Declining Home Prices in Canada: Are We Heading Towards Financial Risk?

As Canadian home prices dip across several markets, concerns are growing about broader financial risks — from reduced household equity to increased default exposure. This article explores whether falling prices are a natural correction or a warning sign for Canada’s economic stability in 2025.

As Canada’s housing market undergoes a historic shift, concerns are mounting—not just for homeowners, but for the financial system as a whole. With interest rates climbing and property values falling in several key regions, the country’s banking watchdog—the Office of the Superintendent of Financial Institutions (OSFI)—has raised red flags in its most recent Annual Risk Outlook.

So, what exactly is going on? Is it just a short-term correction or something bigger? Let’s break it down in simple manner.

Variable Rate Mortgages: What’s the Real Risk?

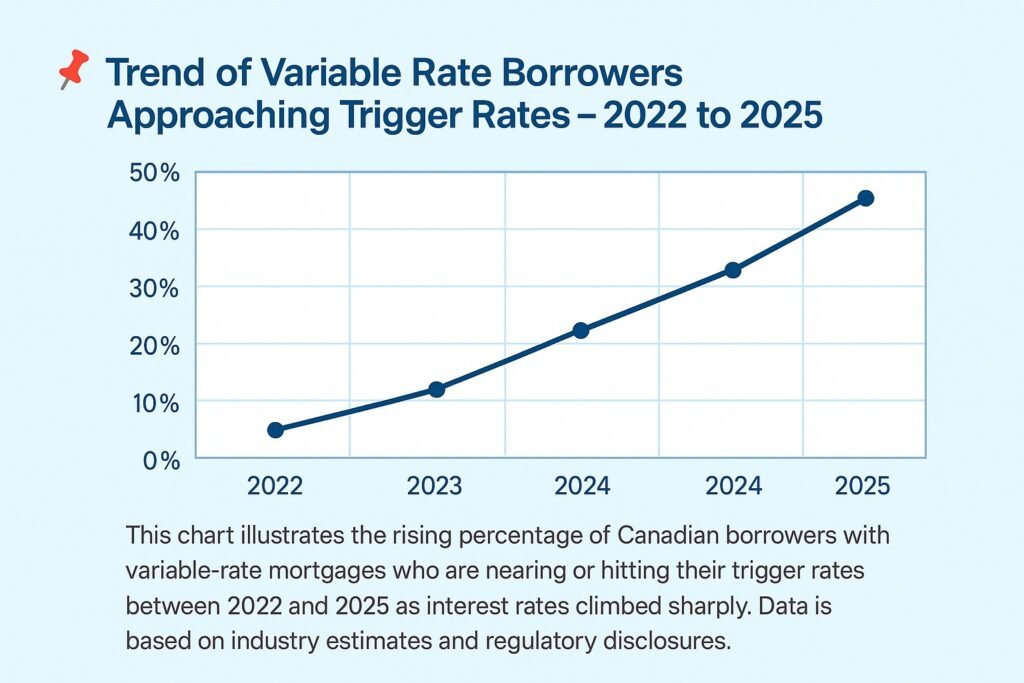

Over the last two years, variable-rate mortgage holders have been playing a risky game. Many Canadians were lured by the ultra-low rates during the pandemic. But here’s the catch—when rates started climbing fast, many of those borrowers hit something called the “trigger rate.” That’s the point where your entire payment goes toward interest, and none of it actually pays down the loan.

The OSFI has specifically flagged this as a growing vulnerability. If interest keeps climbing—or even stays high—more households may hit their trigger points too. That’s when the loan balance actually grows because the interest isn’t fully covered.

As a result, lenders are now under stricter observation. OSFI is ramping up how it monitors risk in the mortgage space, especially in federally regulated financial institutions (FRFIs). While they aren’t predicting a full-blown housing collapse, they’re making it very clear: they’re getting ready for a bumpy ride.

Loan-to-Value (LTV) Ratios: When Home Equity Disappears

Imagine owing more on your mortgage than your house is worth. That’s the reality for more Canadian homeowners than you might think—especially those who bought at the peak of the market.

The Loan-to-Value ratio, or LTV, is a metric used by lenders to assess how much risk is involved in your mortgage. When LTV exceeds 100%, it means your home is no longer backing the loan—it’s underwater.

And that’s becoming more common.

According to OSFI and Canada’s top mortgage insurers like CMHC, Sagen, and Canada Guaranty, a growing percentage of mortgages now have dangerously high LTVs. In fact, Canada Guaranty disclosed that over $4 billion worth of insured loans had LTVs exceeding 100% by the end of 2021. That’s a 10x jump from the year before.

📌 Table: LTV Breakdown – % of Mortgages Over 95% by Insurer, 2020–2025

| Year | CMHC | Sagen | Canada Guaranty |

|---|---|---|---|

| 2020 | 1.2% | 5.0% | 0.74% |

| 2021 | 2.3% | 7.5% | 3.2% |

| 2022 | 2.8% | 9.0% | 4.6% |

| 2023 | 3.1% | 9.8% | 4.9% |

| 2024 | 3.5% | 10.2% | 5.3% |

| 2025 (Est.) | 3.9% | 10.7% | 5.7% |

*Data reflects insured mortgage portfolios with LTVs exceeding 95%, highlighting increased systemic risk as home values decline.*

What does this mean? If prices fall further, more borrowers may choose to walk away. That could result in massive claims to default insurers, triggering a ripple effect in the broader economy.

Default Insurance: The Backstop Under Pressure

Mortgage default insurance is supposed to protect lenders when a borrower can’t pay. But now, that safety net is under pressure too. If defaults increase and homes can’t be sold for the outstanding loan amount, insurers are left to pay the difference.

In 2022, CMHC saw its pool of high-LTV insured loans rise to $5 billion. Sagen followed suit with $14 billion worth of loans over the 95% LTV threshold. This is particularly concerning because these loans were issued at the height of the pandemic boom, when homes were overpriced and mortgage rates were rock bottom.

Now that prices are dipping and interest rates have spiked, the math just doesn’t work anymore for many households.

📌 Infographic: How Falling Home Prices Push LTV Above 100%

This infographic will visually explain how a borrower’s loan-to-value (LTV) ratio can exceed 100%:

- 💸 Example: Buying a $600,000 home with 5% down ($30,000)

- 📉 Home value drops by 10% → Now worth $540,000

- 📈 Mortgage balance remains ~$570,000 due to interest

- ⚠️ LTV becomes 105% → borrower owes more than the home is worth

*Shows how home price declines and minimal equity can lead to underwater mortgages.*

Stress Test and Trigger Rate Gaps

Remember the mortgage stress test? It was designed to make sure borrowers could handle rate hikes by qualifying them at a higher “test rate.”

But during the pandemic, CMHC’s attempt to tighten the rules further actually backfired and was rolled back. Looking back now, those policies could have prevented a lot of the pain Canadians are currently feeling—especially first-time buyers who maxed out their budgets to chase homeownership during the peak.

Fast forward to today, many variable-rate borrowers are learning the hard way. Their payments are no longer covering the full interest, and the unpaid portion is capitalized—added to the original loan. That not only worsens the LTV but also prolongs debt and increases total interest paid over time.

📌 Visual: Timeline – Pandemic Low Rates → 2025 LTV Risk

This timeline visual will illustrate how ultra-low mortgage rates during the pandemic (2020–2021) contributed to:

- 🏠 Rapid increase in home prices

- 💰 High leverage with 5% down payments

- 📉 Sudden home price correction in 2023–2024

- 📊 Rise in loan-to-value (LTV) ratios through 2025

*Helps homeowners understand how past rate environments now impact their mortgage equity position.*

Real Example: Trigger Rate vs Trigger Point

Let’s say you bought a home for $700,000 with a 5% down payment and chose a variable-rate mortgage with fixed payments. Interest rates shoot up. One year in, you hit the trigger rate, meaning your payment is no longer going toward principal. A few months later, your trigger point is hit because your mortgage balance has increased beyond the original loan amount.

That’s when the lender may demand higher payments, a lump-sum payment, or, in the worst case, initiate foreclosure if you can’t comply.

📌 Infographic: Trigger Rate vs Trigger Point – What’s the Difference?

This visual will clearly explain the difference between a mortgage trigger rate and a trigger point using icons, timelines, and visual examples. It will show:

- 📈 What happens when your interest outpaces your payments

- 🧮 How your mortgage balance grows at the trigger point

- 🚨 Lender actions once you cross each threshold

*This infographic helps Canadian borrowers understand when intervention is needed on their variable-rate mortgage.*

Frequently Asked Questions (FAQ)

What’s a trigger rate again?

It’s the interest rate at which your entire mortgage payment goes toward interest, with zero principal repayment.

How do I calculate it?

Use the formula:(Payment x # of payments per year) / Mortgage Balance x 100

For example: $1,800 biweekly x 26 = $46,800 / $651,000 x 100 = 7.19% trigger rate

Why are some mortgages like nesto’s unaffected?

Because nesto offers adjustable-rate mortgages (ARM), not variable-rate ones. With ARM, your payments go up or down along with interest rates, preventing accumulation of unpaid interest.

Final Thoughts: A Market at the Crossroads

There’s no denying that the combination of high interest rates and declining home prices is putting real pressure on the Canadian housing system—from borrowers to lenders to insurers.

But here’s the thing: housing is still a long-term investment. Even if prices dip, owning a home gives you shelter, potential equity growth, and a hedge against future rent increases. The key is to buy smart and borrow responsibly.

If you’re worried about how these changes affect your situation—whether you’re planning to buy, refinance, or renew—it’s worth speaking with someone who knows the ins and outs of today’s market.

📞 Talk to a Mortgage Expert

Not sure how rising rates or falling home values affect your mortgage? Let our experts help you protect your investment and avoid costly surprises.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts