Canadian Fixed Mortgage Rates Hijacked By US CPI Inflation

Canadian fixed mortgage rates are being heavily influenced by U.S. inflation data — with the 5-year bond yield reacting to every CPI release. Here’s how American price pressures are quietly shaping Canadian borrowing costs.

Canadian homeowners and mortgage shoppers are once again feeling the heat—but this time, the fire is coming from south of the border. In March 2024, U.S. inflation surprised everyone by climbing to 3.5%, pushing bond yields up and dragging Canadian fixed mortgage rates along for the ride. It’s a fresh reminder that our mortgage rates aren’t made in isolation; they’re often at the mercy of global economic forces, especially those coming from our largest trading partner.

Why U.S. Inflation Is Impacting Canadian Mortgage Rates When U.S. inflation came in hotter than expected, it immediately triggered a jump in U.S. Treasury yields. But the ripple effect didn’t stop there. Canada’s 5-year government bond yields rose by 14 basis points almost overnight—their biggest spike since October. And since Canadian fixed mortgage rates are directly tied to those bond yields, borrowers here felt the pinch just as quickly.

This kind of market reaction isn’t uncommon. In fact, Canada’s bond market is closely tied to the U.S., meaning rate volatility in Washington can translate into borrowing cost changes in Toronto, Vancouver, or Calgary. The latest data clearly shows how Canadian fixed mortgage rates can be hijacked by developments in the U.S. economy—even when things are relatively stable at home.

📉 How U.S. Inflation Impacts Canadian Bond Yields

Rising U.S. inflation often leads to higher bond yields in Canada — especially the 5-year yield that drives fixed mortgage rates. Here’s how the two indicators moved from 2019 to 2025:

*Data from U.S. Bureau of Labor Statistics (CPI) and Bank of Canada. 2025 values are estimated.

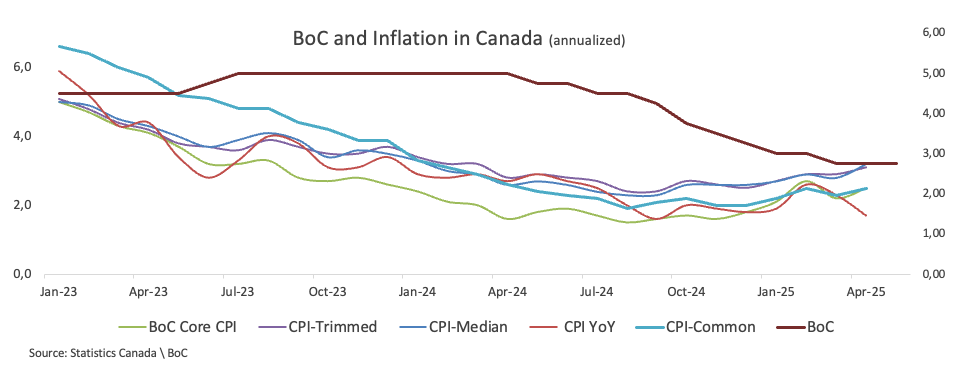

Canada vs. U.S. Inflation Trends: A Tale of Two Directions While the U.S. continues to struggle with sticky inflation, Canada’s numbers are heading in the opposite direction. In March, core inflation in Canada actually cooled, and the Bank of Canada held its key rate steady on April 10, reflecting cautious optimism.

That said, central banks on both sides of the border have acknowledged that reaching their 2% inflation target won’t be a straight line. Inflation tends to behave like a rollercoaster, with unexpected twists along the way. For now, the U.S. consumer’s ability to keep spending despite high prices is fueling inflationary pressure—a sign of economic resilience that’s keeping the Federal Reserve from moving ahead with rate cuts.

Delayed Rate Relief Means More Cost Pressure The Bank of Canada is expected to cut rates before the Federal Reserve, likely starting in June or July. But even that may not bring immediate relief to fixed mortgage rates. Because bond markets have already priced in many anticipated rate cuts, and because investor confidence has been shaken by U.S. inflation and weaker-than-expected bond auctions, yields remain elevated.

The spread between fixed and variable rates is now more than 100 basis points at most lenders. And because fixed-rate mortgages are based on bond yields, any upward pressure—like we saw with the U.S. CPI surprise—makes fixed borrowing more expensive, regardless of what’s happening with the Bank of Canada’s policy rate.

📉 U.S. CPI vs. Canadian 5-Year Bond Yield

A quick look at how inflation in the U.S. tracks against Canadian bond yields — a key driver of fixed mortgage rates.

*Data: U.S. BLS & Bank of Canada. 2025 values are projections.

What Does This Mean for Mortgage Borrowers? Let’s break it down. If you’re in the market for a new mortgage, renewal, or refinance:

- Fixed rates may continue to rise in the short term. The lowest 5-year fixed rate for insured mortgages is currently around 4.84%, but it could reach 5.14% soon if yields keep climbing.

- Variable rates remain unchanged for now, and could fall if the BoC cuts rates as expected. But remember, variable rates are tied to the BoC’s overnight rate, not bond yields.

- The gap between fixed and variable mortgages is wide, giving borrowers a clear choice between predictability (fixed) and potential savings (variable).

For many households juggling high mortgage payments and everyday expenses, locking into a fixed rate can provide peace of mind. But if you’re comfortable with a bit of risk, a variable rate might become more attractive as rate cuts begin.

Inflation Expectations for Canada Are Improving The BoC is now forecasting year-end inflation at 2.2%, lower than previously expected. If that outlook holds, it could set the stage for gradual rate reductions that help ease mortgage costs across the board. But this also depends on global factors, like oil prices and geopolitical risks, which could disrupt inflation trends in both Canada and the U.S.

The key message from policymakers? Don’t overreact to a single data point. Inflation is bumpy. But the long-term trend for Canada is encouraging.

Should You Lock In Now or Wait? With fixed mortgage rates rising due to U.S. inflation and variable rates holding steady, many borrowers are stuck in decision limbo. If your mortgage is up for renewal in the next 120–150 days, it’s a smart move to speak with a mortgage expert and consider locking in a rate.

📈 What Do These Trends Mean for Your Mortgage?

With bond yields shifting alongside U.S. inflation, fixed mortgage rates in Canada could move fast. Let us help you lock the right rate — at the right time.

💬 Talk to a Mortgage AdvisorStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts