How to Save Money on Your Utility Bill

Utility bills aren’t just a monthly inconvenience—they’re one of the biggest ongoing costs of owning a home in Canada. With energy prices and inflation rising, cutting down on electricity, gas, and water usage can add up to meaningful savings. The good news? It doesn’t take drastic sacrifices. Just a few small, consistent changes in how you use your home can make a big difference.

Step 1: Figure Out If Your Bill Is Too High

Before you start slashing kilowatts and chasing leaks, it’s important to understand whether your utility bill is actually high—or just feels like it. One way to tell is by comparing your latest energy bill to the same month last year. If usage (measured in kWh or cubic metres) has jumped significantly without any obvious cause (like buying a hot tub), then it’s worth investigating.

You can also compare your bill with neighbours or similar-sized households in your area. If yours is consistently higher, there may be hidden inefficiencies in your home.

| 🏙️ City | 💡 Electricity | 🔥 Heating | 🚿 Water | 📦 Total Avg. Utility |

|---|---|---|---|---|

| Toronto | $95 | $120 | $40 | $255 |

| Vancouver | $80 | $110 | $35 | $225 |

| Calgary | $90 | $100 | $30 | $220 |

| Montreal | $70 | $90 | $25 | $185 |

| Halifax | $85 | $95 | $28 | $208 |

Step 2: Do a Mini Energy Audit

Walk through your home and note potential energy leaks. Look for things like:

- Drafty windows and doors

- Outdated appliances

- Lights left on in unused rooms

- Plugged-in electronics not in use

You can do a basic audit yourself using an online checklist, or hire a professional energy advisor for a detailed analysis. Some provinces offer this service for free or at a discount.

🧾 Free Online Energy Audit Checklist

Want to find out how energy efficient your home really is? Use this free online energy audit checklist to quickly assess where you could be saving on your utility bills.

🔍 Start Your AuditStep 3: Tap Into Rebates and Incentives

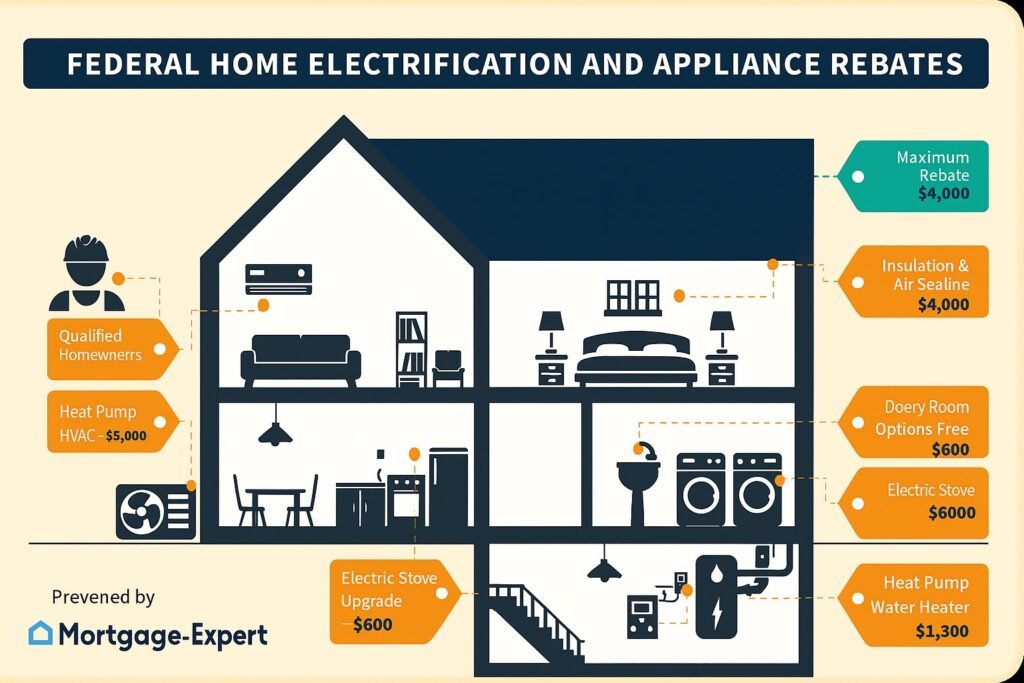

The Canada Greener Homes Initiative offers interest-free loans (up to $40,000) for energy-efficient upgrades. This includes insulation, windows, heat pumps, and more. Local governments also provide rebates for energy-saving upgrades like smart thermostats, solar panels, or low-flow toilets.

Tip: If you’re in a major city like Toronto or Vancouver, there are often over a dozen rebate programs available depending on your income and home type.

Step 4: Cut Phantom Power and Waste

Phantom power (devices drawing energy when not in use) can make up 10% of your bill. Combat this by:

- Unplugging electronics when not needed

- Using smart power bars or timers

- Setting your computer and TV to energy-saving mode

Lighting: Switch to LED bulbs. They use 75–90% less energy and last way longer than traditional ones.

Heating and Cooling:

- Seal air leaks and use weatherstripping

- Install a programmable thermostat

- Only heat or cool rooms you use regularly

Step 5: Use Appliances Smarter

Everyday habits matter. Here’s how to tweak yours:

- Cook with a microwave or air fryer instead of the oven

- Wash laundry in cold water

- Line-dry clothes instead of using the dryer

- Run the dishwasher only when full

Air Conditioning Tip: On milder days, use fans or open windows instead of blasting the AC. Portable and ceiling fans use significantly less electricity.

Step 6: Adjust With the Seasons

In Winter:

- Use thick curtains to keep heat in

- Insulate your attic and crawlspaces

- Lower thermostat at night or when you’re away

In Summer:

- Use blackout blinds to block sunlight

- Avoid oven use—grill outdoors or prep cold meals

- Open windows in the evening to let cooler air in

Step 7: Improve Your Water Usage

Water isn’t free—and heating it adds even more to your bill. Reduce waste by:

- Installing low-flow showerheads and faucets

- Fixing leaks promptly

- Using a bucket or sink to rinse dishes instead of running water

- Keeping showers short and sweet

Fun Tip for Families: Use a timer or a waterproof speaker that plays a 5-minute song to signal shower time for kids.

Final Thoughts

Saving money on your utility bills doesn’t mean sacrificing comfort—it just means making smarter choices. From rebates and appliance tweaks to seasonal hacks and water-saving upgrades, there’s something every homeowner can do today to cut costs.

Looking to free up even more monthly budget? Speak to a nesto mortgage expert and explore how refinancing or renewing your mortgage can also save you thousands in interest.

🔄 Refinance or Consolidate? Let’s Find the Best Fit

Tired of juggling multiple payments or high interest credit cards? Whether you’re looking to refinance your mortgage or consolidate debt into one affordable plan — we can help.

💬 Book a Free Refinance ConsultationStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts