Vancouver Home Sales Dip 2% in July, Market ‘Turning a Corner’: Board

Greater Vancouver home sales dipped 2% in July 2025. Inventory up nearly 20%, prices flat to down slightly. What it means for buyers and sellers.

Mike Moffatt: If It’s a Housing Crisis, Why Are We Building Fewer Homes?

CMHC now sees housing starts sliding toward ~220k by 2027. Ontario & B.C. lead declines. Mike Moffatt asks: why aren’t we building more?

Mortgage Brokers vs. Direct Lenders: Navigating the Canadian Market in 2025

Wondering whether to work with a mortgage broker or go directly to a bank or credit union? Here's how to choose the best route for your mortgage in Canada.

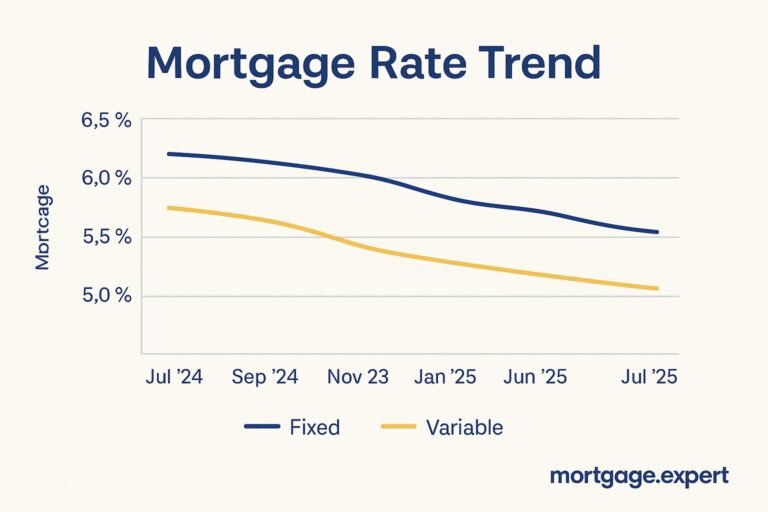

Fixed vs. Variable vs. Hybrid Mortgages in Canada (2025 Edition)

Confused between fixed, variable, or hybrid mortgage rates? This 2025 guide breaks down the pros, cons, and best choice based on your risk tolerance.

How Canada’s Mortgage Reforms Expand Access for First‑Time Homebuyers

Canada’s 2024 mortgage reforms raise the insured loan cap to $1.5M and allow 30-year amortizations for new builds—making homeownership more affordable for first-time buyers in big cities.

U.S.–Canada Trade Tensions Could Delay Mortgage Rate Cuts in 2025

Ongoing trade tensions between the U.S. and Canada are weighing on bond yields and adding uncertainty to rate cut expectations. Here's how that could impact mortgage rates and homebuyers in 2025.

Mortgage Renewals in 2025–26 Could Hit Households Harder Than Expected — Here’s Why

Canadian homeowners facing mortgage renewals in 2025–26 may see monthly payments jump by hundreds of dollars. We break down why, who’s most at risk, and how to prepare.

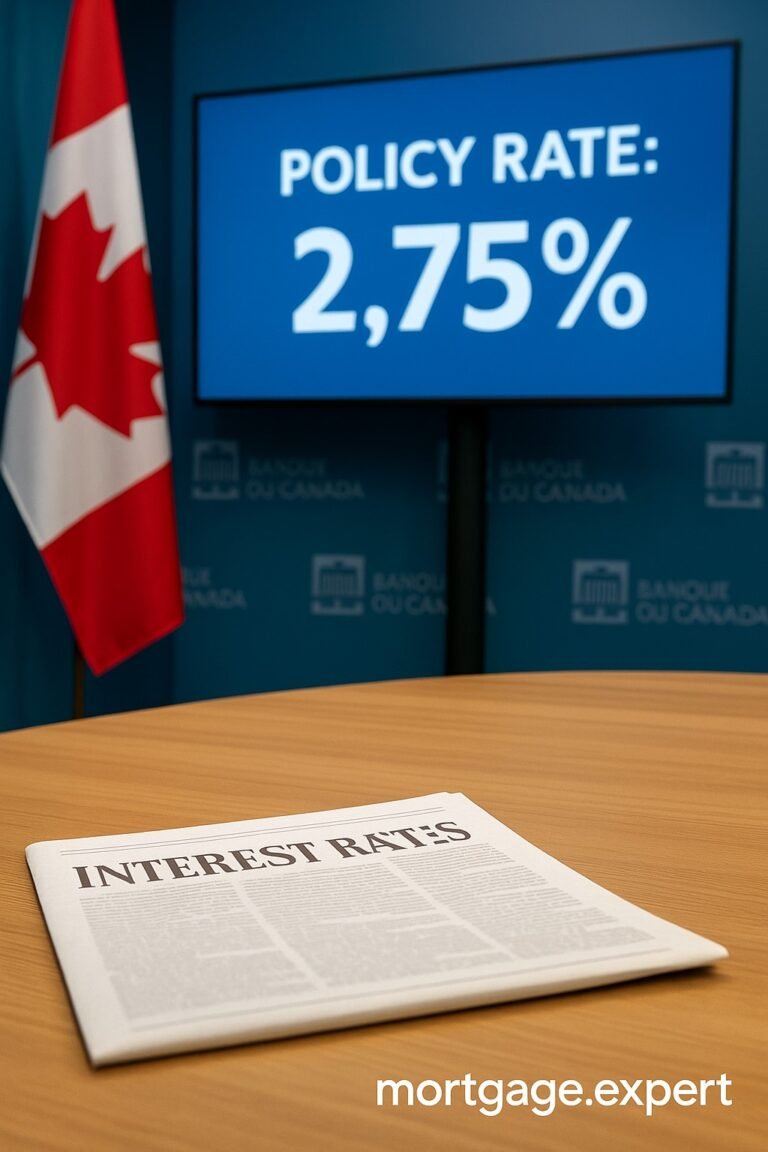

Bank of Canada Holds Benchmark Rate at 2.75% — Are Mortgage Rate Cuts Coming Next?

The Bank of Canada has kept its key interest rate steady at 2.75% amid trade uncertainty and soft inflation. Here's what it could mean for your mortgage — and why cuts may be on the horizon.

CRS Implementation in Canada: What Mortgage Borrowers Need to Know in 2025

Confused about how Canada’s CRS rules affect your mortgage in 2025? This guide breaks down what borrowers need to know — from documentation to lender reporting, and how it could impact your approval.

Canada’s 5-Year Bond Yield Climbs to 3.75% — What This Means for Your Mortgage Rate

Canada’s 5-year bond yield rose to 3.75% in August 2025, pushing average 5-year fixed mortgage rates to 5.19%. Here's what this means for your next mortgage decision.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts