Canadian Dollar Steadies as CPI Report Nears — Rate Cut Odds Drop Sharply

The Canadian dollar is holding steady, but don’t be fooled — rising bond yields and stronger job numbers are pushing rate cut odds lower for July. Here’s what that means for your mortgage strategy.

The Canadian dollar is holding its ground this week, but the real story is what’s happening behind the scenes. After a stronger-than-expected June jobs report, markets are suddenly scaling back their expectations for a Bank of Canada (BoC) rate cut at the next announcement on July 30.

The loonie traded around C$1.3693 per U.S. dollar on Monday, a modest move — but bond yields told a more dramatic tale. The Canadian 10-year yield rose to 3.542%, its highest level since mid-January.

So why the shift in tone? All eyes are now on the June CPI report, which will be released next week. Early forecasts suggest inflation may have crept back up to 1.9%, compared to 1.7% in May. If true, this could stall the BoC’s plans to cut rates again this summer.

As expected, the CPI data helped stabilize the loonie, reinforcing earlier signals that the chances of a near-term rate cut are shrinking.”

💡 What This Means for Mortgage Rates

Rising bond yields usually translate to higher fixed mortgage rates — or at the very least, fewer discounts from lenders. If the Bank of Canada delays its rate cut, five-year fixed rates could remain in the 5.3%–5.7% range longer than expected.

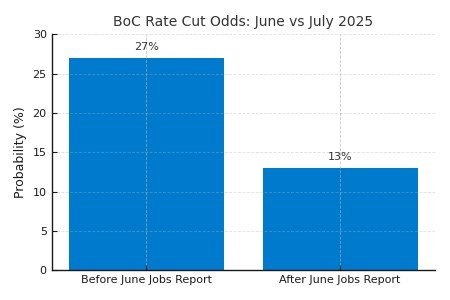

Variable rates likely won’t budge unless the BoC moves. And with only a 13% probability of a cut priced into markets right now (down from 27% last week), homebuyers may want to plan for higher rates in the short term.

“Interestingly, while Canada’s CPI holds steady, U.S. inflation surprises are pushing up Canadian fixed mortgage rates, creating a cross-border ripple effect.”

💬 What This Means for You

If you’re shopping for a mortgage this month, don’t assume rates will drop — the next few weeks could be choppy. Fixed-rate shoppers might want to lock in sooner rather than later. And variable-rate borrowers should brace for stability, not cuts.

💬 Have Questions About Your Mortgage?

Talk to a Mortgage ExpertStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts