BoC Holds Key Rate at 5% — But Hints Cuts Are Coming

Borrowers could see relief by fall if inflation stays on track

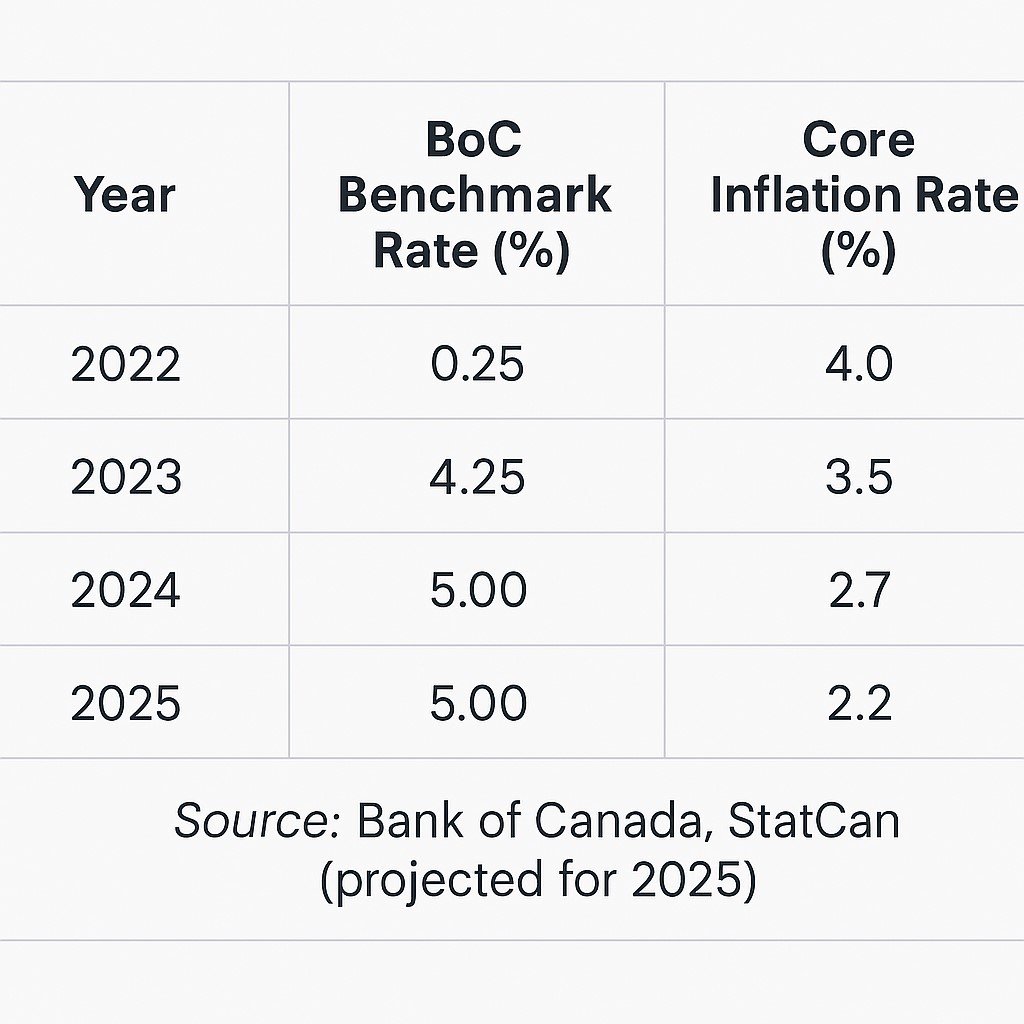

In its latest interest rate announcement, the Bank of Canada (BoC) chose to hold its benchmark interest rate steady at 5.00% — marking the seventh consecutive hold. But the tone of the statement was noticeably softer this time, giving mortgage holders across the country something they haven’t had in a while: hope.

“There’s growing confidence that inflation is moving sustainably toward the 2% target,” the BoC noted. “If progress continues, monetary policy easing may be appropriate.”

This is the central bank’s clearest signal yet that rate cuts may be on the table by fall, especially if inflation continues to behave and core metrics remain subdued.

What This Means for Homeowners and Buyers

While rates haven’t dropped yet, the forward guidance from the BoC is what really matters here.

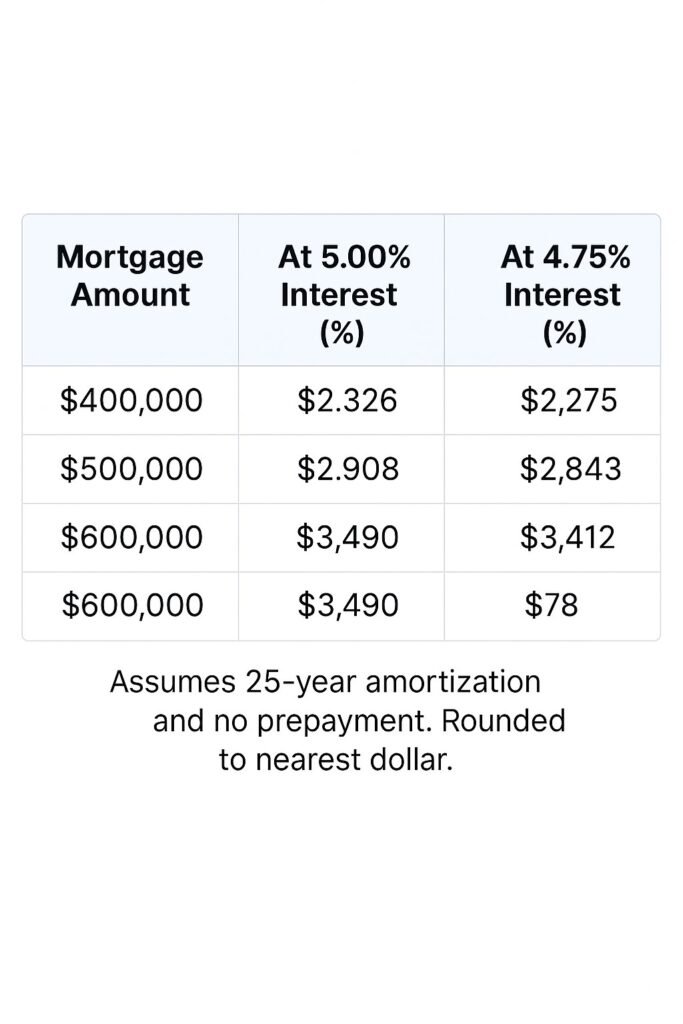

- If inflation holds below 3% and wage growth stabilizes, a 0.25% cut could come as early as September.

- This would be a direct relief valve for variable-rate mortgage holders, who’ve been absorbing steep payment hikes since 2022.

- Fixed rates, already starting to drift downward due to bond market movement, may ease even faster.

📌 Talk to a Mortgage Expert

Build a flexible mortgage plan tailored for you — before rates shift this fall.

Schedule Your Free ConsultationWhy You Shouldn’t Wait Blindly

Just because the BoC is signaling cuts doesn’t mean borrowers should sit idle. There’s still uncertainty in the air.

- Global oil prices, U.S. economic strength, or wage pressures in Canada could delay cuts.

- And if you’re up for renewal in the next 6–12 months, locking in flexibility now can shield you from surprises.

“Hope is not a mortgage strategy,” says one Toronto-based broker. “We’re telling clients to stay proactive — not just hopeful.”

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts