How Election Promises Could Shape Canadian Mortgage Rates in 2025

As Canada approaches the next federal election, political promises around housing affordability, interest rate intervention, and mortgage relief could significantly influence market expectations. This article explores how party platforms might shape the future of Canadian mortgage rates in 2025 — from potential rate freezes to tax incentives for first-time buyers.

As Canada heads toward the 2025 federal election, the housing market and mortgage rates are hot-button issues for millions of voters. While it’s true that campaign promises don’t directly set mortgage rates, they play a major role in shaping the broader economic environment—and that, in turn, impacts what you pay when borrowing for a home.

Whether it’s the Liberals pitching bold investments in innovation and housing affordability, or the Conservatives pushing fiscal restraint and supply-driven growth, each vision could take the country down a different path on inflation, interest rates, and homeownership access. Let’s break it down.

Liberal Approach: Stimulus Spending, Innovation, and Housing Affordability

Under the leadership of Prime Minister Mark Carney, the Liberal Party is making a clear pitch: tackle today’s affordability crisis while preparing Canada for the economy of tomorrow. Their platform promises tax cuts, housing investments, and strategic funding in artificial intelligence, infrastructure, and national defence.

To start, the Liberals propose cutting the lowest federal income tax bracket from 15% to 14%. This alone could put hundreds of extra dollars annually into the pockets of middle-income households—money that could go toward housing.

But the heart of the Liberal strategy lies in investment: $6 billion for a new National Housing Affordability Fund, the removal of GST on homes up to $1 million, and direct funding to expand rental housing supply. At the same time, they’re committing to long-term growth by pumping money into AI innovation and clean infrastructure.

📋 Liberal Housing and Innovation Investment Map (2025–2030)

This infographic illustrates where the Liberal government plans to direct housing and innovation funding across Canada.

| Region | Housing Investment Focus | Innovation/AI Investment Focus |

|---|---|---|

| Ontario (GTA, Ottawa) | Affordable Housing Expansion, GST Waiver | AI Research Clusters in Toronto-Waterloo Corridor |

| British Columbia (Vancouver, Victoria) | Rental Construction Support, Anti-Speculation Enforcement | CleanTech AI & Green Innovation Grants |

| Alberta (Calgary, Edmonton) | Public-Private Housing Partnerships | AI Applications in Energy Sector & Robotics |

| Quebec (Montreal, Quebec City) | Social Housing & Renter Tax Relief Programs | Bilingual AI Research Hubs & Startup Incentives |

| Atlantic Provinces & North | Support for Rural & Indigenous Housing Initiatives | Digital Infrastructure, AgriTech & Climate Monitoring AI |

Could Liberal Spending Push Rates Higher or Lower?

At first glance, big government spending sounds like it might fuel inflation. But the Liberals argue their investments are targeted and productivity-focused, aiming to relieve long-term cost pressures.

For example, building more housing stock should ease demand pressures in hot markets, which could help cool rising prices. Similarly, boosting productivity through infrastructure and AI could lower costs in the long run—helping fight inflation instead of stoking it.

That said, in the short term, these programs could still increase government deficits, prompting the Bank of Canada to stay cautious. If inflation stays sticky due to higher spending, mortgage rates may remain elevated for a while.

📈 Forecasted Inflation Impact of Liberal Spending

| Policy Area | Short-Term Inflation Impact (2025–2026) | Long-Term Inflation Impact (2027–2030) |

|---|---|---|

| National Housing Affordability Fund | ↑ Mild inflation due to increased construction activity | ↓ Inflation as housing supply increases & prices stabilize |

| AI & Innovation Investment | ↔ Neutral – low immediate impact | ↓ Deflationary effect via productivity & tech-driven efficiency |

| Infrastructure Expansion | ↑ Temporary cost increases from labour & materials | ↓ Lower costs via improved logistics & transportation |

| Defence & Trade Diversification | ↔ Neutral – indirect inflationary effect | ↓ Price stability via reduced exposure to US market volatility |

Conservative Approach: Supply, Discipline, and Economic Restraint

The Conservatives are taking a more traditional fiscal approach, promising to unlock federal lands for development, cut permitting red tape, and incentivize cities to increase density. Their plan puts housing supply—not subsidies—at the centre of affordability reform.

They also plan to balance the federal budget within five years, cutting unnecessary programs and streamlining government expenses. The hope? That tighter fiscal control will reduce inflation, increase investor confidence, and lower borrowing costs across the board.

📋 Conservative Housing Supply & Budget Targets Overview

🏘️ Housing Supply Initiatives

- Unlocking Federal Land: 25,000+ acres released for residential development

- Fast-Tracked Permits: Streamlined approval process to reduce build time by 30%

- Municipal Incentives: Bonuses for cities increasing density and permit speeds

💰 Fiscal Discipline Goals

- Balanced Budget by 2029: 5-year plan to eliminate the federal deficit

- Reduced Spending: Targeted audits and cuts on non-essential government programs

- Lower Borrowing Costs: Smaller deficits may lead to reduced bond yields

📉 What It Means for Canadians

- More homes → reduced housing pressure & improved affordability

- Controlled inflation → potential for BoC rate cuts

- Stable fiscal policy → higher investor confidence, stable mortgage environment

Will Conservative Discipline Lead to Lower Rates?

If the Conservative plan effectively reduces inflation without sacrificing growth, mortgage rates could come down. That’s because the Bank of Canada tends to lower interest rates when inflation is under control.

However, supply-side solutions take time. Building homes doesn’t happen overnight. If the government cuts spending too sharply or delays critical infrastructure and climate adaptation projects, Canadians might end up paying more down the road in the form of climate damages or infrastructure failures—which could push prices and inflation back up.

“For a deeper breakdown of potential borrower impacts, see our full analysis on how specific election promises could affect mortgage rates across Canada.”

| Year | Federal Budget Status | Avg Mortgage Rate (%) | Inflation Trend (%) |

|---|---|---|---|

| 1995 | Deficit | 9.75% | 2.2% |

| 2000 | Surplus | 7.10% | 2.7% |

| 2008 | Surplus (pre-crisis) | 6.25% | 2.4% |

| 2015 | Deficit | 3.10% | 1.1% |

| 2020 | Large Deficit (COVID) | 1.90% | 0.7% |

| 2023 | Deficit | 5.75% | 4.0% |

| 2025 | Projected Surplus (Conservative) | 4.25% | 2.1% |

What Actually Determines Mortgage Rates?

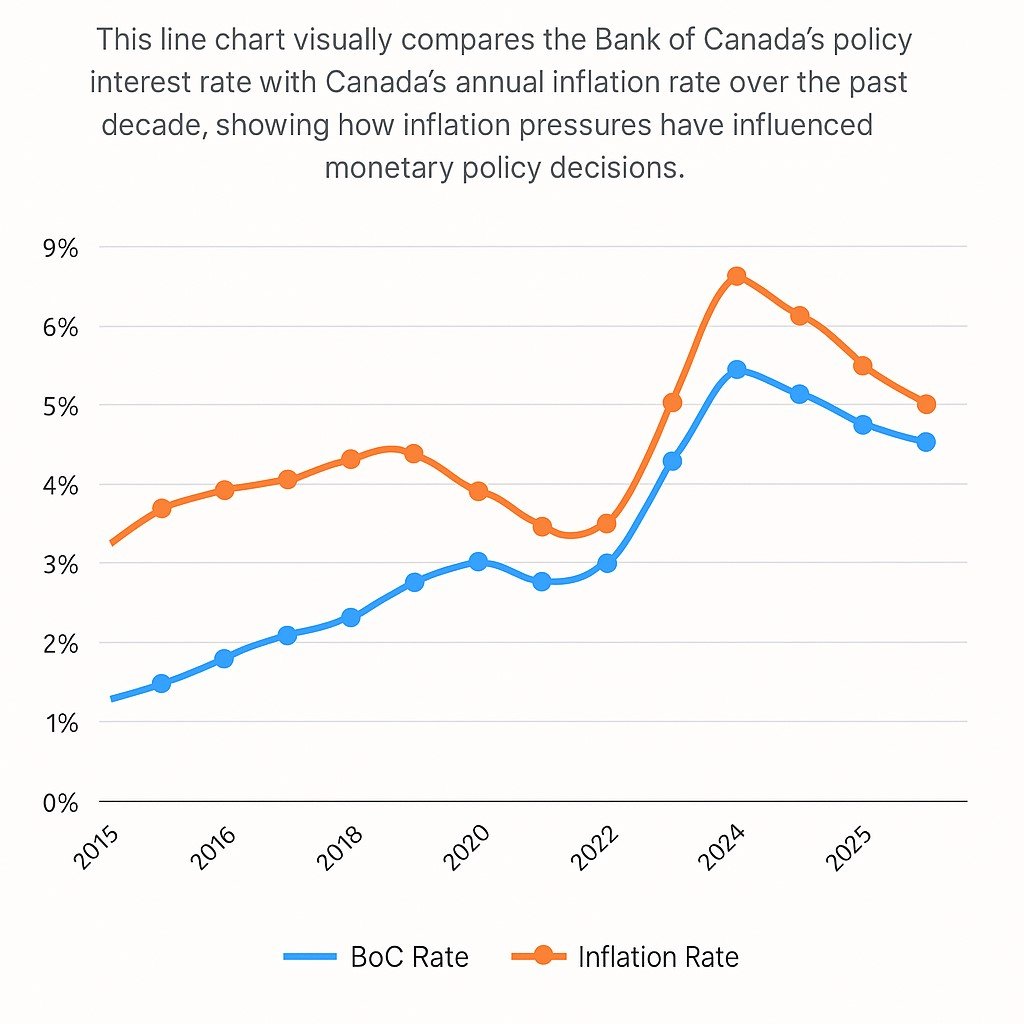

The biggest player in mortgage rates remains the Bank of Canada. It adjusts its policy rate in response to inflation, GDP growth, employment trends, and global conditions.

While election promises influence these conditions indirectly (especially through spending and investment), the BoC is independent and reacts to data, not politics.

If post-election spending sends inflation up, expect rates to stay high. If either party succeeds in cooling inflation—through housing supply, productivity, or fiscal restraint—we might see the Bank ease its stance and lower rates.

What Should Homebuyers and Homeowners Do in an Election Year?

If you’re planning to buy or renew your mortgage, it’s smart to be proactive before policy changes take effect.

Even a 0.25% shift in rates can add hundreds to your monthly mortgage. Locking in a fixed rate, or exploring your renewal options early, might help you avoid any election-induced rate surprises.

Final Thoughts

The 2025 election won’t directly set your mortgage rate, but it will absolutely shape the financial landscape that determines it.

Whether you believe in stimulus or restraint, productivity or deregulation, the big question is: which strategy do you think will best fight inflation while keeping homeownership within reach?

Your vote matters—not just for policy, but for your pocket. And your mortgage.

Stay informed. Stay ahead.

If you want to know how Mortgage Rates determined in Canada. Click Here

📌 Secure Your Mortgage Rate Before Policy Shifts

Election season can bring economic uncertainty. Don’t wait until after the changes hit—get expert advice now and lock in a rate that fits your future.

Talk to a Mortgage ExpertStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts