Top Brokers Predict 50bps Rate Cut by October — Refinance Boom Ahead?

Top mortgage brokers in Canada predict a 50bps Bank of Canada rate cut by October 2025, potentially triggering a major refinance wave. Learn who will benefit and how to prepare now.

A growing number of Canada’s top mortgage brokers believe that a significant rate cut may be just around the corner — and it could spark a fresh wave of refinancing activity.

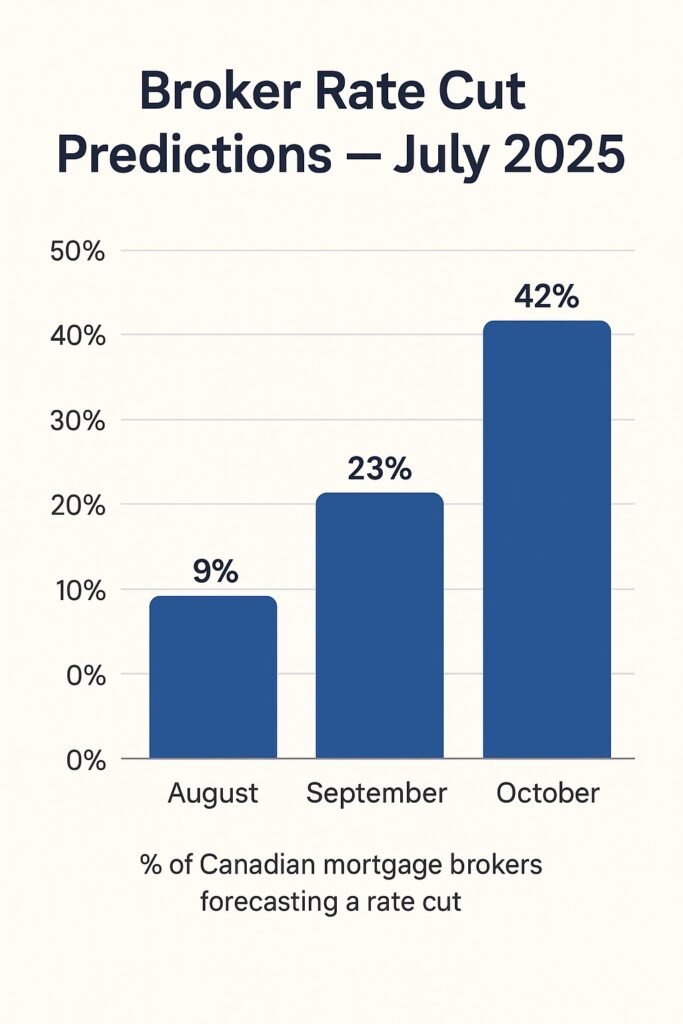

According to a new survey of 30 leading mortgage professionals conducted this week, a 50 basis point (0.50%) rate cut is likely by October 2025, with most respondents expecting the first move as early as September.

What’s Fueling the Optimism?

Brokers are pointing to a combination of weak consumer demand, sluggish inflation trends, and global economic headwinds, all of which are putting pressure on the Bank of Canada to ease its monetary policy. Many believe the central bank is looking for the “right moment” to pivot — and early fall could be it.

“Borrowers are exhausted. Fixed and variable rates remain historically elevated, and the housing market is still soft,” one Toronto-based broker told Mortgage.Expert. “If there’s no action by October, we could see broader consumer fatigue and delinquencies rise.”

“Still, not everyone agrees — some brokers are warning buyers not to get carried away with overly optimistic rate expectations.”

Refinance Activity Already Creeping Up

Even without a confirmed rate cut, many homeowners are preparing early — getting pre-approved, locking in 90-day holds, and reassessing their amortization schedules. Some are consolidating debt, others are switching from variable to fixed.

“With a cut likely in the next 90 days, borrowers with upcoming renewals are better off starting their paperwork now,” said another broker from Vancouver. “When rates fall, the rush will begin.”

“If you’re planning to refinance this fall, it’s worth understanding how mortgage brokers are compensated and who they really work for.”

Who Will Benefit Most From a Fall Rate Cut?

- Homeowners with high-rate renewals (2020–2021 cohort) may finally see relief.

- Variable-rate borrowers, especially those near trigger points, could see lowered payments.

- New buyers may find increased qualification power with a lower stress test rate.

- Refinancers with equity could save thousands over the next 5 years.

“Before rushing into a refinance, compare your options — a broker may offer more flexibility than a traditional bank.”

However, experts warn not to wait blindly. “If rates fall but housing demand spikes, you may end up paying more for the home even if the rate is lower,” one broker explained.

📞 Struggling to Find a Fair Mortgage as a Newcomer?

Read Our First-Time Buyer Guide — Start Your Journey Today.

Explore the Guide NowStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts