2025 Mortgage Rate Forecast in Canada: What Borrowers Need to Know

Wondering where mortgage rates are headed in 2025? This guide breaks down what Canada’s top banks and economists are predicting — and what it means for homebuyers, renewers, and variable rate borrowers.

More than 1.2 million Canadians will renew mortgages in 2025—and many will face payment shocks. Homeowners who locked in ultra-low rates between 2020 and 2021 are now seeing offers two to three times higher. For some, that means hundreds to thousands more per month.

But what’s really ahead in 2025? Will mortgage rates drop, and when? Here’s the latest forecast, real-life renewal examples, and strategies to help you survive—and thrive—in this challenging market.

Why 2025 Is a Big Deal for Renewals

The last time Canada had this many renewals in one year, rates were historically low. Now the script has flipped.

- In 2020, borrowers locked at 1.5%–2.0%.

- In 2025, renewals are landing at 5.0%+.

👉 Example: Carter and Charlie from Calgary bought in 2020 with a $500,000 mortgage at 1.8% → $1,850/month.

In early 2025, renewal offered at 5.4% → $2,950/month. That’s a $1,100 increase every month.

Multiply that across one million families, and the impact on household budgets—and the Canadian economy—is massive.

The Big Banks’ Mortgage Rate Predictions for 2025

Big Banks’ Mortgage Rate Forecasts for 2025 Here’s what Canada’s top banks expect for the policy rate (which drives mortgage rates):What Drives the Bank of Canada’s Decisions?

The BoC policy rate directly impacts mortgage costs. Its main driver? Inflation.

- If inflation stays sticky → expect delayed cuts.

- If it eases toward 2% target → expect gradual cuts from spring/summer 2025.

Other signals BoC watches:

- Core inflation trends

- Wage growth

- Employment strength

- Consumer spending

- U.S. Federal Reserve moves

Fixed vs Variable in 2025: What’s Smarter?

Many borrowers are asking: Should I choose fixed or variable in 2025?

- Fixed-Rate Mortgage → Payment stability. Example: 3-year fixed at 4.9%. Safer if you can’t risk more hikes.

- Variable-Rate Mortgage → Floats with prime. Could save money if cuts come quickly—but risky if cuts stall.

- Hybrid Options → Some choose 2-year fixed now, then variable later. Others go for ARMs (adjustable-rate mortgages).

👉 Tip: If you’re risk-averse, go fixed. If you’re flexible with budget, variable may win in 2025.

Looking Ahead: 2026–2027 Outlook

Most banks expect rates to stabilize around 2.25% by late 2026, staying there into 2027.

💡 Renewal Strategy:

If renewing in 2025, consider a 2–3 year term → positions you for lower rates by mid-decade.

Real-Life Renewal Strategy: Jason & Maya

Jason and Maya in Brampton had a $475,000 mortgage at 1.89%. Renewal in June 2025 jumped their payment by $870/month.

Instead of accepting the bank’s offer, they used a broker:

- Bank offer: 5.3% fixed.

- Broker offer: 4.85% 2-year fixed.

- Result: Saved $3,000 in interest over the term—even after discharge fees.

📌 Lesson: Shop early and shop around. Don’t just accept your bank’s first renewal letter.

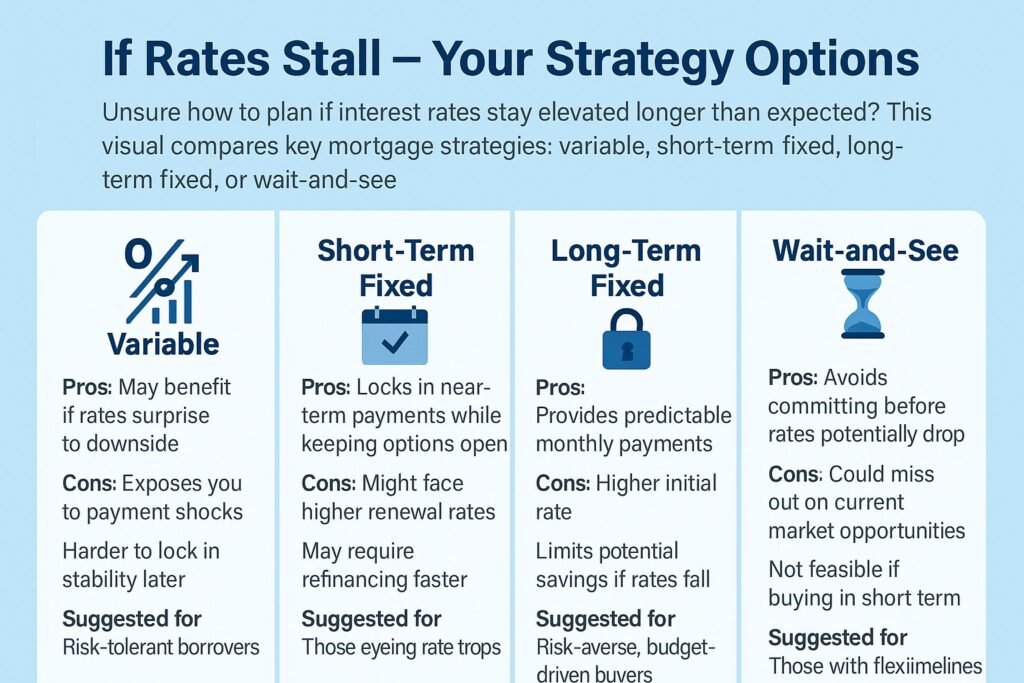

What If Rates Don’t Drop?

Forecasts aren’t guarantees. If inflation rises or the economy stays strong, cuts may be delayed.

Risk taker → Try variable, but keep a buffer for high payments.

Safer choice → Lock into a short-term fixed (2–3 years).

Tools to Use Before You Renew

Use free tools to make informed choices:

✅ Rate Comparison Dashboards – Spot better lender deals.

✅ Mortgage Payment Calculator – Estimate new monthly payments.

✅ Refinance vs Renewal Tool – See if breaking saves money.

✅ Stress Test Simulator – Check if you qualify at today’s rates.

FAQs on Mortgage Renewals in 2025

Will rates return to 1.5%? → No. Expect lows around 2.0–2.5%.

Should I go fixed or variable? → Depends on risk tolerance.

Can I renew early? → Yes, most lenders allow 90–120 days before maturity.

What if I can’t afford payments? → Talk to your lender early. Options include extending amortization or blended rates.

Final Word: Survive and Thrive in 2025

2025 is a reset year for Canadian borrowers. Rates are higher, but smart planning helps:

- Explore short-term fixed or hybrid options.

- Use tools and compare lenders.

- Start shopping 3–4 months before renewal.

- Work with a mortgage expert—not just your bank.

The difference could be thousands saved and years of financial relief.

💡 Need help making sense of your renewal options? Visit Mortgage.Expert to explore custom strategies, rate calculators, and one-on-one support.

📉 Not Sure What to Do If Rates Stay High?

Our mortgage experts will walk you through fixed, variable, and hybrid strategies — based on your goals, budget, and renewal date. Don’t get stuck waiting.

📞 Book a Free Strategy CallStuck with a Mortgage Decision?

Don’t stress — our team is here to help. Reach out for free, no-obligation guidance.

Contact the Experts