Homewise Launches Pre‑Approval API for Partners

A big move in mortgage tech — and a win for real estate platforms and digital-first buyers.

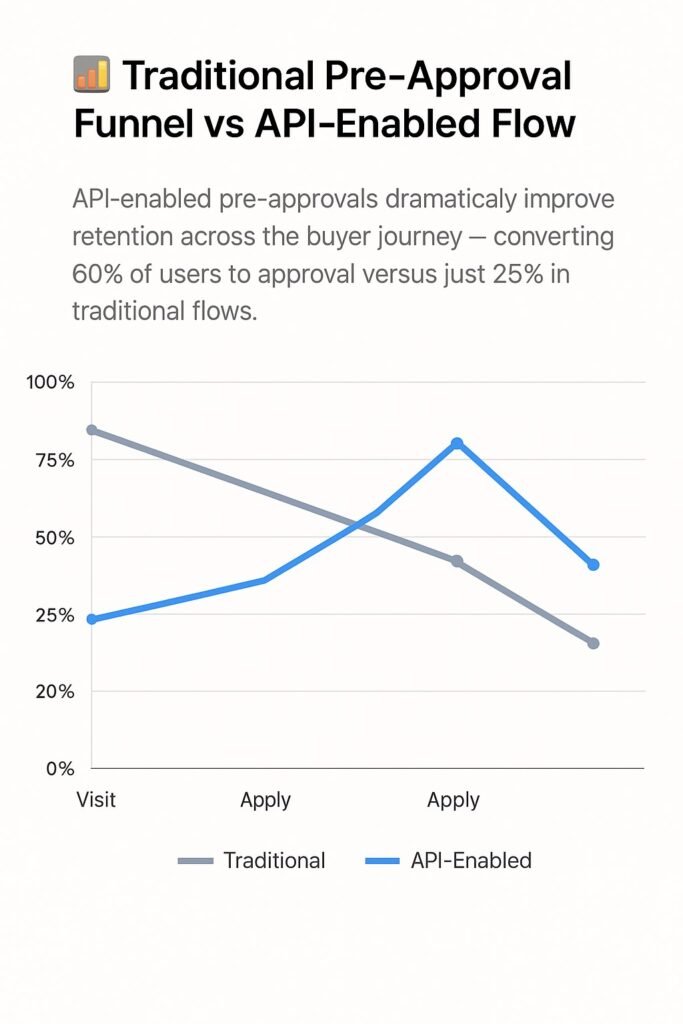

Canadian mortgage fintech Homewise just rolled out a new tool that could shake up how pre-approvals work across the industry. Their new Pre‑Approval API allows real estate websites, proptech companies, and partner platforms to embed instant mortgage pre-approval tools directly into their own digital experiences.

Instead of redirecting users to a separate pre-approval page, platforms can now run approvals behind the scenes, giving borrowers an instant sense of what they can afford — without ever leaving the site.

“This is about speed, simplicity, and smarter lead conversion,” said a Homewise spokesperson. “We’re giving partners a way to keep users engaged and moving forward with confidence.”

Why This Matters

Pre-approvals are often the first (and most frustrating) step for first-time buyers. Delays, document requests, and clunky interfaces can cause leads to drop off entirely.

With this API, digital-first brokerages and proptech tools can:

- Capture warm leads earlier in the buying journey

- Offer smarter recommendations based on budget instantly

- Connect buyers to lenders seamlessly, without waiting on manual forms

What It Means for Borrowers

If you’re using a real estate app or mortgage comparison site that partners with Homewise, you might soon see built-in affordability results after entering just a few basic inputs.

That means:

- No more switching tabs or waiting for email responses

- Instant clarity on your price range

- More control over your buying journey from day one

But it also means borrowers need to be cautious. API-driven results aren’t full approvals — they’re based on stated income and estimated debt, not formal documentation. So follow up with a real advisor to verify the numbers before house hunting.

📋 3 Benefits of Embedded Mortgage Tech for Buyers

- ⚡ Instant Affordability Insights: Buyers can see what they qualify for in real time, without switching apps or waiting for callbacks.

- 📱 Seamless User Experience: No redirect loops or clunky forms — the pre‑approval process happens right inside the site or app they’re already using.

- 📊 Smarter Shopping Decisions: With pre‑approval baked in, buyers browse homes that match their budget — reducing false expectations and wasted time.

Embedded mortgage tools aren’t just convenient — they can help buyers stay confident, realistic, and ready to act faster.

📌 Talk to a Mortgage Expert

Ready to move beyond basic rate calculators? Get a smarter, personalized pre‑approval experience backed by real advice — not just automation.

Start Your Smart Pre‑ApprovalStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts