More Canadians Choosing Variable Rates Again — Smart Move or Dangerous Bet?

After months of Canadians overwhelmingly choosing fixed-rate mortgages, variable rates are slowly creeping back into favour. But is this shift a sign of confidence — or a gamble that could backfire?

A Return to Variable: What’s Driving It?

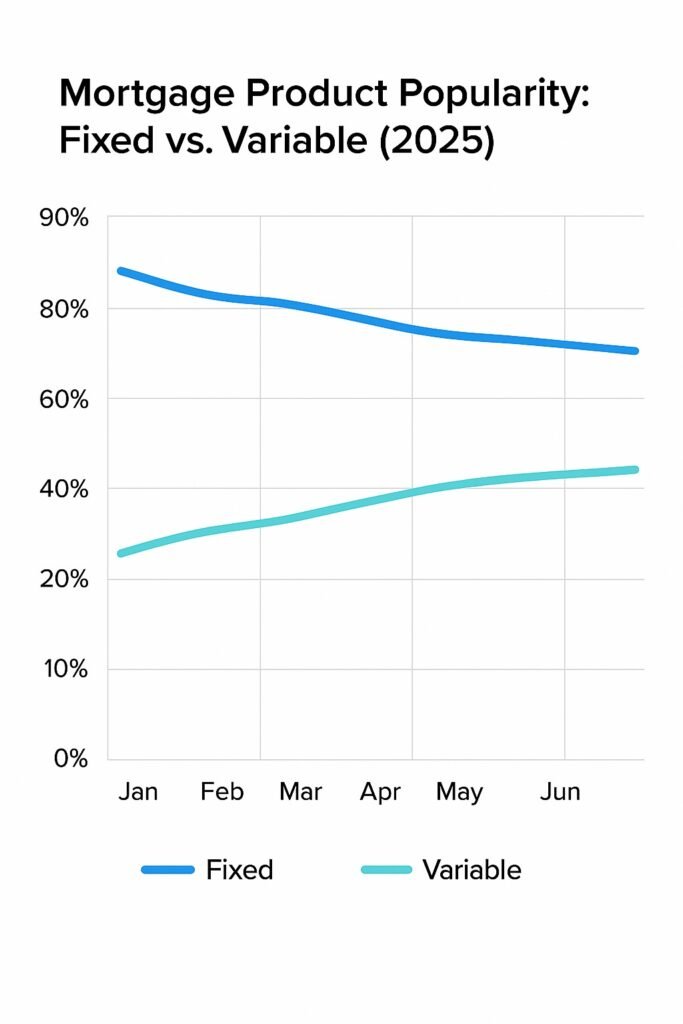

Throughout most of 2023 and early 2024, fixed-rate mortgages dominated new mortgage originations in Canada. Borrowers were spooked by rapidly rising interest rates and wanted the peace of mind of predictable payments. But by mid-2025, that trend is showing signs of reversal.

With the Bank of Canada pausing rate hikes and inflation cooling in recent quarters, many economists are forecasting one or two rate cuts before year-end. That outlook is nudging borrowers — especially younger buyers and renewers — back toward variable-rate options in the hopes of saving money over the long term.

According to recent brokerage data, roughly 22% of new mortgage applicants in June 2025 chose a variable rate, up from just 11% earlier in the year.

Why Some Borrowers Are Betting on Variable

The appeal of variable rates today boils down to three core beliefs:

- Rates Have Likely Peaked: With inflation mostly under control and the economy slowing, many experts believe the Bank of Canada is done hiking.

- Long-Term Savings Potential: Historically, borrowers on variable rates have paid less over time — especially when rate cuts are expected.

- Short-Term Pain for Long-Term Gain: Some buyers are willing to weather higher payments today for potential savings next year.

Even lenders are responding to this renewed interest. Several major banks have slightly sweetened their variable offers, and some brokers are offering cash-back perks or reduced penalties to entice risk-tolerant borrowers.

But Is It the Right Move for Everyone?

Variable rates might look tempting now, but they come with real risks — especially if economic forecasts prove wrong.

If inflation flares up again due to energy shocks, supply chain disruptions, or global unrest, the Bank of Canada could delay or even reverse course. In that case, today’s variable-rate borrowers could see their payments increase — possibly without warning if they’re on an adjustable-payment plan.

Even with a modest mortgage of $400,000, a 1% rate hike could translate to over $200 more per month in payments.

Expert Tip: Consider a Hybrid or Cap

Some financial advisors recommend a hybrid mortgage — part fixed, part variable — to balance the risk and reward. Others suggest shopping for variable rates with payment caps, where your rate may rise, but your payment won’t jump suddenly.

But it’s not all upside — the Bank of Canada has warned about the risks tied to variable mortgages. Here’s what policymakers are saying.

Final Word

The return of variable-rate popularity doesn’t mean it’s the right move for everyone. Borrowers should consider their risk tolerance, timeline, and budget flexibility before making the switch.

As always, talking to a licensed mortgage broker can help you customize a strategy that protects your financial future — no matter which way the rates move next.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts