BoC Rate vs Core Inflation — Are They Finally Converging?

As of mid-2025, the Bank of Canada’s policy rate and Canada’s core inflation are finally showing signs of aligning — but will it last?

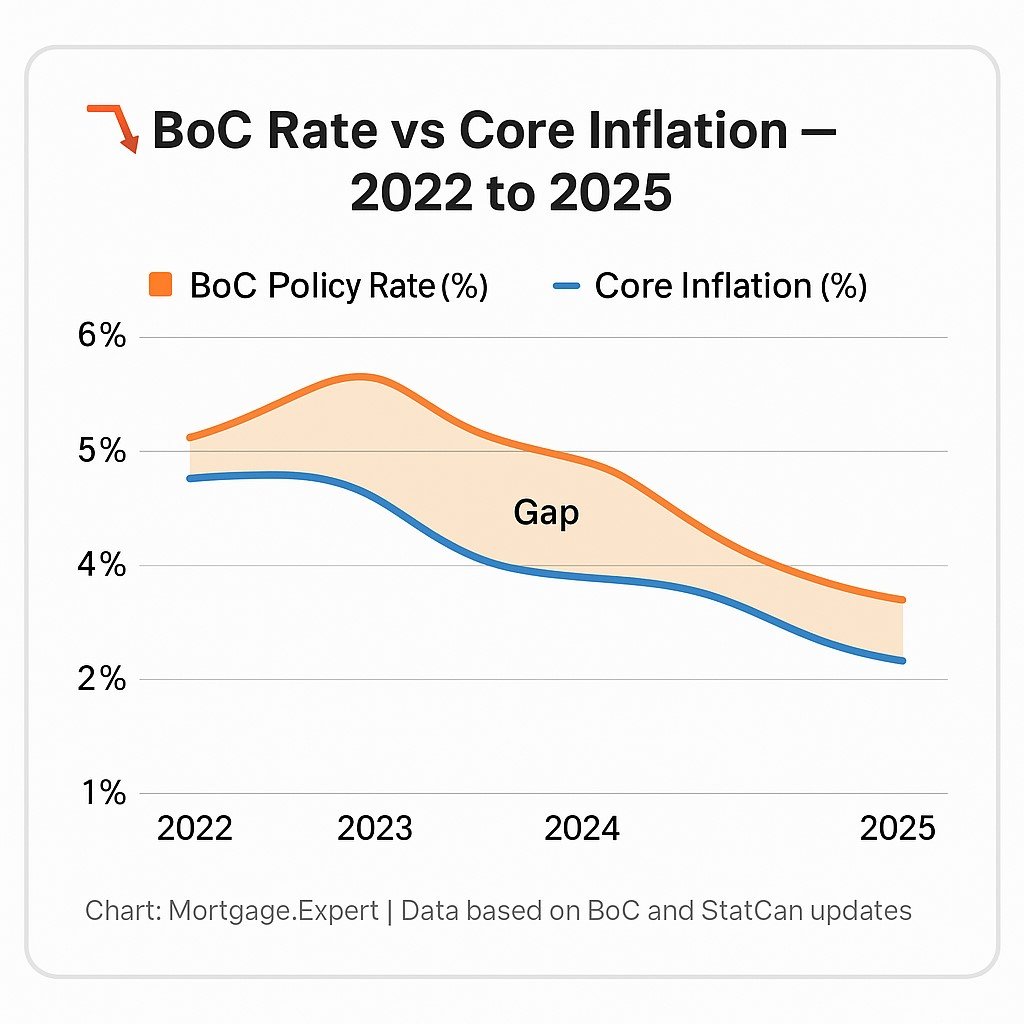

For nearly two years, the Bank of Canada (BoC) has held its key overnight rate far above the rate of inflation. This aggressive stance was meant to tame price growth, but it has also kept borrowing costs historically high, especially for mortgage holders.

Now, with core inflation easing closer to the 2% target, the BoC’s hold on its 5.00% policy rate is drawing attention — and scrutiny.

“We’re seeing real signs that inflation is being tamed, but the BoC wants to be absolutely sure before cutting,” said one fixed-income strategist from TD.

Why It Matters for Mortgage Rates

Bond markets — and by extension, fixed mortgage rates — tend to move based on inflation expectations. As core inflation has cooled, 5-year bond yields have slipped, and lenders are starting to follow suit.

In July 2025, several A-lenders trimmed their fixed rates by 10–15 bps — not major, but enough to signal a shift.

This gap between the two has been historically wide — and it’s this divergence that has made borrowing feel more painful than ever for Canadian homeowners.

Will a Rate Cut Actually Happen?

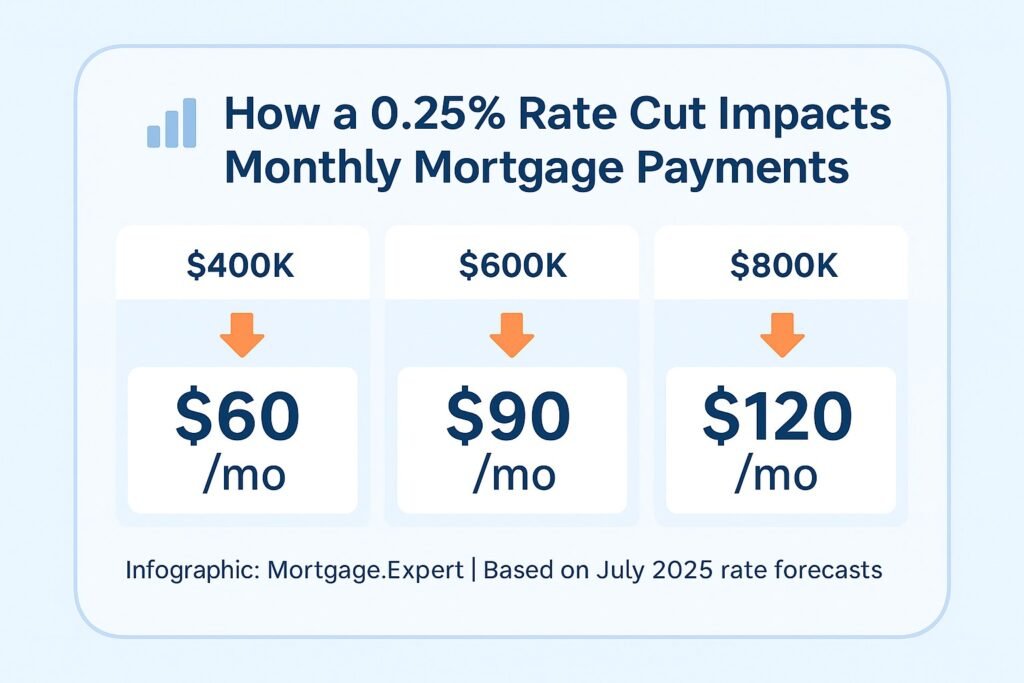

The BoC has publicly stated it wants to see several more months of subdued inflation before committing to cuts. But economists say a 0.25% reduction as early as October is now possible — especially if the labour market remains soft.

In plain terms, a quarter-point cut could save the average variable-rate borrower about $60 to $100/month depending on their loan size.

Mortgage.Expert Take

If you’re currently holding out for lower rates, we’re getting closer — but timing matters. Locking into a flexible mortgage, or being pre-approved with multiple options, could give you the edge.

📌 Talk to a Mortgage Expert

Waiting for the rate cut? Get pre-positioned now. We’ll help you build a flexible strategy that moves when the market does.

Build Your Mortgage PlanStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts