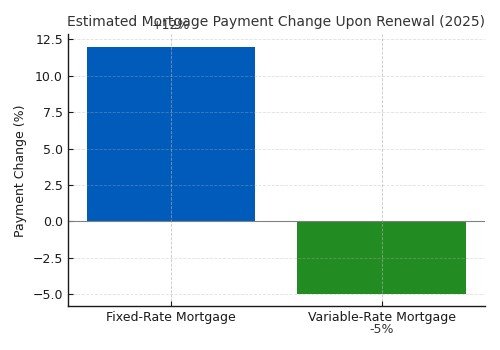

Mortgage Payments Could Surge by 10% in 2025 — What the BoC Report Reveals

The Bank of Canada warns that 2025 renewals could mean a 10% surge in mortgage payments for most borrowers — with some facing even steeper hikes. Here’s how to prepare.

If your mortgage is up for renewal in 2025, brace yourself — your monthly payments could jump significantly, even if interest rates don’t rise any further. According to a new Bank of Canada (BoC) staff analysis, most Canadian homeowners set to renew in 2025 will see their payments increase by 10% or more, with some fixed-rate holders facing jumps as high as 20%.

That’s a big pill to swallow — especially for those who locked in rock-bottom rates during the pandemic and are now re-entering a very different lending environment.

Why Are Payments Rising?

It comes down to rate shock. In 2020 and 2021, many Canadians secured mortgages at ultra-low interest rates — some as low as 1.5% on 5-year fixed terms. Fast forward to 2025, and those same borrowers are now renewing into a market where the best 5-year fixed rates are hovering around 5.3% to 5.6%.

The BoC report outlines that:

- 60% of mortgage holders will renew between 2025 and 2026.

- In 2025, average payments are expected to rise by 10% compared to December 2024.

- In 2026, the average jump is slightly lower — around 6%, as rates may begin to ease.

But There’s a Twist: Variable Borrowers May Catch a Break

Interestingly, those with variable-rate mortgages could actually see lower payments when they renew — assuming the Bank of Canada continues easing in the second half of 2025. The report suggests variable borrowers may benefit from 5% to 7% payment reductions, especially if they locked in during the peak rate cycle.

“The BoC’s detailed report outlines the risks — including a 10% surge in payments.”

But that relief comes with caution: variable rates still depend on prime rate fluctuations, and the BoC’s decisions remain data-dependent.

What Homeowners Should Do Right Now

If your renewal is coming up within the next 12–18 months, don’t wait to get informed. Start comparing offers, speak with a mortgage broker, and ask about options like:

- Early renewal before rates rise again

- Extending amortization to lower payments

- Exploring variable vs fixed trade-offs

- Switching lenders for better terms

“If you’re wondering what this means for your next renewal, here’s what you need to know.“

Many borrowers fall into the trap of automatic renewals — and end up overpaying by thousands. Being proactive could save you a serious chunk of change in this tight-rate environment.

💬 Unsure What Your Renewal Will Look Like?

Talk to a Mortgage ExpertStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts