Bank of Canada Warns: More Canadians Taking on Risky Variable Mortgages

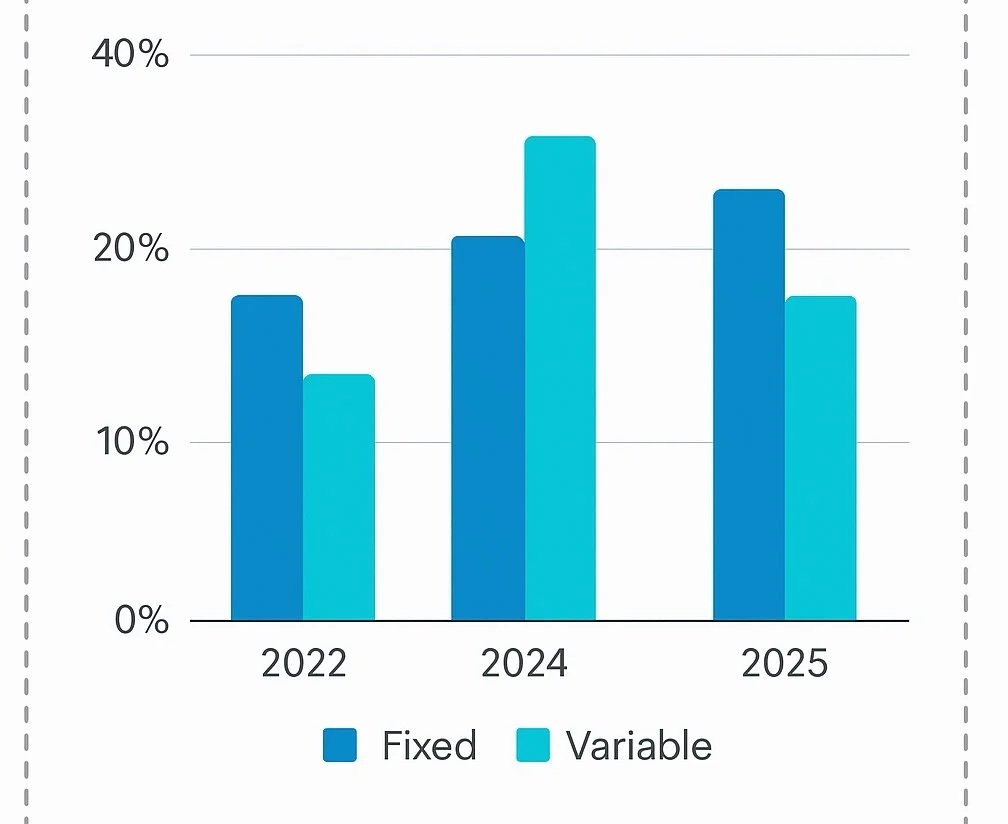

Despite uncertainty around rates, a growing number of Canadians are opting for variable mortgages, a move BoC warns may pose rising financial risk.

BoC Highlights Growing Shift to Variables

In its latest Financial Stability Report, the Bank of Canada (BoC) flagged the rising preference among Canadians for variable-rate mortgages as a key financial stability risk. Despite an uneven economic outlook and rate policy uncertainty, many borrowers are betting on potential cuts rather than locking in higher fixed rates.

Why It’s Risky

Variable mortgages — which track the prime rate — may start lower (around 3.95%), but homeowners are vulnerable to sudden rate hikes. While BoC has paused rate increases since June, variable borrowers are bracing for possible volatility ahead.

Who’s Most at Risk

- New borrowers choosing variable products

- Those nearing renewal under variable terms

- Households with tight budgets — rate swings could quickly erode affordability

For a closer look at why Canadians are opting for variable rates despite the risks, read this analysis on borrower behaviour.

What You Can Do

If you’re considering a variable-rate mortgage:

- Understand the prime + spread mechanism

- Compare with current fixed rates

- Have a plan if rates increase—for instance, flexible prepayment options, stress-testing budgets

While variable mortgages might offer near-term savings, the BoC cautions that these come with greater exposure — especially for borrowers with lower risk tolerance. A balanced view is crucial.

🏡 Not Sure if a Variable Mortgage is Right for You?

Talk to a licensed mortgage expert and get personalized advice to choose between fixed and variable rates in 2025.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts