Why U.S. Inflation Is Making Canadian Fixed Mortgage Rates So Unpredictable

U.S. inflation is creating waves in Canada’s mortgage market. Find out why fixed mortgage rates are so volatile and what it means for Canadian borrowers.

In 2025, many Canadians were hoping for mortgage rate relief. The Bank of Canada had already begun easing policy, and early indicators suggested inflation might finally be on a downward path. But just when it looked like things were starting to settle, a surprise spike in U.S. inflation threw a wrench into everyone’s plans — and Canadian fixed mortgage rates are once again reacting to events beyond our borders.

Let’s unpack why U.S. inflation data matters so much to Canadian borrowers, how fixed mortgage rates are being affected, and what you can do to protect yourself as a homeowner or first-time buyer in today’s economic climate.

U.S. CPI Surge Derails Canadian Rate Optimism

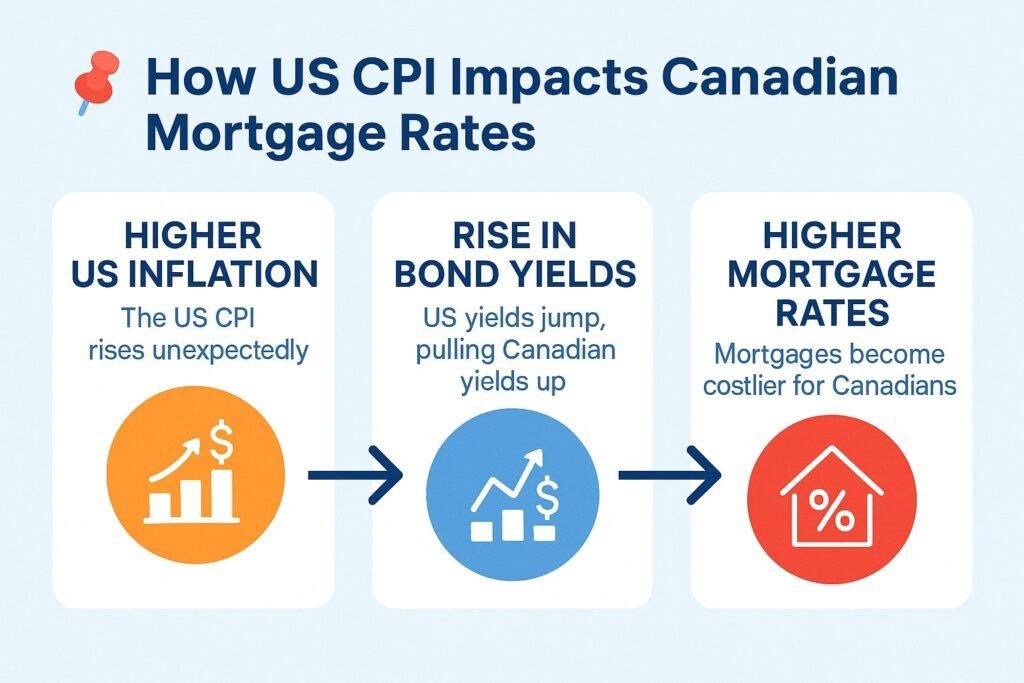

In March 2024, the U.S. Consumer Price Index (CPI) unexpectedly rose to 3.5%, up from the previous month’s reading and well above economists’ forecasts. This may not sound like a massive jump, but in financial markets, even a few decimal points can trigger sharp reactions.

As soon as the CPI data was released, U.S. bond yields spiked — and in a highly interconnected world, Canadian bond yields followed. Within hours, the Government of Canada’s 5-year bond yield shot up by 14 basis points, the largest single-day move since late 2023.

Why does this matter to you? Because Canada’s fixed mortgage rates are closely tied to bond yields. When yields rise, lenders adjust their fixed-rate offerings upward to maintain profit margins. And just like that, the expectation of cheaper fixed-rate mortgages vanished — at least for now.

📈 US CPI vs Canadian Bond Yields (2023–2025)

| Quarter | US CPI (%) | Canada 5-Year Bond Yield (%) |

|---|---|---|

| Q1 2023 | 6.5 | 3.00 |

| Q2 2023 | 6.2 | 3.10 |

| Q3 2023 | 5.8 | 3.00 |

| Q4 2023 | 5.4 | 3.20 |

| Q1 2024 | 4.9 | 3.30 |

| Q2 2024 | 4.3 | 3.40 |

| Q3 2024 | 3.9 | 3.50 |

| Q4 2024 | 3.7 | 3.30 |

| Q1 2025 | 3.5 | 3.40 |

| Q2 2025 | 3.6 | 3.50 |

| Q3 2025 | 3.5 | 3.60 |

| Q4 2025 | 3.5 | 3.65 |

This chart shows how rising U.S. inflation is influencing Canadian bond yields — which directly affect fixed mortgage rates.

Global Bond Markets Don’t Respect Borders

Many Canadians are surprised to learn that even though we have our own central bank, our mortgage market is still highly influenced by what happens in the U.S. That’s because bond investors often view Canadian debt as a sibling to U.S. securities. When U.S. Treasury yields rise, Canadian yields typically follow — even if the Canadian economy is telling a different story.

This is especially true for 5-year fixed mortgage rates, which are directly priced based on Government of Canada bond yields. So, if U.S. inflation keeps surprising to the upside, it becomes harder for Canadian fixed rates to fall, regardless of what the Bank of Canada does with its overnight rate.

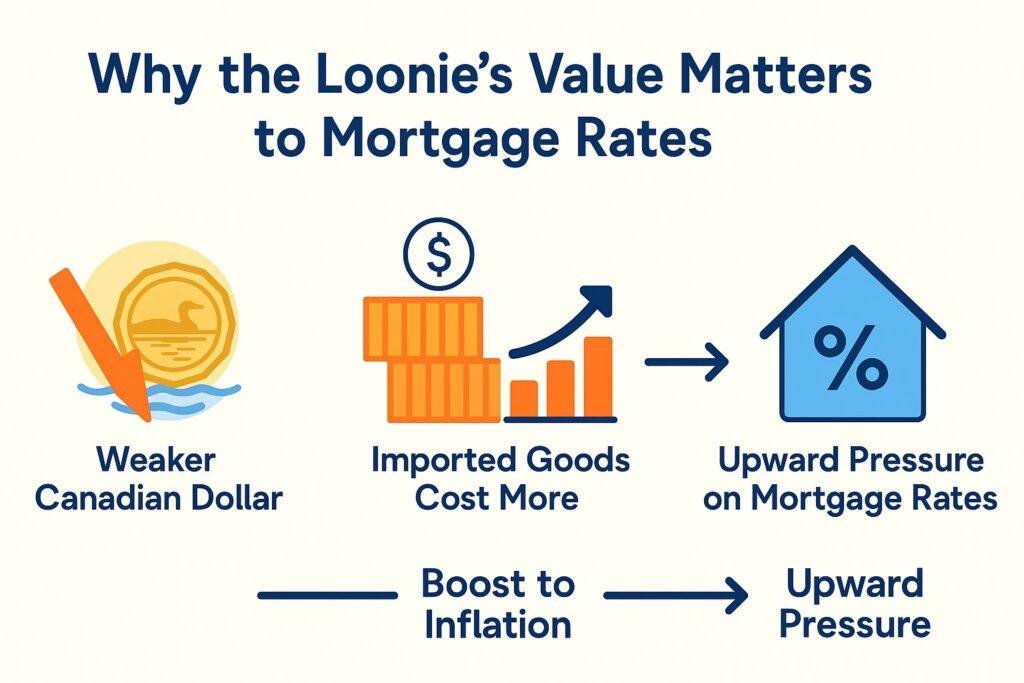

The Fed Holds Steady While the BoC Eyes Cuts

The Federal Reserve has made it clear: it won’t cut rates until it’s absolutely confident inflation is headed sustainably toward its 2% target. The Bank of Canada, on the other hand, has hinted that it’s ready to cut sooner — possibly as early as June or July — if domestic inflation continues to cool.

That divergence creates pressure on the Canadian dollar, which weakens when our rates fall while U.S. rates stay high. A weaker loonie increases the price of imported goods, fuels inflation, and could force the BoC to be more cautious with further cuts. It’s a tricky balancing act.

📉 BoC vs Fed Policy Rate Divergence (2022–2025)

| Quarter | BoC Rate (%) | Fed Rate (%) |

|---|---|---|

| Q1 2022 | 0.25 | 0.50 |

| Q2 2022 | 0.50 | 1.00 |

| Q3 2022 | 1.00 | 1.50 |

| Q4 2022 | 1.50 | 2.00 |

| Q1 2023 | 2.25 | 2.50 |

| Q2 2023 | 2.50 | 3.00 |

| Q3 2023 | 3.00 | 3.25 |

| Q4 2023 | 3.25 | 3.50 |

| Q1 2024 | 3.50 | 4.00 |

| Q2 2024 | 3.75 | 4.25 |

| Q3 2024 | 4.25 | 4.50 |

| Q4 2024 | 4.00 | 4.50 |

| Q1 2025 | 3.75 | 4.50 |

| Q2 2025 | 3.50 | 4.50 |

| Q3 2025 | 3.25 | 4.50 |

| Q4 2025 | 3.00 | 4.50 |

This chart highlights the growing gap between Canadian and U.S. central bank policy rates, which is now influencing mortgage pricing and currency pressures.

Rate Relief Keeps Slipping Away

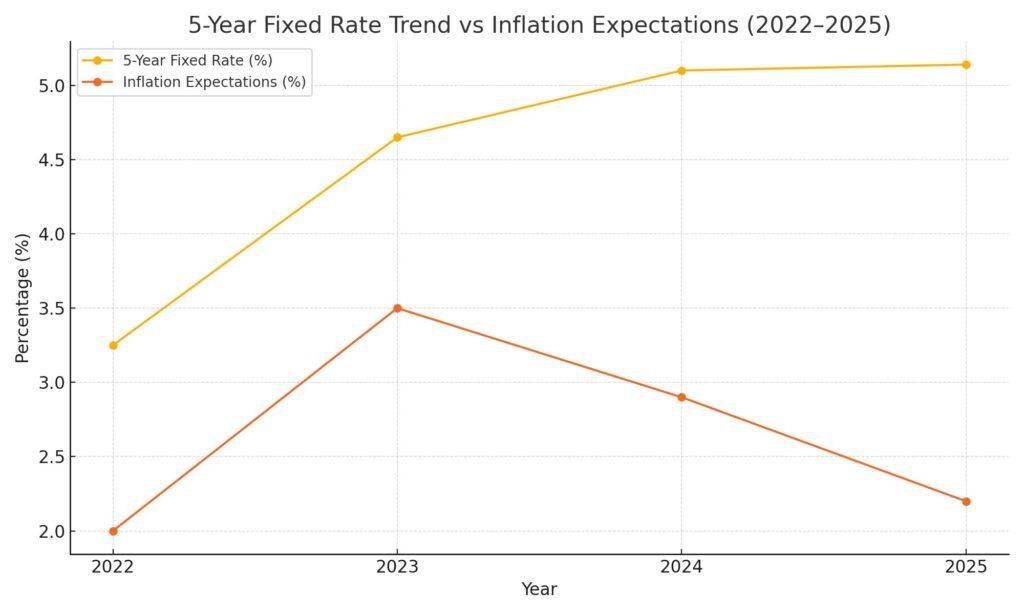

Just a few months ago, many lenders had priced in rate cuts for spring 2025. But those expectations are now being pushed further down the road. The bond market has already adjusted — and as bond yields climb again, the cost of borrowing through fixed mortgages goes up.

The spread between fixed and variable mortgage rates has widened considerably. At many lenders, the difference is now over 1.00%. This means that locking in a fixed rate could cost significantly more upfront than taking a variable-rate mortgage — but the predictability of fixed payments remains appealing to many borrowers.

If you were counting on fixed rates dropping this spring or summer, it may be time to reassess.

📌 Fixed vs Variable Rates: Comparison at Major Lenders – Q2 2025

| Lender | 5-Year Fixed Rate | 5-Year Variable Rate | Rate Spread (bps) |

|---|---|---|---|

| RBC | 5.09% | 4.05% | 104 |

| TD Bank | 5.14% | 4.09% | 105 |

| Scotiabank | 5.04% | 3.99% | 105 |

| CIBC | 5.02% | 3.92% | 110 |

| nesto | 4.84% | 3.79% | 105 |

Rates as of June 2025. Spread shows the difference in basis points (bps) between fixed and variable offerings at each lender.

US Consumer Resilience Complicates Forecasts

One of the reasons U.S. inflation is proving so stubborn is the surprising strength of the American consumer. Despite higher borrowing costs and global uncertainty, Americans continue to spend — which keeps prices elevated.

This resilience has puzzled many economists who were expecting inflation to fall more sharply by now. Meanwhile in Canada, core inflation has been trending downward, and the BoC believes that headline inflation could land at 2.2% by year-end. That’s a positive sign, but not enough to completely insulate us from U.S.-driven volatility.

Why Canadian Fixed Rates May Keep Rising Even as BoC Cuts

It sounds counterintuitive, but yes — fixed mortgage rates in Canada could rise even if the BoC cuts its overnight rate this summer. That’s because fixed rates follow bond yields, and bond yields are moving based on global inflation risks, trade disruptions, and fiscal policy fears — not just domestic interest rates.

Right now, the lowest insured 5-year fixed rates in Canada sit around 4.84%. If bond yields keep rising or rate cuts are delayed, that number could climb above 5.14% within two months.

That might not sound dramatic, but for a mortgage of $600,000, even a 30 bps increase can raise your monthly payment by over $90–$100, depending on your amortization.

The Silver Lining: Inflation Is Cooling in Canada

Thankfully, not all the news is gloomy. Canada’s inflation trajectory looks far better than the U.S. for now. Wage growth, commodity prices, and supply chains are stabilizing. And while global uncertainty remains, the BoC’s forecast of 2.2% inflation by year-end gives hope that rate cuts are still possible.

That’s why most economists believe that June 5th or July 24th are the likely windows for the BoC to deliver its first rate cut of the year. Markets are pricing in a 75% chance of a June move.

What Should Mortgage Borrowers Do Now?

If you’re renewing your mortgage or about to close on a home in the next 120–150 days, now is the time to consider a rate hold. Many lenders offer free rate locks with no obligation — and in a rising rate environment, this could protect you from sudden jumps.

If you’re leaning toward a fixed-rate mortgage, weigh the security of consistent payments against the risk that rates could stay elevated longer than expected. On the other hand, if you can handle some short-term volatility, a variable-rate mortgage may offer lower initial costs — but only if rates don’t climb further.

And for new buyers? Budget conservatively. Use today’s rates to stress-test your affordability and speak to a mortgage expert who can help tailor your strategy to your risk comfort, not just market hype.

📞 Talk to a Mortgage Expert

Lock in your best rate today and make a smart move in this shifting market.

Get Expert AdviceFinal Thoughts: Fixed Rates Still Have Room to Surprise

The headline here is simple: Canadian fixed mortgage rates are being hijacked by U.S. inflation volatility. Even if our economy is behaving differently, bond markets don’t care about borders. The ripple effect from U.S. CPI is real, and it’s something every Canadian borrower needs to understand.

In this kind of environment, the best thing you can do is stay informed, be proactive, and plan your mortgage decisions based on facts — not just forecasts.

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts