How Are Mortgage Rates Determined in Canada?

Ever wonder why mortgage rates rise or fall? Learn how the Bank of Canada, bond yields, lender risk, and inflation all influence how your mortgage rate is set in Canada.

Whether you’re applying for a mortgage for the first time or renewing an existing one, understanding how mortgage rates are determined in Canada can help you make smarter, more confident decisions. Rates don’t just appear out of thin air—they’re influenced by a complex web of economic indicators, government policy, and lender-specific factors. Let’s break it all down in simple terms.

Who Actually Sets Mortgage Rates?

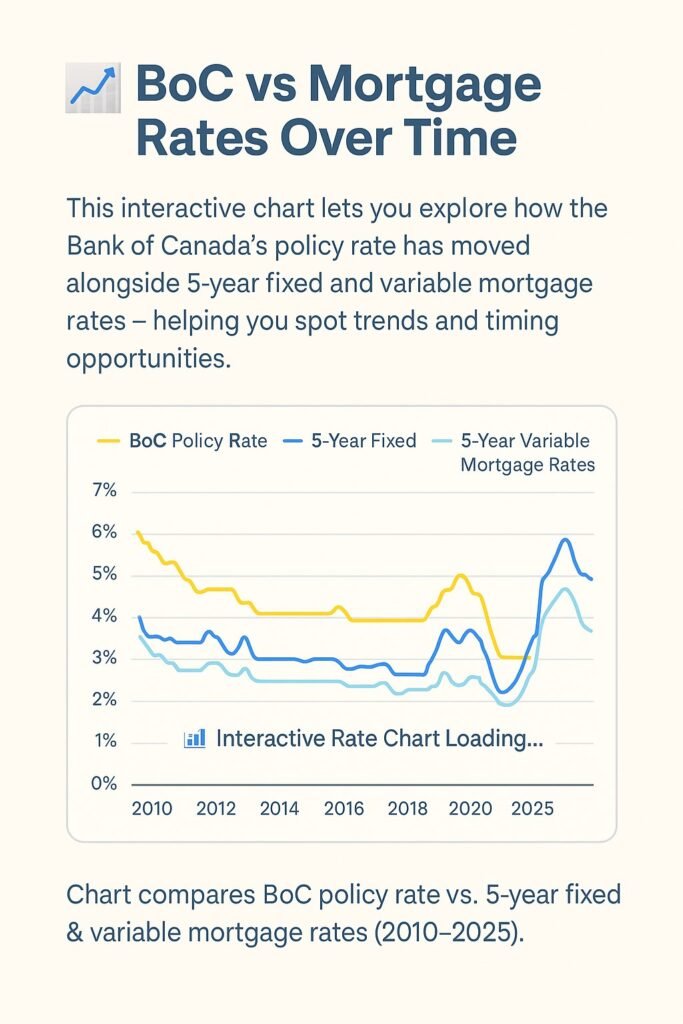

Mortgage rates are technically set by individual lenders, but their decisions are heavily influenced by broader forces—mainly the Bank of Canada’s policy rate and Government of Canada bond yields.

- Variable-rate mortgages are directly linked to the Bank of Canada’s overnight rate.

- Fixed-rate mortgages follow the movement of government bond yields, particularly 5-year bonds.

Lenders add a margin (or “spread”) on top of these rates to cover their own risks, operational costs, and profit margins.

What Impacts Mortgage Rates in Canada?

1. The Bank of Canada’s Policy Rate

This is the rate at which the BoC lends money to major banks. It directly affects the prime rate, which is the starting point for setting variable-rate mortgages. If the BoC raises this rate, borrowing becomes more expensive, and mortgage rates usually go up. If the BoC cuts it, rates generally fall.

2. Bond Yields

Bond yields are market-driven and influence fixed-rate mortgages. When investors expect economic trouble, bond yields drop—and so do fixed mortgage rates. When inflation is high or interest rates are expected to rise, bond yields climb.

3. Economic Indicators

Inflation, GDP growth, employment data, and housing demand all influence how lenders price risk. In uncertain economic conditions, lenders may raise rates to protect themselves.

4. Your Personal Profile

Your credit score, down payment amount, loan-to-value ratio, income stability, and even the purpose of the home (primary residence vs. rental property) can influence the rate you’re offered.

Fixed vs. Variable: How Are These Rates Set?

Fixed-Rate Mortgages

Fixed mortgage rates are determined by the 5-year government bond yield, plus a markup. For example, if the 5-year yield is 3.5%, lenders might offer a 5-year fixed mortgage at 5.25%.

Variable-Rate Mortgages

These are tied to a lender’s prime rate, which usually floats about 2.2% above the BoC policy rate. For example, if the policy rate is 4.75%, the prime rate might be 6.95%, and your variable rate could be prime minus 0.5% (i.e., 6.45%).

How Do Interest Rates Impact Home Affordability?

Higher mortgage rates increase monthly payments, shrinking your buying power. Lower rates reduce monthly payments and can make more homes affordable.

👉 Example:

- A $500,000 mortgage at 5.14% costs about $2,964/month.

- The same mortgage at 6.14%? Now it’s $3,266/month—a difference of over $300.

That’s why even a small rate change can significantly impact your ability to afford a home.

BoC’s Rate Announcement Schedule

The Bank of Canada updates its policy rate 8 times per year, usually on a Wednesday. These announcements can influence the entire mortgage landscape.

BoC 2024 Rate Dates:

January 24, March 6, April 10, June 5, July 24, September 4, October 23, December 11

What About the Mortgage Stress Test?

To ensure borrowers can handle higher rates in the future, lenders apply a “stress test”. You must qualify at the higher of:

- 5.25% (set by OSFI), or

- Your contract rate + 2%

This protects you—and the financial system—from overleveraging.

Final Thoughts

Mortgage rates in Canada are shaped by global forces, domestic policy, and your personal financial picture. While you can’t control the Bank of Canada or bond markets, you can improve your chances of getting a great rate by boosting your credit score, saving a bigger down payment, and comparing lenders.

💬 Need Help Timing Your Next Mortgage?

Whether you’re tracking trends or unsure when to lock in a rate, our licensed mortgage experts are here to help you make smarter, personalized decisions.

💬 Talk to a Mortgage ExpertStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts