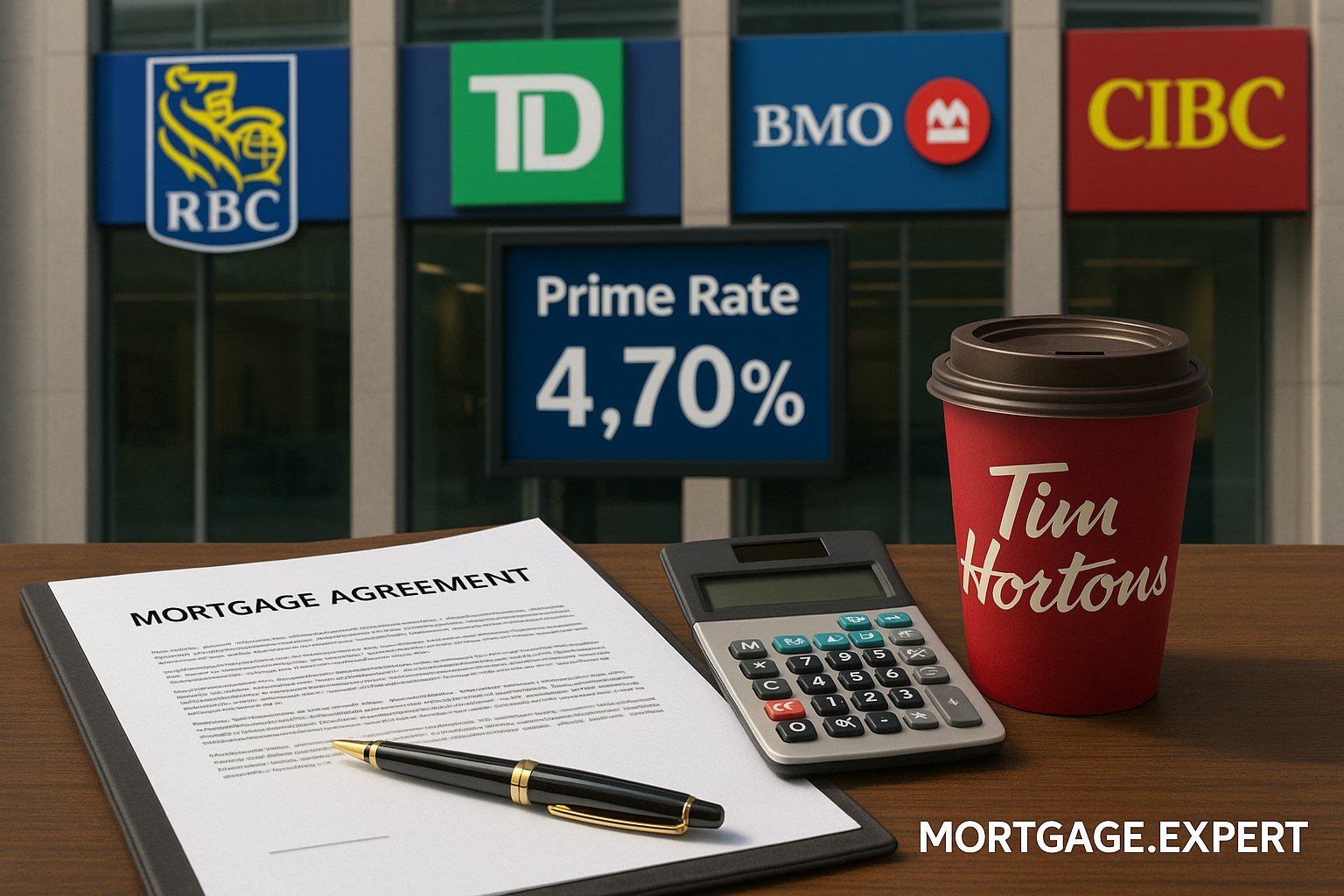

Canadian Banks Cut Prime Rate to 4.70% After BoC’s Policy Easing

Canada’s big banks have cut their prime lending rate to 4.70% following the Bank of Canada’s latest policy easing. Here’s how this impacts variable mortgages, fixed rates, and home affordability in 2025.

Canada’s major lenders — RBC, TD, CIBC, and BMO — have reduced their prime lending rate to 4.70%, following the Bank of Canada’s decision this week to cut its benchmark overnight rate by 25 basis points to 2.50%. The move marks the lowest level for the prime rate in nearly three years and signals a potential shift in the mortgage market for both new buyers and existing homeowners.

What the Rate Cut Means

The Bank of Canada’s policy change was widely expected after weeks of weak economic data. With the economy showing signs of slowing, and inflation easing below the 2% mark, policymakers moved to lower borrowing costs.

For Canadian households, the most immediate effect has come through the prime rate, which determines the pricing of variable mortgages, home equity lines of credit (HELOCs), and certain business loans.

By trimming prime from 4.95% to 4.70%, the big banks have aligned lending rates with the new monetary policy stance. This means variable-rate borrowers will start to see lower interest charges, while those considering a switch from fixed mortgages might find new options worth evaluating.

Variable Mortgage Holders Get Relief

For homeowners on a variable-rate mortgage tied to prime, the 25-basis-point cut can translate into meaningful savings.

- On a $500,000 mortgage, the rate cut reduces monthly payments by around $65–$80, depending on amortization.

- Over a year, that adds up to nearly $1,000 in interest savings.

This could provide much-needed breathing room for households who have faced steep increases in borrowing costs since 2022. Many variable-rate borrowers had seen their payments jump by several hundred dollars a month over the last two years.

Fixed vs. Variable: A Renewed Debate

The Bank of Canada’s rate cut has reopened the debate between choosing a fixed mortgage versus going variable.

- Fixed rates: While fixed mortgage rates are also trending lower — five-year fixed deals now available at around 3.9–4.1% — they remain higher than the variable products expected to fall further if the BoC continues easing.

- Variable rates: With prime down to 4.70%, most major lenders are offering variable mortgage rates in the 5.0–5.3% range, and further cuts could make them more competitive against fixed.

Mortgage advisors are urging clients to weigh their risk appetite. If the economy weakens further and more cuts follow, variable could outperform fixed. But if inflation surprises to the upside, fixed offers more certainty.

Broader Housing Market Impact

The prime rate cut comes at a time when the Canadian housing market is already cooling. According to CMHC, housing starts fell 16% in August, showing developers are cautious in the face of affordability challenges.

Still, lower borrowing costs could help restore demand in the fall and winter. Some analysts predict a modest pickup in resale activity as lower mortgage rates coax buyers back into the market, particularly first-time buyers who had been priced out.

Real-Life Example: A Toronto Couple

Consider a young couple in Toronto carrying a $650,000 mortgage on a variable rate of prime minus 0.6%. Before the cut, their effective rate was 4.35%, and they were paying about $3,550 per month.

After the BoC decision and the banks’ prime rate reduction, their new effective rate is 4.10%. Their payment drops to around $3,470, freeing up $80 a month. While not a dramatic change, it provides incremental relief — and if further cuts arrive later in 2025, the savings will grow.

What Comes Next

The Bank of Canada has signalled it remains open to additional rate cuts if economic risks intensify. Many economists now forecast at least one more 25-basis-point cut before year-end.

If that happens, Canada’s prime rate could fall to 4.45% or even lower, bringing further savings to borrowers. However, the central bank remains cautious, balancing the need to support growth with the risk of stoking another surge in housing prices.

Bottom Line for Borrowers

- Variable-rate holders: Expect lower payments starting this month; more relief possible if cuts continue.

- Fixed-rate seekers: Fixed terms are also edging down, but not as fast as variable. Locking in still makes sense if you value stability.

- New buyers: Improved affordability, but home prices and supply constraints remain hurdles.

- Investors: Lower financing costs may revive some investment demand, but rents and vacancy trends will also matter.

Whether you’re a first-time buyer, an upgrader, or refinancing, the latest rate cut is a turning point in Canada’s mortgage landscape. With prime now at 4.70%, the decisions you make in the coming months could shape your financial picture for years.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts