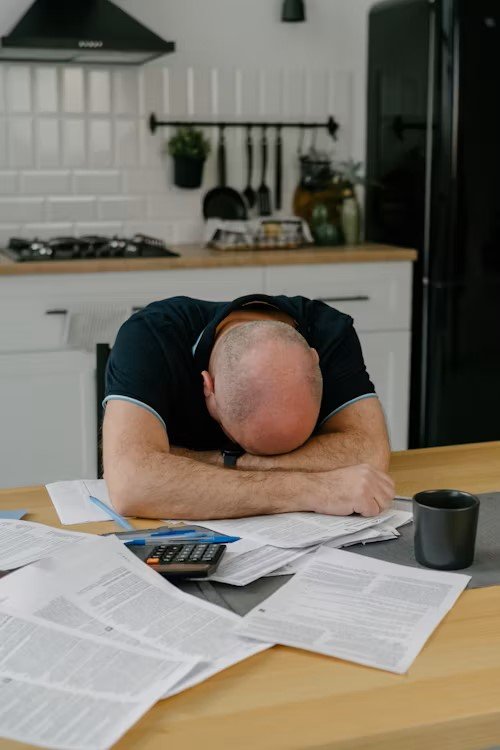

Payment Shock is Coming for Canadian Mortgage Holders – What You Need to Know

What is Payment Shock? Payment shock is what happens when your monthly mortgage payments suddenly jump—often by hundreds of dollars—at the time of renewal. And unfortunately for millions of Canadian homeowners, that’s exactly what’s headed their way between now and…

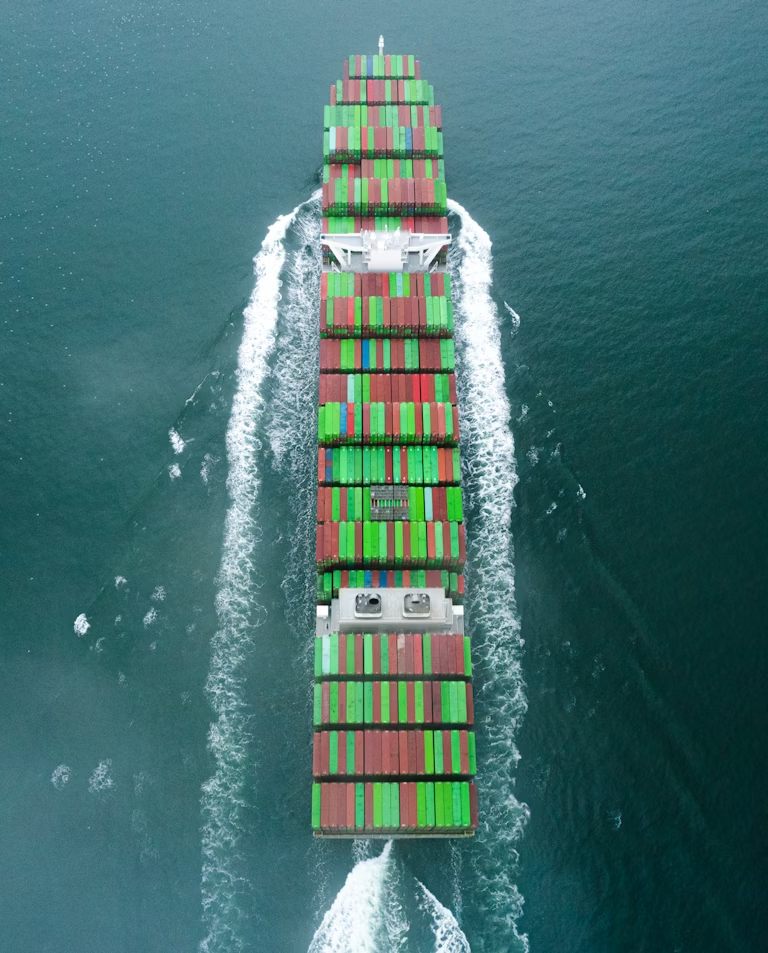

Asian Supply Chains Hit by US Tariffs — Will Canadian Builders Feel the Squeeze?

US tariffs on Southeast Asian imports may hit Canadian builders hard in 2025 — with rising costs, delays, and housing affordability concerns.

Why Global Trade Wars May Reshape Canadian Housing Costs in 2025–26

A Canadian suburban street set against the backdrop of global shipping trade, capturing how international tariffs and supply chain tensions may influence housing prices in Canada during 2025–26.

Could a Global Supply Shock Hit Canada’s Renovation Costs Again?

If you were one of the thousands of Canadians who tried to renovate during the pandemic, you probably remember the chaos: backorders, shipping delays, and the shocking price of lumber, tiles, and faucets. Now, in 2025, that nightmare might be…

Will Trump’s New Tariffs Push Global Inflation Higher — And Delay Rate Cuts in Canada?

As former U.S. President Donald Trump announces aggressive new tariffs on Asian goods, Canadian borrowers are left wondering: could this global tension creep into our wallets and delay the Bank of Canada’s next rate cut? With proposed 25% tariffs on…

How Are Mortgage Rates Determined in Canada? A Deep Dive for Homebuyers and Renewers

Mortgage rates can feel like a moving target—especially when you’re trying to buy your first home or decide whether to renew or refinance. One day, you see a lender offering 4.89%, and the next, it jumps to 5.29%. What’s going…

How Election Promises Could Shape Canadian Mortgage Rates in 2025

As Canada approaches the next federal election, political promises around housing affordability, interest rate intervention, and mortgage relief could significantly influence market expectations. This article explores how party platforms might shape the future of Canadian mortgage rates in 2025 — from potential rate freezes to tax incentives for first-time buyers.

More Canadians Choosing Variable Rates Again — Smart Move or Dangerous Bet?

After months of Canadians overwhelmingly choosing fixed-rate mortgages, variable rates are slowly creeping back into favour. But is this shift a sign of confidence — or a gamble that could backfire? A Return to Variable: What’s Driving It? Throughout most…

RBC vs. TD: Which Bank Offers the Better 5-Year Fixed Rate This Week?

As of the second week of July 2025, homebuyers across Canada are watching mortgage rates like hawks — and the biggest showdown is happening between RBC and TD. If you’re in the market for a 5-year fixed mortgage, chances are…

CMHC Warns: High Debt Loads Could Worsen If Rates Stay Elevated

CMHC Issues Mortgage Renewal Warning Amid Persistently High Rates Canada’s housing watchdog is sounding the alarm. According to the latest CMHC report, elevated interest rates are putting pressure on a growing number of homeowners — especially those nearing mortgage renewal.With…

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts