Could Trump’s Tariffs Push Canadian Mortgage Rates Higher? A 2025 Guide for Homeowners

Could US tariffs lead to higher mortgage rates in Canada? This 2025 guide breaks down how international policy might impact your home loan.

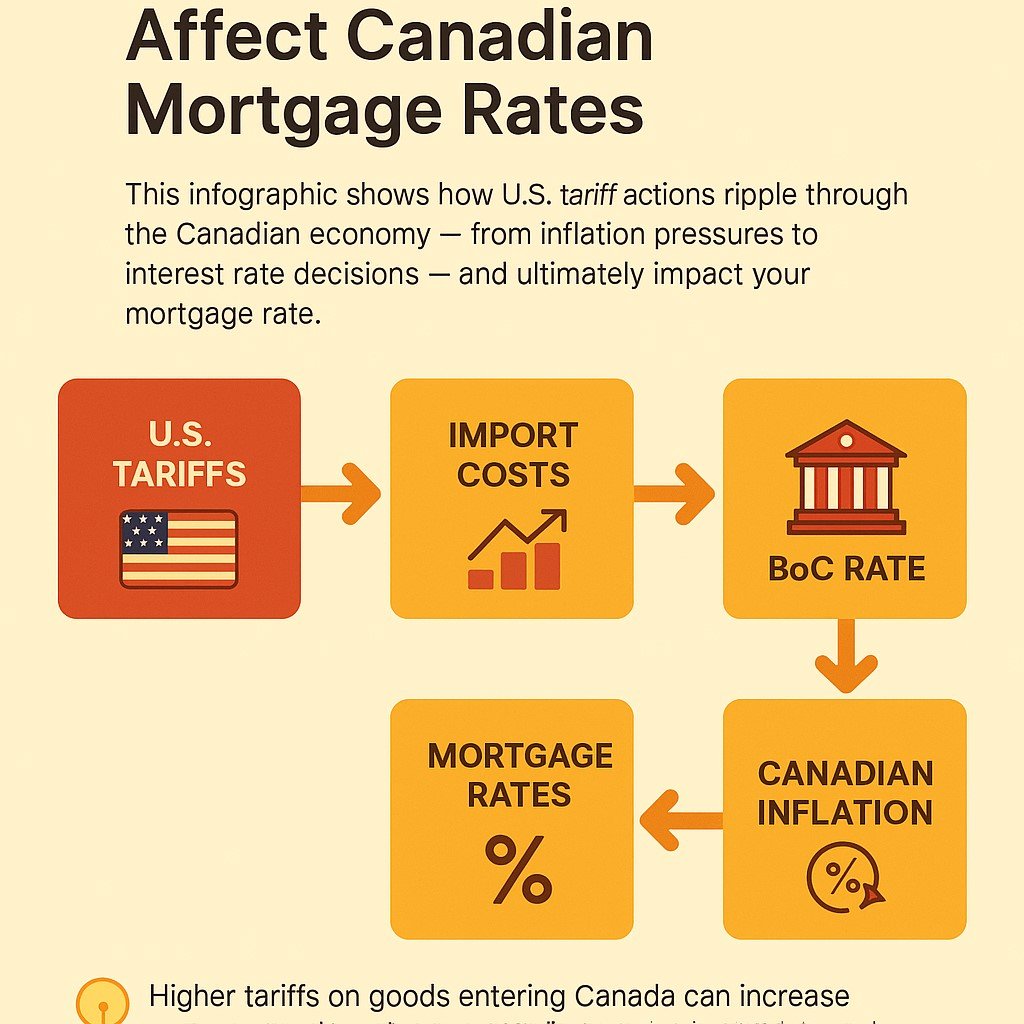

In 2025, mortgage rates in Canada aren’t just being shaped by inflation, housing demand, or the Bank of Canada’s next policy decision — they’re also being influenced by what’s happening far beyond our borders. With U.S. President Donald Trump returning to the global stage and reintroducing tariff threats, Canadians may soon feel the ripple effects on their homeownership costs.

These aren’t just political headlines. Tariffs directly impact trade, supply chains, and inflation — which then influence the Bank of Canada’s rate decisions. If you’re a homeowner, buyer, or someone planning to refinance, understanding how these economic tensions might affect your mortgage is more important than ever.

What’s Happening with U.S. Tariffs in 2025?

Donald Trump has hinted at imposing a new round of tariffs on imported goods — including Canadian aluminum, vehicles, and agricultural products. The move is framed as a way to protect American industry, but for Canada, it could raise the price of imports, disrupt trade routes, and trigger retaliatory tariffs from Ottawa.

This type of economic uncertainty can lead to inflationary pressure, which forces central banks — like the Bank of Canada — to respond. In Canada’s case, that often means keeping rates higher for longer to tame inflation.

Could Mortgage Rates Rise Because of Tariffs?

In short: yes, they could.

Here’s how the chain reaction plays out. Tariffs raise the cost of goods like cars, food, and electronics. That drives inflation up. And when inflation rises beyond the Bank of Canada’s comfort zone, it often raises interest rates — or holds them steady for longer than planned.

That’s bad news for variable-rate mortgage holders. Because when the BoC rate rises, prime rates move with it. And so do monthly mortgage payments for many Canadians.

Even fixed mortgage rates — which are more influenced by bond yields — can rise in anticipation of inflation, or if investors think rate cuts are being delayed. In either case, mortgage borrowers feel the pinch.

What This Means for Mortgage Borrowers in 2025

Let’s say you’re a homeowner who locked in a five-year fixed mortgage at 2.49% back in 2020. That rate is coming up for renewal sometime this year — along with nearly 60% of all Canadian mortgages. And if tariffs push rates even slightly higher than current levels, you might end up renewing at 5.5% or more.

That’s a payment shock scenario for thousands of households across the country.

A family currently paying $2,200/month could see that number rise by $500 or more after renewal. That can hit especially hard if wages haven’t kept pace with inflation.

📈 Sample Mortgage Renewal: Old vs New Rate (2025)

See how renewing at a higher rate can affect monthly payments and total interest — based on a $600,000 mortgage with 25-year amortization.

💡 That’s nearly $1,000 more per month — and almost $300,000 more in interest over the life of the mortgage.

Will Lenders Tighten Their Standards Again?

Absolutely — and some already are.

During periods of economic risk, lenders tend to become more conservative. That means higher credit score cut-offs, stricter documentation requirements, and tougher debt service thresholds.

In other words, getting approved for a mortgage — especially if you’re self-employed, have variable income, or a modest down payment — could become harder.

Even private and alternative lenders may raise their rates, since their cost of borrowing will increase too.

🏦 2025 Lender Comparison: A Lenders vs B Lenders

Here’s how top-tier banks and alternative lenders differ when it comes to interest rates, credit requirements, and down payments in 2025.

💡 A lenders offer lower rates but stricter rules. B lenders help borrowers with lower credit or non-traditional income get approved — at a higher cost.

First-Time Buyers: Expect More Affordability Pressure

For those trying to enter the housing market for the first time, tariff-driven rate hikes could be a major blow.

Higher rates reduce how much you can qualify for under Canada’s mortgage stress test. For example, if the qualifying rate jumps from 6.5% to 7.25%, your mortgage approval limit could shrink by tens of thousands of dollars — even if your income hasn’t changed.

📉 Mortgage Stress Test Calculator

Rising mortgage rates mean you have to qualify at higher rates — reducing how much you can borrow, even if your income stays the same.

| Scenario | Contract Rate | Stress Test Rate (MQR) | Max Mortgage You Qualify For |

|---|---|---|---|

| 2022 Buyer | 4.00% | 5.25% | $550,000 |

| 2024 Buyer | 5.25% | 7.25% | $475,000 |

| 2025 Buyer (Today) | 5.99% | 7.99% | $430,000 |

💡 The higher the stress test rate, the lower the mortgage you’ll qualify for — even if your income doesn’t change.

Many hopeful buyers might find themselves priced out of the market or forced to consider smaller homes, co-buying with family, or delaying their purchase altogether.

Should You Lock in a Rate Now?

If you’re within 120 days of your renewal or home purchase, the safest move is probably to lock in a rate now. Many lenders offer pre-approvals or early renewals with a rate hold — protecting you from future hikes.

And while fixed rates might look higher than a variable option today, the peace of mind they offer can be worth it — especially in an uncertain environment like this one.

🏡 Fixed vs Variable Mortgage: 2025 Comparison

💡 Choose fixed if you prefer peace of mind. Go variable if you’re comfortable with change and want to potentially save on interest.

Real-Life Example: How It Plays Out

Let’s take Amelia and Oliver, a Toronto couple renewing their mortgage in October 2025. Their current rate is 2.39%, and they owe $450,000 on their home.

Without locking in early, they’re offered 5.59% at renewal. But had they started the renewal process in June and locked a pre-approval, they could have secured 5.09% — saving nearly $12,000 in interest over the next five years.

“We break it down further in our article on how Trump’s tariffs are directly impacting Canadian rate volatility.”

📉 Early Lock-In vs. Delayed Renewal – 2025 Mortgage Scenario

Early Lock-In (June 2025)

Rate Secured: 4.79%

Loan Amount: $600,000

Monthly Payment (25 yrs): ~$3,431

Total Interest (5 years): ~$131,800

✅ Predictable payments, rate protection

Delayed Renewal (Oct 2025)

Expected Rate: 5.49%

Loan Amount: $600,000

Monthly Payment (25 yrs): ~$3,666

Total Interest (5 years): ~$149,100

⚠️ Higher payments, risk of market volatility

💡 Even a small rate change can cost thousands. Locking in early helps you plan ahead.

Fixed or Variable: What Should You Choose in 2025?

The debate between fixed and variable is hotter than ever. But this year, the answer depends entirely on your financial cushion and risk tolerance.

Fixed-rate mortgages offer security. They shield you from surprises — which could be worth it if tariffs fuel unpredictable rate hikes.

Variable rates, on the other hand, still start lower. But that advantage shrinks if the Bank of Canada delays cuts or raises rates again. You’ll also need to be comfortable with payments that could fluctuate every few months.

Still not sure? Ask yourself: could you handle a $300/month payment jump without stress? If yes, variable might still be a valid option. If no — fixed may be your best bet right now.

📊 Fixed vs Variable Mortgage – Pros & Cons for 2025

Final Thoughts: Don’t Wait for Tariffs to Hit Your Wallet

Tariffs might feel like distant policy debates — but for Canadian homeowners, their impact is very real.

Whether you’re shopping for a new home, preparing for renewal, or thinking about refinancing, now is the time to act. Mortgage rates are still relatively stable, but that could change quickly if trade tensions flare.

If Trump’s trade threats become reality, Canadian inflation could spike, the BoC could react with caution, and your next mortgage rate could be significantly higher than it is today.

Don’t wait for headlines to catch up to your finances. Lock in what you can. Speak to a mortgage expert. And protect your future while you still have options.

💬 Talk to a Canadian Mortgage Expert Today

Confused about rates? Our trusted mortgage professionals are ready to help you make the smartest move — whether you’re buying, renewing, or refinancing.

Book Your Free ConsultationStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts