How Mark Carney’s Liberal Government Could Reshape Housing and Mortgages in Canada

If Mark Carney leads a Liberal government in 2025, Canadians could see major shifts in housing policy — from affordability programs and tax incentives to interest rate outlook and mortgage regulation. This article explores how Carney’s economic expertise might shape the future of homeownership in Canada.

If you’ve been following Canada’s latest political shift, you already know that Mark Carney is now Prime Minister—and housing is front and centre on the Liberal agenda. With sky-high home prices, stubborn inflation, and volatile interest rates, Carney’s platform is built around a bold promise: fix the housing crisis and protect Canadians from financial uncertainty.

But what does this really mean for homebuyers, renters, investors, and anyone carrying a mortgage?

Let’s break down how Mark Carney’s economic background, new policies like Build Canada Homes, and upcoming tax reforms could impact your wallet—and your mortgage strategy—in 2025 and beyond.

Who is Mark Carney, and Why Does He Matter?

Before diving into policy, it’s worth understanding who’s steering the ship. Mark Carney isn’t just a politician; he’s a former Governor of the Bank of Canada and Bank of England. This is the man who helped navigate Canada through the 2008 global financial crisis and kept the UK economy relatively steady during Brexit.

Carney’s global experience, academic roots (he holds a PhD in economics from Oxford), and crisis-tested leadership make him a unique kind of Prime Minister—one who understands both Wall Street and Main Street. His approach to governance combines market discipline with social purpose, and his first major focus as PM is housing.

📌 Mark Carney’s Resume: BoC, BoE, Global Advisor → Prime Minister

🎓 Oxford University – PhD in Economics

Established deep expertise in global finance and macroeconomic theory.

🇨🇦 Bank of Canada Governor (2008–2013)

Navigated the country through the global financial crisis with stable monetary policy.

🇬🇧 Bank of England Governor (2013–2020)

Managed UK’s central bank through Brexit volatility and early COVID-era challenges.

🌱 UN Special Envoy on Climate Finance (2020–2023)

Promoted sustainable finance and integrated climate risk into global markets.

🍁 Prime Minister of Canada (2025–Present)

Elected on a mandate to fix housing, boost economic resilience, and manage global trade tensions.

Alt text: “Timeline infographic showing Mark Carney’s rise from economist and central banker to Canadian Prime Minister in 2025.”

Build Canada Homes: A Federal Developer Enters the Chat

One of the most ambitious planks of the Liberal housing plan is the creation of a new federal housing developer called Build Canada Homes. This agency would act like a national construction engine, using underutilized federal land and up to $25 billion in financing to build homes at scale.

Carney’s Liberals are aiming to double home construction to 500,000 units per year, with a big push for modular and prefabricated homes to bring down costs and speed up timelines. If done right, this could be Canada’s modern-day version of the post-WWII housing boom.

But skeptics say execution will be everything—public developers have had mixed results globally, and coordinating across provinces won’t be easy.

📌 Timeline: Canada’s Annual Housing Starts vs Liberal Targets (2020–2025)

Alt text: “Bar chart comparing actual housing starts in Canada from 2020–2024 vs. the Liberal government’s 2025 target of 500,000 homes.”

Why Modular Housing is Suddenly a Big Deal

Modular housing, which uses factory-built components to create homes faster and cheaper, is a big part of this plan. Countries like Japan and Sweden have used it successfully, and Canada’s federal government wants to lead by example by purchasing at scale and standardizing regulations.

Experts like Dr. Mike Moffatt are cautiously optimistic. However, Canada’s patchwork of local building codes could slow down mass deployment unless provincial and municipal governments come on board.

📌 Modular Housing in Canada: How It Works + Potential Cost Savings

🔧 What Is Modular Housing?

Modular homes are factory-built houses delivered in sections and assembled on-site. They’re built to meet or exceed local building codes and offer faster, cost-effective alternatives to traditional construction.

⏱️ How It Works – The Process

- Design & approval of blueprint modules

- Factory manufacturing of home sections

- Transportation to site

- On-site assembly on a prepared foundation

- Final finishes, inspections, and move-in

💸 Cost Benefits Compared to Traditional Builds

| Cost Category | Traditional Build | Modular Build |

|---|---|---|

| Construction Time | 12–18 months | 4–6 months |

| Cost per sq. ft. | $250–$300 | $150–$200 |

| Labour Cost | High (on-site trades) | Lower (factory labour) |

| Weather Delays | Frequent | Minimal (controlled factory environment) |

Did you know? According to CMHC, modular housing can reduce overall construction costs by up to 20–25%—a major incentive in today’s high-cost housing environment.

Alt text: “Infographic comparing modular vs traditional homes in Canada, showing construction time, cost per square foot, labour savings, and build efficiency.”

Bringing Back the MURB Incentive—But Will It Work?

In a move aimed at boosting rental supply, the Liberals want to revive the MURB (Multi-Unit Rental Building) tax incentive. This would allow investors to write off some construction costs for new rental apartments.

While this could shift investor focus from condo flipping to rental development, zoning laws and high land costs in cities like Toronto and Vancouver still present serious barriers. Plus, the economic conditions of the 1970s (when MURB first launched) were quite different—today’s cost of capital is much higher.

GST Relief for First-Time Buyers—But With Limits

Here’s one for the new buyers: Carney’s Liberals propose eliminating GST on homes under $1M and cutting it for homes priced between $1M–$1.5M, but only for first-time buyers.

This isn’t the same as the current GST rebate. This would be an upfront price reduction, especially helpful for those buying pre-construction homes.

However, some experts warn this may not do much to increase supply—it might just fuel more demand in an already heated market.

📌 First-Time Buyer Savings with Proposed GST Break

Estimated GST savings for qualifying homes under the Liberal 2025 housing plan.

| Home Price | GST Before Relief | New GST (2025 Proposal) | Estimated Buyer Savings |

|---|---|---|---|

| $600,000 | $30,000 | $0 | $30,000 |

| $850,000 | $42,500 | $0 | $42,500 |

| $1,000,000 | $50,000 | $0 | $50,000 |

| $1,200,000 | $60,000 | $30,000 (50% GST) | $30,000 |

| $1,400,000 | $70,000 | $52,500 (25% relief) | $17,500 |

Alt text: “Table showing GST savings for homebuyers under new Liberal housing plan with full relief on homes up to $1M and partial relief up to $1.5M.”

Forces Outside Ottawa’s Control Still Matter

Even with big promises, not everything is in the government’s hands.

Tariff tensions with the U.S., unpredictable bond yields, and inflationary pressures all affect how much it costs to build and borrow. Developers in cities like Vancouver and Toronto are already struggling to finance new projects because of high interest rates.

As Prof. Andy Yan from Simon Fraser University puts it: “Federal incentives help, but they can’t overcome economic gravity.”

Beyond Housing: Other Affordability Promises

The Carney Liberals are also rolling out a number of affordability measures to boost household cash flow:

- Middle-class tax cuts that could save families up to $825 a year

- RRIF flexibility for seniors, reducing withdrawal requirements by 25%

- Increased GIS support for lower-income seniors

- Disability tax credit expansion

- More investment in trades and construction training

All of these aim to ease the pressure on Canadian households and build the labour force needed to meet housing targets.

What Happens to Mortgage Rates Now?

Carney’s government will likely try to maintain stability during a time of global turbulence, but markets have a mind of their own.

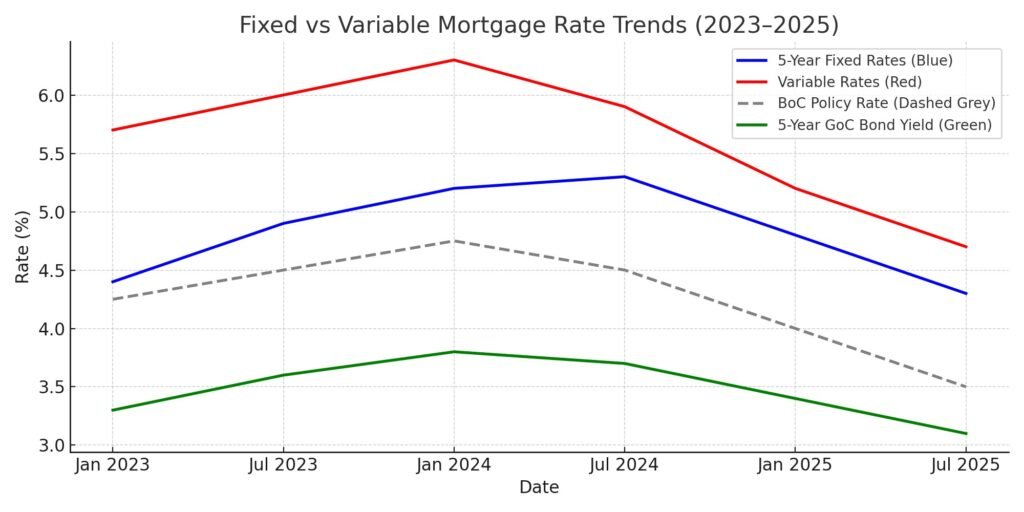

The Bank of Canada has already delivered two rate cuts this year, bringing the policy rate down to 3%, and more cuts are possible in 2025. That means adjustable-rate mortgages (ARMs) and variable-rate mortgages (VRMs) may become more attractive again.

But bond yields are still volatile—especially with looming deficits, inflation concerns, and U.S. tariff threats. This means fixed-rate mortgages may see upward pressure, even as variable rates decline.

What Carney’s Government Means for Borrowers

If these policies succeed, we could see more housing, slightly lower home prices, and improved affordability. But that won’t happen overnight. In the meantime, borrowers must deal with continued rate volatility.

If government deficits grow or inflation stays hot, the Bank of Canada may slow rate cuts, or bond markets might push yields up—resulting in higher mortgage rates for everyone.

So whether you’re buying, renewing, or refinancing, the best approach is to lock in a smart strategy now, not later.

💰 Sample Monthly Mortgage Payments on a $600,000 Loan

Assuming a 25-year amortization and fixed interest rate.

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 3.00% | $2,843 | $253,000 |

| 4.00% | $3,167 | $350,000 |

| 5.00% | $3,501 | $450,000 |

| 6.00% | $3,869 | $560,000 |

Alt text: “Table comparing monthly payments and total interest for $600K mortgage at different interest rates.”

Final Thoughts: A New Era, But Same Mortgage Rules

Mark Carney brings experience, bold ideas, and a promise to tackle the housing crisis head-on. His government’s housing strategy—if successfully implemented—could reshape Canada’s real estate market over the next five years.

But until the dust settles, the rules of the game are still the same: borrow smart, plan ahead, and watch the rates.

🗨️ Talk to a Canadian Mortgage Expert Today

Get honest, personalized guidance from a commission-free mortgage advisor. We’ll help you find the right rate, strategy, and term—tailored to your needs.

📞 Book Your Free CallNo pressure. No commission. Just expert advice, 100% online.

Alt text: “Blue CTA banner prompting users to speak with a Canadian mortgage expert for personalized advice.”

Why Choose Mortgage.Expert

At Mortgage.Expert, we break down complex topics like housing policy, rate trends, and government reforms so you can make smart mortgage decisions in real time. Our platform is built for Canadians who want clarity, strategy, and better options—whether you’re buying your first home or negotiating your third renewal.

📊 Mortgage Strategy Comparison

Fixed vs Variable Mortgage Trends (Carney-Era Influences)

🔒 Fixed Rate

- Stable monthly payments

- Ideal in high-inflation or uncertain rate environments

- Higher upfront rate, but safer for risk-averse borrowers

- Less influenced by BoC rate changes

📉 Variable Rate

- Lower initial rate

- Fluctuates with BoC policy rate

- Higher savings potential in Carney-like rate-cut cycles

- Better for flexible, financially stable borrowers

Alt text: “Side-by-side visual comparing fixed vs variable mortgage strategies influenced by Mark Carney’s interest rate policies.”

Stuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts