How Much House Can I Afford in Canada? A Realistic Guide for First-Time Buyers

Buying a home is one of life’s biggest milestones — exciting, emotional, and yes, a little intimidating too. Before you start scrolling MLS listings or dreaming of kitchen backsplash tiles, there’s one question that needs an honest answer: How much house can I really afford?

Affordability isn’t just about the price of the home. It’s about your full financial picture — your income, your debt, your credit score, and those sneaky costs that pop up at the time of closing. Let’s walk through what lenders look at when you apply for a mortgage, and what you should consider to avoid getting in over your head.

How Lenders Decide: The Role of Debt Service Ratios

When you apply for a mortgage in Canada, your lender will take a close look at your income and existing debt to see how much of a monthly mortgage payment you can handle. This assessment is based on two key calculations: the Gross Debt Service (GDS) ratio and the Total Debt Service (TDS) ratio.

The GDS ratio shows what percentage of your gross income would go toward housing expenses — things like mortgage payments, property taxes, heating, and if you’re buying a condo, half the maintenance fees. Most lenders don’t want this to exceed 35%.

TDS takes it a step further. It includes all of your monthly debt obligations, including car payments, credit card minimums, student loans, and any other loan balances. TDS shouldn’t typically go above 42%, though some lenders will stretch this under special programs.

📱 Try Our Mortgage Affordability Calculator

Not sure how much home you can afford? Estimate your maximum purchase price based on your income, debt, and down payment.

Calculate Your Affordability NowCredit Score: The Invisible Factor Behind Your Rate

Even if your income looks good on paper, your credit score plays a big role in determining whether you’ll qualify for a mortgage — and at what interest rate.

Most lenders want to see a score of at least 680 for prime rates, though you can get approved with a lower score through alternative lenders or insured programs. But lower credit = higher rates, and even a 1% increase in your mortgage rate can add thousands to your total interest paid.

If you haven’t checked your score in a while, now’s the time. You can request your report for free from Equifax or TransUnion. Look for errors, unused cards that are still open, and try to keep your credit utilization below 30% of your available limits.

How Much Do I Need for a Down Payment?

Your down payment is your first major hurdle — and it directly affects how much house you can afford. In Canada, the minimum required down payment is:

- 5% on the first $500,000 of the home price

- 10% on any portion of the price above $500,000

- 20% if the home costs over $1 million

So, if you’re buying a $700,000 home, your minimum down payment would be $45,000 (5% of the first $500K = $25,000, plus 10% of the remaining $200K = $20,000).

Putting down 20% or more has a major advantage: you avoid CMHC mortgage default insurance — a cost that otherwise gets added to your loan.

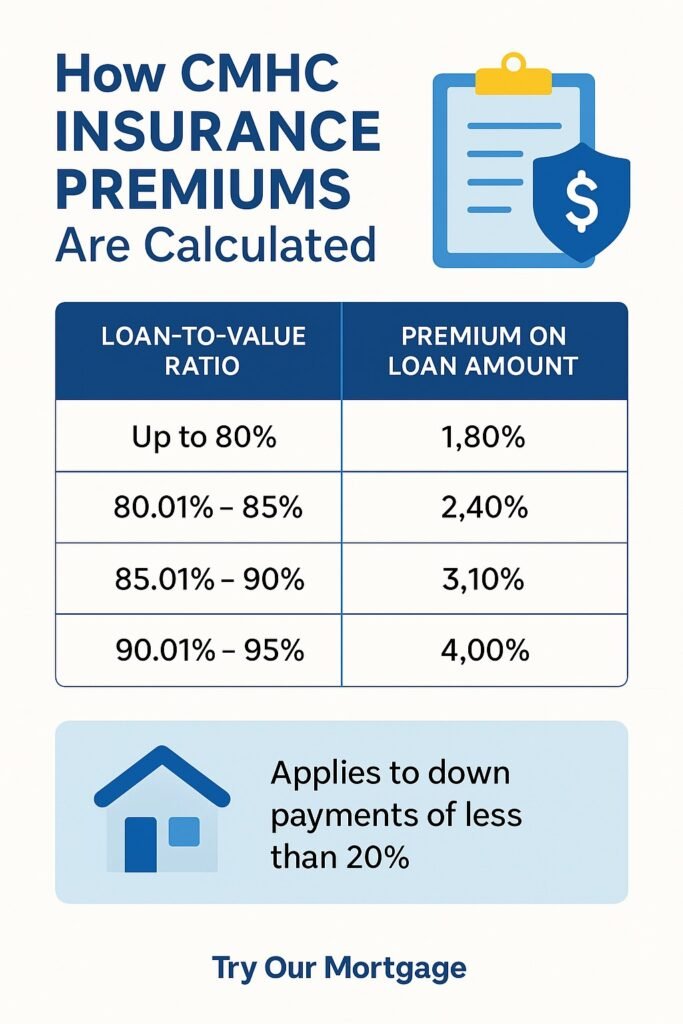

What is CMHC Insurance (Mortgage Default Insurance)?

If you’re putting down less than 20%, your mortgage must be insured through a government-backed program like CMHC, Sagen, or Canada Guaranty. This protects the lender in case you default, not you as the borrower.

The cost of this insurance ranges from 2.8% to 4% of your total mortgage amount, and it gets rolled into your mortgage balance. So, while you won’t pay it upfront, it does mean paying interest on the insurance premium over time.

Closing Costs: The Hidden Expenses

Many first-time buyers are caught off guard by closing costs — the additional fees and expenses due when your home purchase closes. These are separate from your down payment and can’t usually be added to your mortgage.

Here’s what might be included:

- Land transfer taxes (especially steep in Toronto and Vancouver)

- Legal fees

- Title insurance

- Home inspection fees

- Appraisal fees

- Property tax adjustments

These can add up to 3–5% of your home’s purchase price. So, on a $600,000 home, you might need an additional $18,000 to $30,000 at closing.

| Closing Cost Item | Estimated Amount (CAD) | Notes |

|---|---|---|

| Land Transfer Tax (Provincial) | $8,475 | Based on Ontario’s tiered LTT structure |

| Legal Fees & Disbursements | $1,500 | Includes title search, registration |

| Title Insurance | $400 | Protects against ownership disputes |

| Home Inspection | $400–$600 | Optional but highly recommended |

| Appraisal Fee | $300–$500 | May be required by lender |

| CMHC Insurance Premium (if < 20% down) | $19,680 | Added to mortgage, not upfront; based on 5% down |

| Adjustments (Property Taxes, Utilities) | $500–$1,000 | Based on timing of closing date |

| Moving Costs | $500–$1,500 | Depends on distance and service |

What Will My Mortgage Payment Be?

Your monthly mortgage payment is made up of:

- Principal – the amount you borrow

- Interest – the cost of borrowing that amount

- (Sometimes) property taxes, condo fees, and insurance if you’ve opted to include them

Most lenders use amortized payments over 25 years. That means, in the early years, you’re paying more interest than principal. But over time, more of your payment goes toward paying off the loan.

Things that affect your payment include:

- Loan size – more you borrow, bigger the payment

- Amortization period – longer term = lower payments but more total interest

- Interest rate – higher rate = higher payment

- Payment frequency – accelerated bi-weekly saves interest long term

| Home Price | Down Payment (20%) | Mortgage Amount | Monthly Payment (Est.) |

|---|---|---|---|

| $400,000 | $80,000 | $320,000 | $1,864 |

| $500,000 | $100,000 | $400,000 | $2,330 |

| $600,000 | $120,000 | $480,000 | $2,796 |

| $700,000 | $140,000 | $560,000 | $3,262 |

| $800,000 | $160,000 | $640,000 | $3,728 |

📌 Find Out Your Monthly Payment

Use our free Mortgage Calculator to estimate your monthly payments and plan your budget with confidence.

Try the Mortgage CalculatorHow Much Can I Comfortably Afford?

Here’s the thing: just because the bank approves you for a $700,000 home doesn’t mean you should spend it all. You’ll still have to budget for:

- Utilities

- Maintenance & repairs

- Property taxes

- Emergency funds

- And, of course, life expenses — kids, cars, vacations, and savings

So a better question might be: How much house can I afford and still sleep at night?

A good rule of thumb: keep your total housing costs under 32–35% of your gross income, and keep all debt payments under 40%.

If you’re leaning toward building your dream home, check out the full cost breakdown before choosing a location.

And once you’re confident in your price range, be sure to learn the mortgage terms every first-time buyer should know.

Final Thoughts: Plan Before You Purchase

Homeownership is a huge accomplishment, but it comes with responsibility. By planning ahead — understanding how much house you can afford, setting a realistic budget, and using tools like affordability calculators and mortgage pre-approvals — you’ll set yourself up for long-term success.

Still unsure how to run the numbers?

📊 Budget Breakdown for First-Time Homebuyers

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts