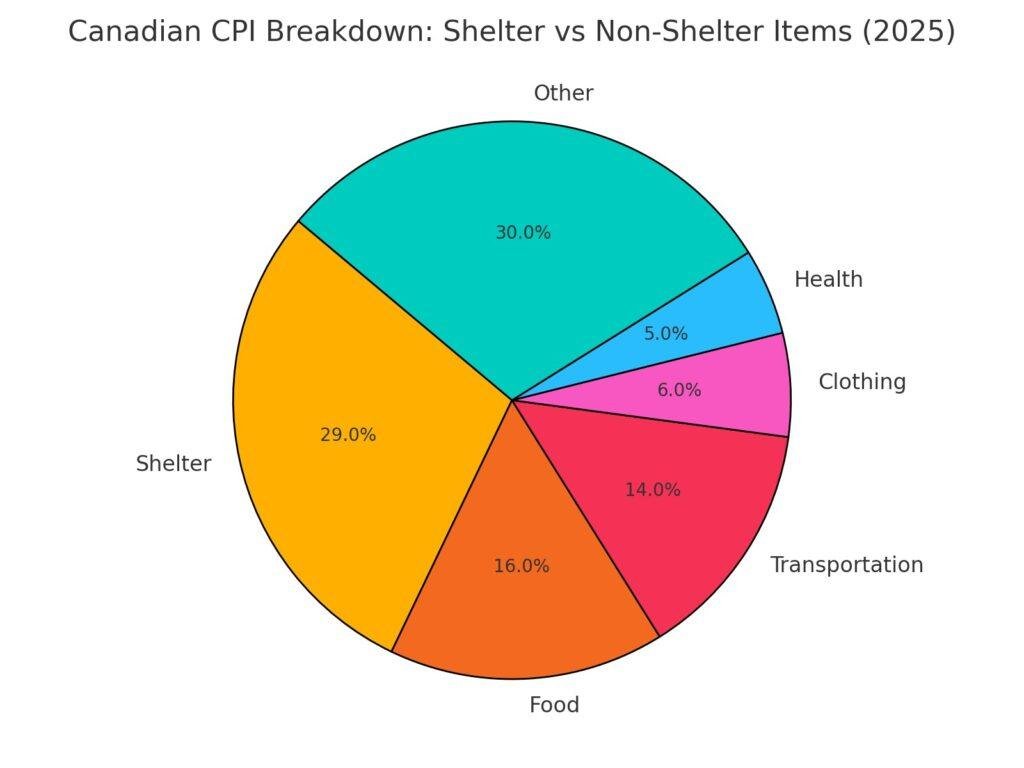

But here’s the catch: while many prices have come down, shelter costs remain stubbornly high. Things like rent, mortgage interest, heating bills, condo fees, and property taxes are still pushing inflation upward. In fact, shelter costs now account for 5.7% of the total CPI, despite only making up 29% of the basket. This ongoing pressure makes it difficult for the BoC to confidently cut rates.

So, even though inflation is moving in the right direction, the housing component — which affects nearly every Canadian — is dragging out the rate relief timeline.

Why the U.S. Fed Still Controls the Mood in Canada

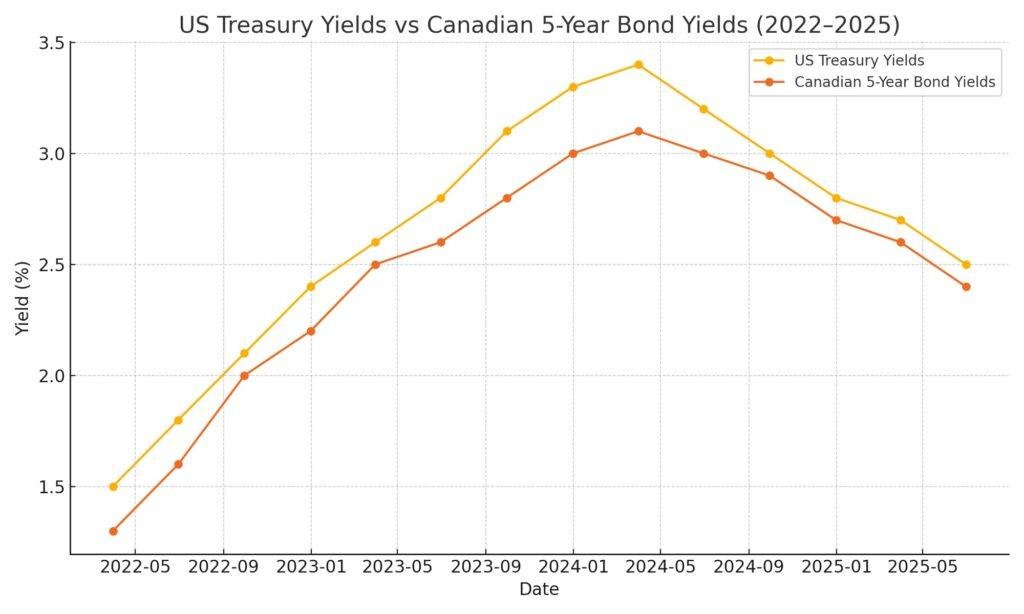

You’d think the Bank of Canada’s decisions would be entirely domestic, but it’s not that simple. Canadian bond yields — which directly influence our fixed mortgage rates — often move in sync with the U.S. Treasury market.

And lately, there’s been a lot of noise from south of the border.

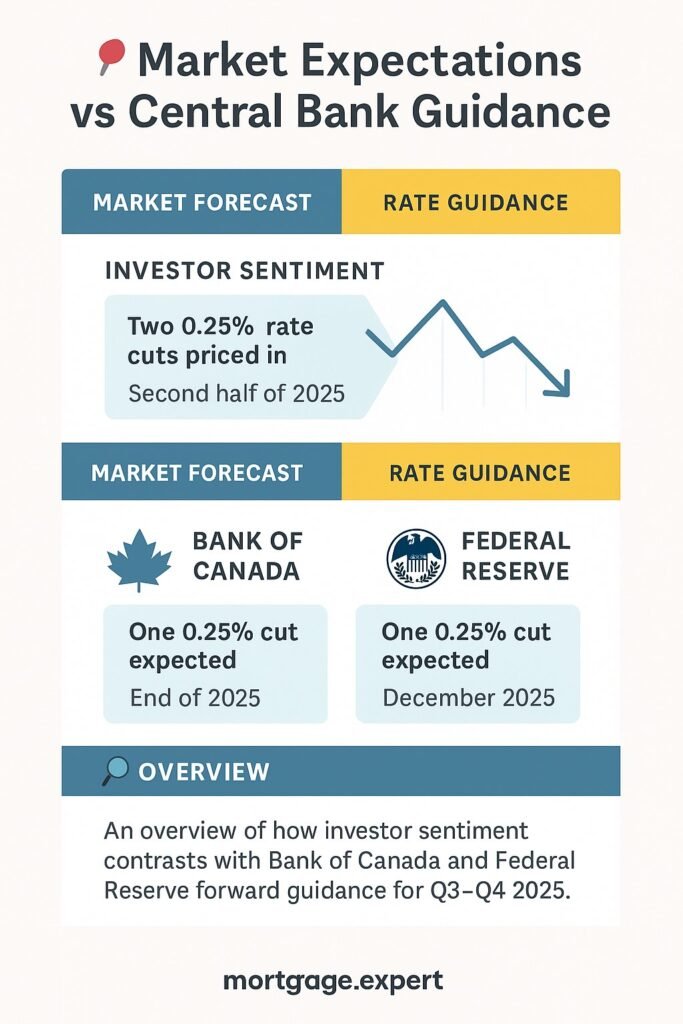

After the latest Federal Open Market Committee (FOMC) meeting, U.S. markets rallied, even though Fed Chair Jerome Powell didn’t confirm any major cuts were coming soon. This reaction shows how sensitive markets are to even small changes in tone.

Here’s the kicker: the yield on U.S. 10-year Treasuries fell below 4%, which signals recession concerns. At the same time, U.S. inflation is hovering around 3%, and bond investors are betting that the Fed may cut rates — even though Powell is trying to stay cautious.

This contrast between market expectations and central bank messaging is adding to the uncertainty in both countries — and it’s directly impacting Canadian mortgage pricing.

Is the Fed Getting Ready to Cut Rates? And What Does That Mean for Us?

Markets love to speculate, and right now, they’re heavily betting on U.S. rate cuts later this year. Some analysts believe we could see reductions of 75 to 100 basis points by December.

For Canadians, this matters more than it might seem. When U.S. bond yields drop, Canadian bond yields often follow. And since 5-year fixed mortgage rates are tied to bond markets, this could create room for Canadian lenders to start dropping their rates too.

The Bank of Canada is watching closely. If the Fed starts easing, it gives the BoC more cover to move in the same direction — without risking a dramatic weakening of the Canadian dollar..

Mortgage Affordability Remains a Major Concern in Canada

Even with signs of economic improvement, housing affordability in Canada remains stretched.

More homes are being listed, but buyers are hesitant. Interest rates are still high, and that’s discouraging many first-time buyers. In fact, the average mortgage amount in Canada has jumped to $410,000, and down payments are becoming harder to save — especially in cities where rent has also increased.

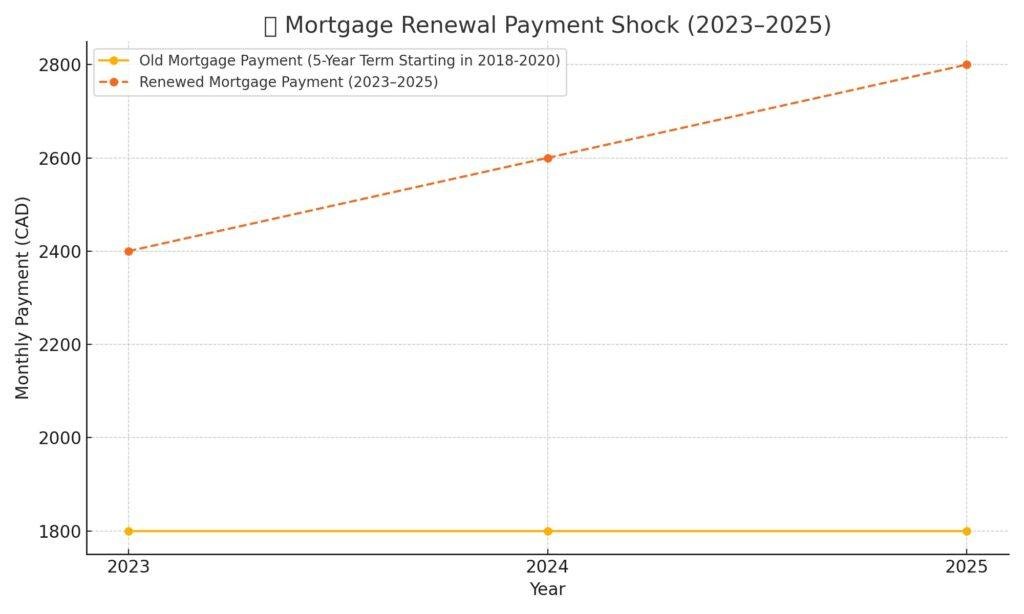

At the same time, a growing number of Canadian households are experiencing renewal shock. As older mortgages come up for renewal, borrowers are finding that their monthly payments have risen by hundreds of dollars — even though they haven’t moved or borrowed more.

To make matters worse, credit card debt is soaring, especially among mortgage holders. Canadians are relying more on short-term credit to handle rising expenses, which could add even more stress in the months ahead.

What Are the Best Mortgage Strategies in This Environment?

There’s no one-size-fits-all answer, but here’s how to think about the two most popular mortgage types right now:

Variable Rate Mortgages: A Strategic Gamble

If you believe the BoC will cut rates in the next 6–12 months — and you’re financially flexible — a variable-rate mortgage could pay off. While you might start with a slightly higher payment than a fixed mortgage, you’ll likely benefit from falling rates over time. This is ideal for those who can handle short-term volatility for longer-term savings.

Fixed Rate Mortgages: Comfort With a Price

Fixed rates offer predictability. If your budget is tight or you’re worried about rising costs elsewhere, locking in a shorter-term fixed rate (like 1–3 years) could give you peace of mind while leaving the door open for renewal into a lower-rate environment later.

One caution: fixed rates don’t always fall just because the BoC cuts rates. They move with bond markets — and those are influenced by inflation, U.S. data, and investor expectations. So, even in a falling-rate environment, fixed rates might stay elevated.

📌 Fixed vs Variable Rates at Major Canadian Lenders – July 2025

| Lender | 5-Year Fixed Rate | 5-Year Variable Rate |

|---|---|---|

| RBC | 5.09% | 6.00% |

| TD Canada Trust | 5.14% | 5.95% |

| Scotiabank | 4.99% | 5.85% |

| BMO | 5.04% | 5.89% |

| CIBC | 5.11% | 5.94% |

Rates updated as of July 2025. Subject to change based on lender discretion and borrower profile.

In Conclusion: Stay Calm, Stay Informed, Stay Flexible

Canadian mortgage rates may be preparing for a gentle descent, but the U.S. market is still holding the steering wheel. Even as inflation cools at home, shelter costs, global bond trends, and Fed policy are all combining to keep fixed rates in a volatile state.

The best approach for Canadian borrowers right now is to stay informed and talk to a mortgage expert before locking in a rate. Whether you’re buying your first home or facing a renewal, timing and flexibility will be your biggest assets in 2025.

Talk to a Mortgage Expert

Lock in your best rate today with personalized, commission-free advice.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts